Weekly macroeconomic and market update 05 October 2015

Weekly macroeconomic and market update 05 October 2015

Weekly macroeconomic and market update 05 October 2015

Non-farm payrolls miss out by 60,000

Friday’s non-farm payrolls proved very disappointing, with a significant miss as just 142,000 jobs were added in September (compared to the 203,000 forecast). Rubbing salt in the wound, the report also revised down the readings for August and July.

Away from the headline numbers, the detail also failed to provide any comfort, with no month-on-month increase in hourly earnings (compared to 0.4% in August and expectations of a 0.2% increase) and a slip in the participation rate to the lowest level since 1977. Unemployment remained steady at 5.1%. Following the disappointing report, the market-implied probability of a hike in interest rates by the end of the year fell to 31%.

Still no good news from China

There was little to be positive on in the world’s second largest economy either, as the official Chinese manufacturing PMI remained below the breakeven at 49.8. The General Services PMI reading, calculated by the private partnership between Markit and Caixin, also slipped from 51.5 to 50.5 – casting some doubt over the health of the tertiary sector which has appeared reasonably robust recently.

Some improvements in Europe

Business confidence was improved in Europe, with the overall measure increasing to 0.34 from 0.2 in August. Within this, economic sentiment continued to strengthen, and whilst industrial sentiment was still negative at -2.2, this was an improvement from the -3.7 reading last month.

Detracting somewhat from these positive signals, German retail sales figures disappointed as growth slowed more than expected from 3.8% to 2.5%, and the headline inflation figure slipped back into deflation with prices down 0.1% from a year ago.

Last week’s other events

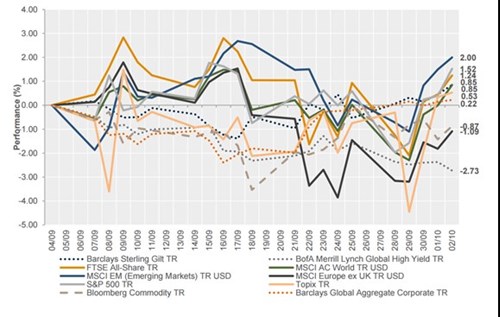

The markets

Following the US data release, bonds and gold rallied, whilst equities were relatively unmoved after a volatile week.

Equities – The FTSE finished up 0.2%, the S&P 500 ended +1.0% (but still below 2000 at 1951), and Europe (ex-UK) was at +0.5%. On the other hand, Japan slipped -0.6% and Hong Kong was down -1.9%.

Bonds – After the release of non-farm payroll data US treasury yields fell, and even after recovering 10-year treasuries were still fractionally below 2%. UK 10-years were also 13 bps lower at 1.60% whilst 10-year German bunds were down 14 bps to 0.51%.

Commodities – Oil was fairly unchanged, with Brent crude finishing at US$48.79. Copper was slightly stronger on the week at US$2.35 and gold surged on Friday to US$1,137.60 – reversing much of the weakness from the two previous weeks.

Currencies – Movements were fairly subdued. The sterling weakened, down 0.27% against the euro and 0.39% against the yen, but only 0.09% against US dollar (which was itself weaker).

The week ahead

In the UK we begin the week with services PMI, which is expected to remain strong in the mid-50s, followed by European retail sales growth, forecast to come in slightly lower than the month before at 1.8%. In the afternoon, the US will report non-manufacturing PMI which is also expected to remain strong. There is relatively little to report on Tuesday, with only Germany reporting on factory orders in the morning and the US releasing balance of trade data in the afternoon.

Overnight on Wednesday the Bank of Japan will announce any changes to the interest rate, along with its Leading Economic index. Later in the day the UK will report on Industrial and Manufacturing production, both of which are expected to bounce back from July’s contraction.

There will be plenty to watch from the Bank of England on Thursday, as the monetary policy decision will be reported and the minutes released at the same time – providing some insight into the latest thinking at the Central bank after the outcome at the Federal Reserve (Fed) last month. The Fed minutes are then released in the evening UK time. We finish the week with some trade data, including the UK’s balance of trade report and construction output in the morning, followed by US import and export prices in the afternoon.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.