The most discussed economic event of the year

Arguably the most discussed economic event of the year came to pass with the US Fed raising interest rates for the first time since 2006, although given the sensitivities, the Fed did exactly what everyone expected – a 25 bps hike to give a new ‘corridor’ of 0.25-0.50% for the Fed Funds rate. The messaging remained to expect a very gradual hike, and almost to highlight the point, some of the rate path forecasts in the years ahead were reported as more dovish – however the decision to hike rates was unanimous. Equity markets initially rallied during the press conference, but subsequently slid through the rest of the week. Our house view remains that this has come too late in the cycle and we remain particularly concerned about US markets.

Surprise moves from the Bank of Japan

Hot on the heels of the Fed action, the Bank of Japan surprised markets by appearing to join the ECB in loosening monetary policy whilst denying any fresh stimulus and referring to the changes as technicalities. The move, which was only supported by a 6-3 decision, will see the Bank of Japan purchase longer-dated bonds (seven to twelve years, from seven to ten previously) – and also increase the equity purchase programme by purchasing a further 300 billion yen (equivalent to US$2.4 billion) of equity.

Confusingly, however, this equity is reportedly to be targeted at companies proactively investing in labour and capex, though the details remain vague. Overall this surprise move caught markets off guard and it doesn’t appear to have been well executed, which could sap the Japanese authorities’ credibility.

Growing support for Spain’s anti-austerity party

It was a bad week for traditional political parties in Spain as the conservative Prime Minister Mariano Rajoy lost his majority and anti-austerity parties received a lot of support. The ruling People’s Party was still the largest party, but remains far short of a majority with 29% of the vote. The main opposition Socialist party received 22% but it was the anti-austerity Podemos party that did even better than expected, receiving 21% of the vote. The political mathematics now starts, but with the latest disruption and disparate political stances, it is currently difficult to see how a stable and enduring coalition could work.

Revised Chinese GDP expectations for next year

Chinese authorities are expecting GDP growth of 6.8% in 2016 – a slowdown from official estimates of 6.9% this year, and still far more optimistic than most other observers. The revised figures represent official acknowledgement of the growing problems facing the world’s second largest economy, with recognition that rising non-performing loans and overcapacity would hamper the economy – though the Peoples’ Bank of China also believes stimulus and reform measures will offset much of these drags. Also on China it is noteworthy that, following last week’s announcement of the change to how the currency would be valued and the action of the US Fed, the renminbi depreciated slightly against the US dollar through last week.

Last week’s other events

- A lot more positive signs in the UK. Inflation was back in the black at 0.1% year on year whilst core inflation increased a further 1.2% year on year. Employment conditions remain solid, unemployment fell for the fourth consecutive month since the summer to 5.2%. Average earnings came in just below expectations, but still at a respectable 2.4%. Retail sales figures also surprised on the upside, accelerating to 5.0% year-on-year growth, up from 4.2% in the previous month and well ahead of expectations for 3% growth.

- Eurozone industrial production improved unexpectedly, growing at a pace of 1.9% year on year from 1.3% a month earlier. Flash PMI figures remained expansionary but were a little mixed with manufacturing PMIs increasing by 0.3 to 53.1 whilst services PMI slipped by the same amount to 53.9. Construction output remained strong at 1.1% year on year compared to 0.1% the month before.

- Supporting the Fed’s outlook, inflation was 0.3% higher at 0.5% year on year whilst core inflation was also slightly up at 2.0%, in line with forecasts. Both building permits and housing starts both increased ahead of expectations. Detracting from the positivity were some softer industrial data. Year-on-year industrial production fell -1.2% and manufacturing PMI slipped more than expected to 51.3. Services also fell short as the Market Services PMI fell from 56.1 to 53.7, dragging the composite PMI figure from 55.9 to 53.5, compared to expectations of an acceleration to 56.3.

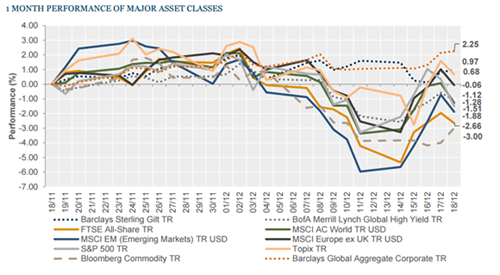

The markets

Equity and bond markets remain mixed in relatively thin trading, with the US rally after the Fed announcement quickly fading amid another difficult week for oil.

- Equities – No dramatic movements despite the Fed hike, thanks to very clear signalling and a lack of surprise. The US equity markets actually ended the week very slightly down, with the S&P 500 returning -0.3% after selling off at the end of the week. UK and European equities fared better, returning +1.6% +0.8% respectively as measured by the FTSE All Share and FTSE Europe (ex-UK). In the far East the Topix index of Japanese equities fell -0.8% whilst the Hang Seng (Hong Kong equities) advanced 1.3%

- Bonds – By the end of the week US Treasuries had steepened, with 6-month Treasuries 6 bps tighter to 0.46% whilst ten-year yields were 8 bps wider at 2.20%. UK gilts were barely changed with 10-year yields finishing the week at 1.83%, and German bunds were also little changed overall with 10-year yields ending at 0.55%.

- Commodities – Further weakness in oil saw Brent crude fall to US$36.39. Copper and gold both remained fairly subdued at US$2.10 a pound and US$1,066 an ounce respectively.

- Currencies – Sterling was generally weaker against other major currencies – it was last seen at US$1.49 and 180.71 yen.

The week ahead

With the Christmas period upon us, there is relatively little in the way of data out over the next couple of weeks. On Wednesday the UK releases Q3 GDP figures which are likely to be confirmed as 2.4% year on year, and then the US gives us the usual data dump of inflation durable goods, personal spending and home sales. Given the volatility in the oil price, the weekly EIA Crude Oil Stocks readings are likely to be closely watched and could drive some market volatility. New Year’s Day will see Chinese official PMI for both manufacturing and non-manufacturing.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.