Weekly macroeconomic and market update

Weekly macroeconomic and market update

Weekly macroeconomic and market update

Are we seeing a potential shortcut to Grexit?

The Greece situation continued to deteriorate last week, with the usual political brinkmanship now tinged with frustration and exasperation from all sides involved. By all accounts, Greece has essentially run out of money and almost certainly cannot make the €1.5 billion payment to the IMF due at the end of the month without the release of bailout funds from creditors. Arguably this is still effectively a “soft” deadline – there are no automatic events triggered by a non-payment and the nature of the loans means ratings agencies won’t consider this an actual default.

Of greater concern is how much longer the ECB will provide emergency liquidity to the Greek banking system, which is starting to suffer very significant capital flight. Cash withdrawals accelerated last week with €5 billion being withdrawn from a total deposit pool of €134 billion at the end of April. This has sparked concerns that a bank run could follow, which in turn could force the hand of authorities into imposing capital controls – a potential unintended shortcut to Grexit.

“Gradual” is the US Fed’s new buzz word

The new buzz word from the US Federal Reserve is “gradual” and guidance on interest rates has followed this theme. Chairwoman Janet Yellen spoke about lingering concerns over cyclical weakness in the US labour market, even as other measures of economic growth have indicated continuing strength.

The ‘dot plots’ of forecasts by individual members still point to a September lift-off, but the trajectory now appears more gentle than before. There is also a greater likelihood of just a single rate hike this year (despite previous expectations for two hikes).

Last week’s other events

The markets

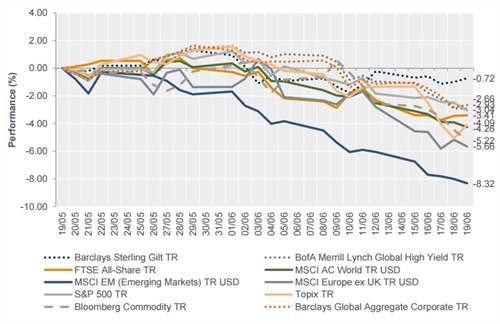

Last week saw mixed results for all the major asset classes. Notable updates for UK investors included the continued strengthening of the sterling against other major currencies, the FTSE finishing the week down 1.1%, and little change for 10-year Gilt yields.

The week ahead

Eurozone leaders will hold a make-or-break meeting this evening to discuss the Greek debt crisis. Before that, we have Eurozone consumer confidence data as well as US home sales. Tuesday sees the release of numerous PMI readings, starting with flash Chinese Manufacturing PMIs. These are followed by Eurozone flash PMIs for Services and Manufacturing, and then US Manufacturing PMIs. Expectations on both sides of the Atlantic are for little change in the low 50s, indicating continued marginal economic expansion.

We have a quiet Wednesday with the IFO German Economic surveys as the most notable releases of the day, followed on Thursday morning by German consumer confidence numbers. In the afternoon we also get flash Services PMI updates, personal income and spending figures from the US. Friday morning will see Japanese readings for inflation, household spending and unemployment before we finish the week with French and Italian consumer confidence numbers.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.