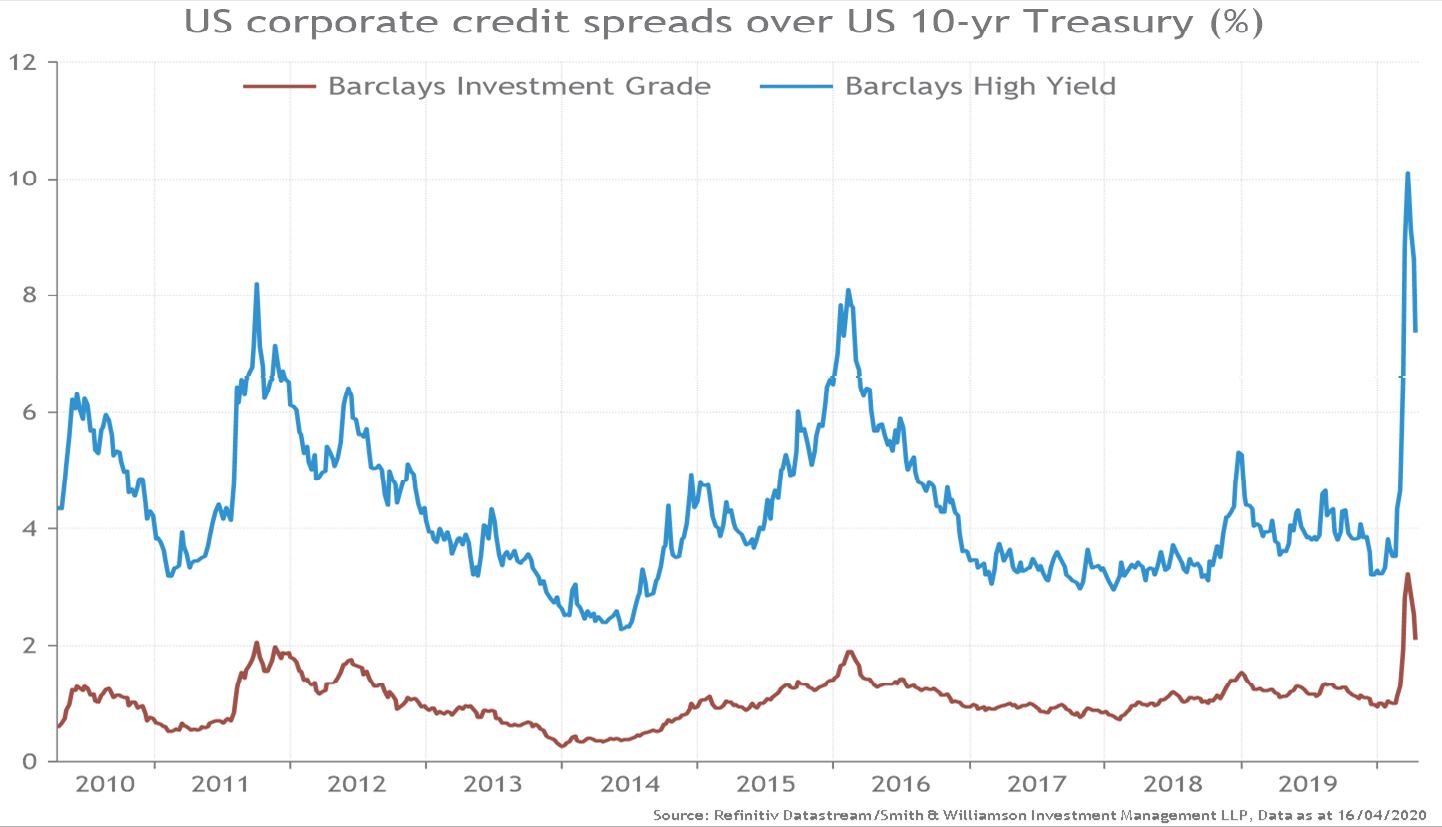

The US corporate bond market offers an opportunity for income seeking investors. Investment grade and high yield corporate bonds currently trade at yields of 2.1%, and 7.4% respectively, which compares to a S&P 500 equity trailing dividend yield (DY) of 2.2%. Given that the futures market discounts a 22% cut in US dividends in 2020, the likely DY is probably nearer 1.7% (see our previous Webinar - How deep will dividend cuts be, 3 April 2020). Not only do corporate bonds look inexpensive relative to equities in terms of yield, but corporate bond spreads (the difference in yield between corporate bonds and treasury bonds of the same maturity) are elevated and have room to compress (see chart 1). In short, corporate bonds offer an alternative source of yield in a multi-asset portfolio where there is considerable uncertainty over equity dividend payouts.

Chart 1: US corporate bond spreads are elevated, but they are narrowing

Source: Refinitiv Datastream/Smith & Williamson Investment Management LLP, as at 15 April 2020

