Weekly macroeconomic and market update 21 September 2015

Weekly macroeconomic and market update

Weekly macroeconomic and market update

We’re still waiting for a US interest rate hike

The much-anticipated US Federal Reserve (the Fed) meeting was the highlight of the week, and yet again the committee opted not to hike. This was largely in line with most recent expectations, but a far cry from the forecast at the start of the year for a summer take-off. During the press conference, Chairwoman Janet Yellen highlighted concerns over the global economy and markets following turbulence driven by China over the last month. Despite fairly healthy domestic data, inflation projections appear below their targets and officials fret that the US economic recovery could be affected if there is a sharp slowdown in China.

During the meeting only one committee member voted for an interest rate rise, whilst another was reportedly pushing for a cut into negative territory. Official projections – the ‘dot plots’ – suggest a single rate increase this year, with only October and December meetings left in the calendar. At the press conference, Yellen was again clear on the data dependency of the committee’s decision and appeared generally in favour of a hike this year, though the press conference and statement was generally slightly more dovish than many had expected.

In terms of official forecasts, long-run unemployment forecasts were cut by 0.1% to 4.9%. GDP growth figures were upgraded for 2015 from 1.9% to 2.1%, but downgraded for 2016 from 2.5% to 2.3%, potentially due to headwinds created by the strong dollar. Inflation was also downgraded, and the Fed now doesn’t expect to hit its 2% target until 2018.

Chinese economic data fails to meet expectations

In China, there were more signs of the economic slowdown as fixed asset investment fell short of expectations, slowing down to 10.9% in July from 11.2% the month before. Industrial production growth also missed expectations with a marginal increase to 6.1% in August. Retail sales figures were more positive, increasing from 10.5% to 10.8% for August against expectations for no change. China has been aggressively loosening monetary policy in recent months in an effort to combat its economic slowdown, but its policy change on the currency and heavy-handed stock market interventions have unsettled markets globally.

Snap elections in Greece

Alexis Tsipras and the radical left-wing Syriza party won Greek snap elections on Sunday, in what could be considered something of a vindication for Mr Tsipras after he reluctantly signed a highly unpopular austerity-for-bailout deal with creditors over the summer. At the time of writing, projections had Syriza winning 145 of the 300 parliamentary seats (including 50 ‘bonus’ seats based on plurality), having secured 35% of the vote. The main opposition, New Democracy, admitted defeat in the early hours having gained 25% of the vote, which translated to 75 seats. The far-right Golden Dawn party will be the third largest party with 18 seats, though Syriza is expected to continue a coalition with the Independent Greeks party, which is forecast to have 10 seats.

Snap elections were called amid growing tensions within the anti-austerity Syriza party over the deals being done with creditors – a group of rebels split from Syriza to form the Popular Unity party. Early indications are that Popular Unity failed to secure any seats. This result should ease some of the political challenges to implementing the bail-out deal, though Merkel remains under pressure in the Bundestag.

Last week’s other events

The markets

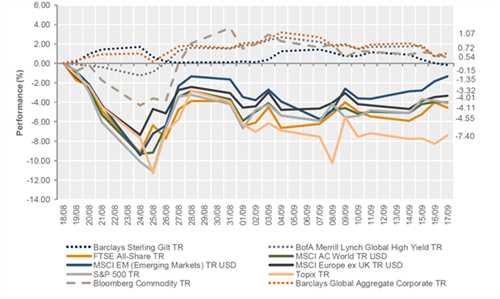

There was little market movement this week compared to earlier periods, as investors awaited the interest rate decision from the United States. After the news was announced the markets took on board the cautious tone set by the Fed.

Equities – Most major bourses were marginally down on the week, climbing early ahead of the Fed decision before surrendering these gains after the announcement. In the UK, the FTSE All-share index returned -0.34%, whilst US equities fell -0.15% on the S&P 500. Continental Europe was similarly down with the FTSE Europe (ex-UK) index returning -0.16%, whilst Japan suffered more significantly as the Topix shed -1.13%. Of the major indices, the Hang Seng index of Hong Kong equities stood out as a winner and achieved 2.03% for the week.

Bonds – US treasury yields were unsurprisingly lower on the week, particularly at the short end, with six-month treasury bonds falling 14 bps to 0.10%. The 10-year treasury was 6 bps lower overall but still above the 2% mark at 2.13%. UK gilts and German bunds were barely changed on the week with 10-years at 1.83% and 0.66% respectively.

Commodities – Oil had a short-lived rally mid-week, with brent crude oil briefly touching US$50 per barrel before finishing the week at US$47.47. Copper also dipped at the end of the week to finish at US$2.40, whilst gold had a solid week, appreciating in an uncertain environment to finish at US$1,138 an ounce.

Currencies – The euro suffered through the week, falling 1.12% against the sterling and 0.62% against the US dollar. The dollar fell against most other major currencies after Thursday’s Federal Open Market Committee announcement, down 0.51% versus sterling and 0.56% against the yen.

The week ahead

We have German factory-gate prices first thing on Monday, which are expected to have slipped month on month going into August. In the afternoon the US existing home sales data are released, which we expect to have fallen to 5.53 million, a 1.3% contraction on the July figure. On Tuesday there will be a flash reading of the Eurozone consumer confidence survey, with forecasts suggesting sentiment is still subdued and an expected reading of -7.0.

PMI readings start on Wednesday, beginning with the Caixin Manufacturing PMI which is forecast at 47.5 (still below 50, the ‘breakeven’ mark for expansion). This is followed by Manufacturing and Services PMI readings in the Eurozone and then US Manufacturing PMI in the afternoon. All are forecast to be relatively unchanged in the low 50s.

Japan joins in with its own PMI reporting early on Thursday morning, after which Germany updates consumer confidence and the state of the current business climate through the IFO surveys. In the afternoon the US releases durable goods orders and new home sales – expected to have increased at a slower pace. There will also be initial jobless claims from the US, forecast to be slightly up to 271,000 in August from 264,000 in July.

On Friday, overnight Japanese inflation is reported and is forecast to remain subdued. The rest of the morning is quiet, and then the afternoon has the first reading of the US Services PMI from Markit, as well as revisions for second quarter GDP growth, corporate profits and the Michigan Consumer Sentiment measure.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.