Will we finally see a US Fed rate rise in December?

The US Fed meeting minutes didn’t disappoint, with a clearly hawkish tone reinforcing the messaging interpreted from the Federal Open Market Committee (FOMC) meeting statement at the end of October. The key point jumped on by the markets was that the majority of committee members believed that the preconditions for rising rates “could well be met” by the December meeting. This makes a year-end lift off highly likely, despite GDP slowing and US corporations suffering two quarters of falling earnings whilst complaining about excessive dollar strength.

The Fed has been reluctant to move whilst there has been turmoil in overseas economies and markets, and whilst there has been a lack of coherence in the US labour market indicators. However, with overseas markets now calming and both job growth and wages data telling the same story as inflation starts to feed through, the Fed finally seems to have the setting it has been waiting for (although our house view remains that they have acted too late and ultimately this path will be viewed as a policy error).

At the same time, the broader messaging from various committee member speeches clearly points to a very gradual hiking path from here, which is likely to be considerably slower than previous cycles. This has helped to reassure markets. The only realistic obstacle to a rate hike would seem to be the November non-farm payroll numbers due out next week, which we expect would have to be a shockingly bad miss to stay the Fed’s hand.

The Bank of Japan leaves its policy unchanged

Still on the theme of Central banks, the Bank of Japan left its monetary printing programme unchanged, purchasing at a rate of ¥80 trillion per annum. The bank chose not to increase the programme despite the Japanese economy lapsing back into recession. Instead, the Central bank is leaving it to the government’s special budget to inject stimulus through fiscal policy. In a statement, Governor Koroda remained confident that Japan’s economy was improving and that upcoming wage negotiations would help bring inflation back towards the 2% target. Headline annual inflation is currently zero, and core inflation is just below 1%.

Over in Europe, whilst there was no meeting of the policy-setting committee, ECB President Draghi continued to drop strong hints that the ECB would further loosen monetary policy at its December meeting. This could involve both a drop in the main interest rate further into negative territory, as well as a boosting of the QE programme.

Last week’s other events

- UK headline CPI remained in deflation for a second month, with year-on-year prices falling -0.1%. However, the core rate (which excludes the more volatile and largely external commodities) picked up by 0.1% to 1.1% year on year. This provided some justification for confidence that inflation could pick up once some of the commodity base effects move out of the numbers.

- Still in the UK, year-on-year retail sales figures were a source of disappointment – slowing more than expected to 3.8% from 6.2% a month earlier. The markets had only pencilled in a decline to 4.2%.

- According to the ZEW surveys of business confidence, German corporations have an improving economic outlook. The Economic Sentiment index increased from 1.9 to 10.4 in November, although the current conditions index slipped back from 55 to 54.4.

- US inflation picked up another 0.1% to 0.2% year on year in October, whilst core inflation held steady at 1.9%. US Industrial Production fell from the previous month for the second consecutive time, finishing down -0.2% against expectations for a slight rise. However, a stronger report from the Philadelphia Fed Manufacturing index helped support sentiment. Month-on-month housing starts were also sharply lower, falling 11% in October from August.

The markets

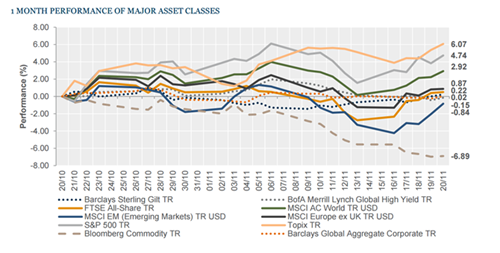

Risk assets recovered some of their poise following the falls last week as both equities and bonds took comfort from the latest output from Central bankers.

Equities – A strong showing for major markets. In the UK, the FTSE All-Share returned +3.2% and similar moves were seen in the US and Europe, where the the S&P 500 and the FTSE Europe ex-UK indices returned +3.3% and +2.2% respectively. Far Eastern markets were also up, with the Topix index of Japanese equities gaining +1.0%, whilst in Hong Kong the Hang Seng returned +1.7%.

Bonds – There were generally positive moves for sovereign bonds as well. UK ten-year gilt yields were 10 bps tighter at 1.88%, US treasuries barely moved, and ten-year German bunds were 7 bps tighter.

Commodities – Overall there was little movement in the oil markets over the week, with Brent finishing at US$44.46. However, copper was lower throughout the week, and fell further on Friday to finish barely above the $2 per lb mark at US$2.05. Gold reversed some of its recent weakness in dollar terms, rising to US$1,076 by the end of Friday.

Currencies – The euro weakened on the back of dovish comments from ECB President Draghi, falling -0.37% against the sterling and -0.47% against the dollar. The main gainer was the yen, as its Central bank held off further QE. The currency strengthened 0.71% against the dollar and 0.36% against sterling. Sterling was barely changed against the US dollar, slipping a mere -0.07%.

The week ahead

A range of PMI readings are out this week. In the UK the Government also reports on fiscal matters in its Autumn Statement, which could provide some interest given our house view that fiscal policy may start taking over from monetary policy as key tools in the attempt to boost economic growth. Black Friday at the end of the week will be a key consumption measure, but it comes after UK market closes.

On Monday morning there are Flash Manufacturing and Services PMIs for the Eurozone, which are expected to remain steady in the early 50s – reinforcing a reasonable expansion story. In the afternoon US manufacturing PMI is reported along with existing homes data.

Tuesday sees the release of German business sentiment surveys from IFO following the ZEW surveys last week. In the afternoon, aggregate US corporate profits are updated as well as any revisions to the Q3 GDP figures. Finally we’ll get some more detail on US consumers from the S&P/Case-Shiller house prices index and the latest consumer confidence measure.

Wednesday’s highlight will be the UK Government’s Autumn Statement, after which there is a US data-dump with Services PMI mixed in alongside durable goods, new home sales and personal income and spending. As we move on to Thursday, there will be more data on the state of the Japanese economy with unemployment and job hunting numbers plus the latest inflation figures.

On Friday morning the UK will release the latest consumer confidence readings and the first revision to Q3 GDP. Then, to finish the week Eurozone Business Confidence survey results will be published. Expectations are that industrial sentiment will stay subdued, but that overall economic sentiment will remain relatively robust.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.