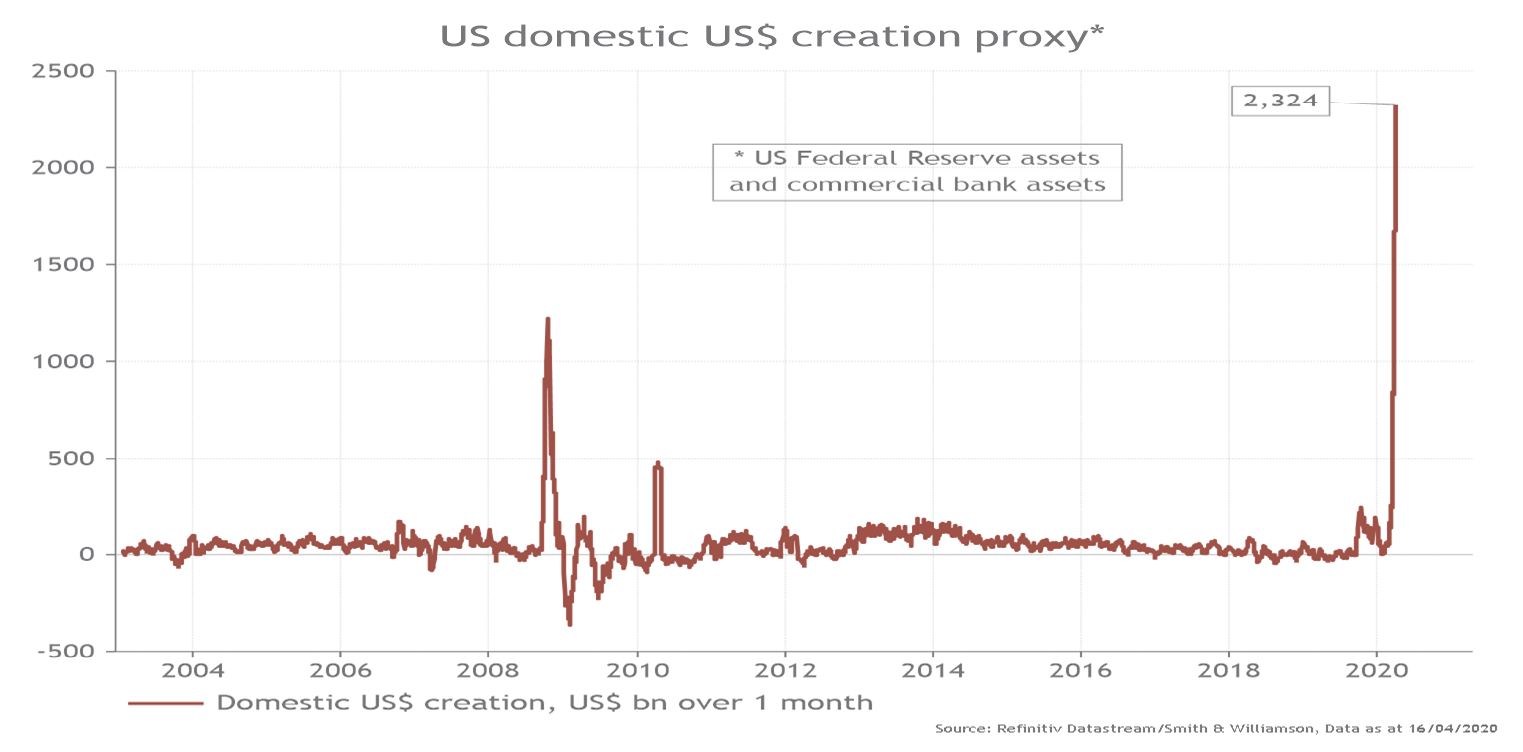

A key reason to look at the corporate bond space now is that unlimited Fed asset purchases (Quantitative Easing, or QE) and a step-up in government-backed commercial bank loans provides considerable support for companies during the coronavirus crisis. To get an idea of how much money is being injected into the financial system, we can add the monthly change in Fed assets with the total commercial bank loans & leases. Over the past month, the change in this metric totalled $2.3trn, far higher than the maximum rise of $1.3trn during the Global Financial Crisis (GFC) in 2008 (see chart 2). This liquidity is feeding through to broad M2 money supply (e.g. currency in circulation and bank deposits), which is expanding at over 14%, the fastest rate since World War 2. In other words, there is ample liquidity flowing through the financial system.

Chart 2: The Fed and commercial banks are providing records levels of funding

Source: Refinitiv Datastream/Smith & Williamson Investment Management LLP, as at 15 April 2020

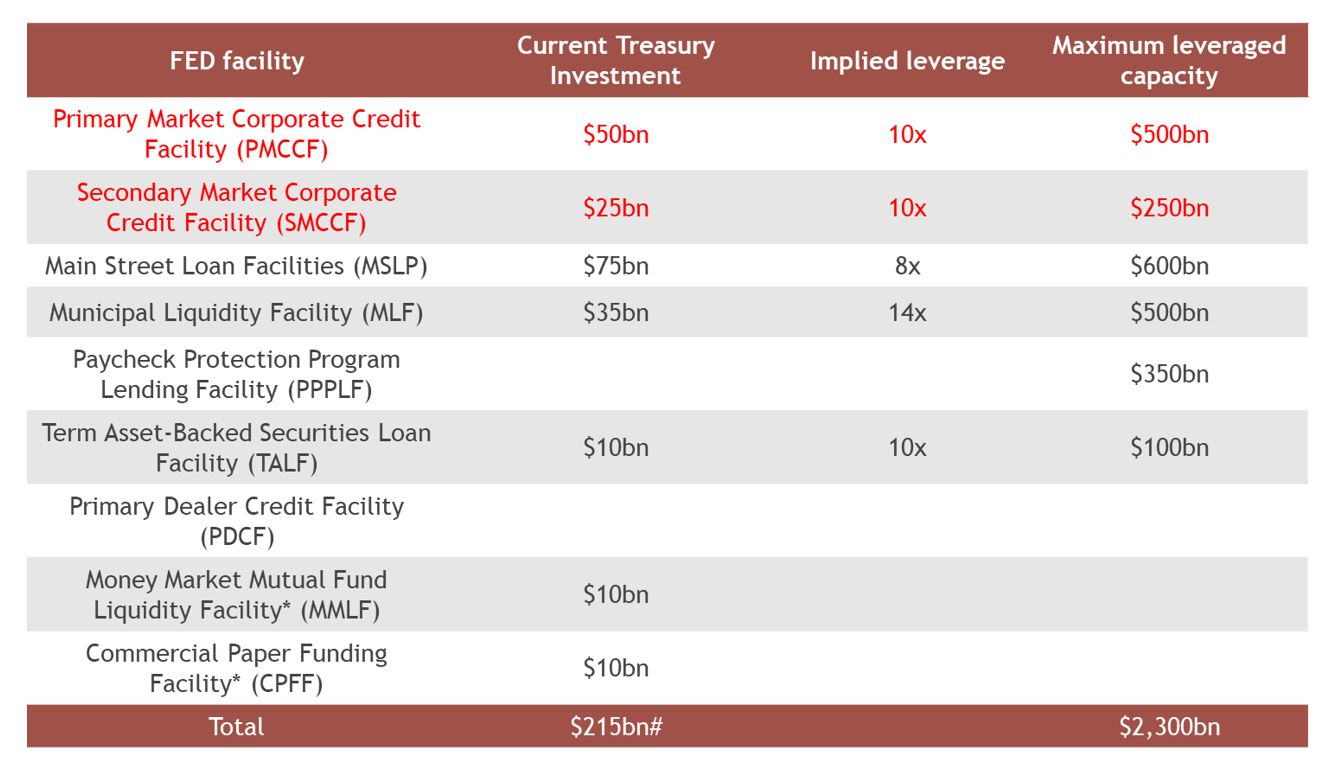

Moreover, the Federal Reserve has launched a smorgasbord of credit lending facilities over the past month. Specifically, the Fed introduced two facilities which enable funds to be channelled directly into the corporate bond market and Exchange Traded Funds (ETFs), which invest in corporate bonds. The first is the Primary Market Corporate Credit Facility (PMCCF), which provides a funding backstop for non-bank issuers to access capital in the corporate bond market. While there is a charge to borrowers for this facility, creditors will be reassured that companies do have access to capital to meet debt payments if required. The second is the Secondary Market Corporate Credit Facility (SMCCF) that allows the Fed to buy eligible existing corporate bonds on capital markets, as well as US-listed ETFs that provide broad exposure to the US corporate bond market (including selected high-yielding bonds).

The scale and scope of the Fed’s $2.3trn in credit facilities (see table 1) to keep corporate America humming along is vastly different to measures provided during the GFC. First, the PMCCF and SMCCF combined are funded with a $75bn investment from the US Treasury that is used to absorb the first-loss protection in the event of loan defaults. The Fed is then free to leverage the Treasury’s initial investment up to 10 times to deliver $750bn in funding capacity. However, given that only around half of the Treasury investment from the US Coronavirus, Aid, Relief, and Economic Security Act (the “CARES Act") has been allocated by Congress so far, the Fed’s corporate bond funding capacity could potentially be doubled to $1.5trn when fully utilised. Second, while the PMCCF was used between 2008-2010, the Fed only provided very short-term overnight money, compared to up to 90 days today. This means the Fed is taking on additional term credit risk from lenders. Third, even during the GFC, when the Lehman’s bankruptcy increased counterparty risk, the Fed never intervened in the secondary corporate bond market or bought ETFs. And fourth, the Fed has expressed its willingness to move along the credit risk spectrum to buy corporate debt in the high-yield or junk market. That gives a clear message to investors that riskier debt will also be bailed out by the Fed.

Table 1: Summary of recently launched Fed lending facilities

*Leverage was not specified for the MMLF and the CPFF. # $215bn is only part of the $454bn Treasury investment under Title IV from the $2.2trn CARES Act (Coronavirus Aid, Relief and Economic Stability Act)

Source: Deutsche Bank/Smith & Williamson Investment Management LLP, as at 15 April 2020

Holistically, QE, commercial bank loans with government guarantees and the latest Fed credit facilities should provide a financial cushion for US businesses (both large and small firms) to weather the expected downturn in the economy from COVID-19. To paraphrase former ECB president, Mario Draghi, the Fed and Congress have made it clear that they are prepared to do ‘whatever it takes’ to make sure there is ample funding available for US firms.

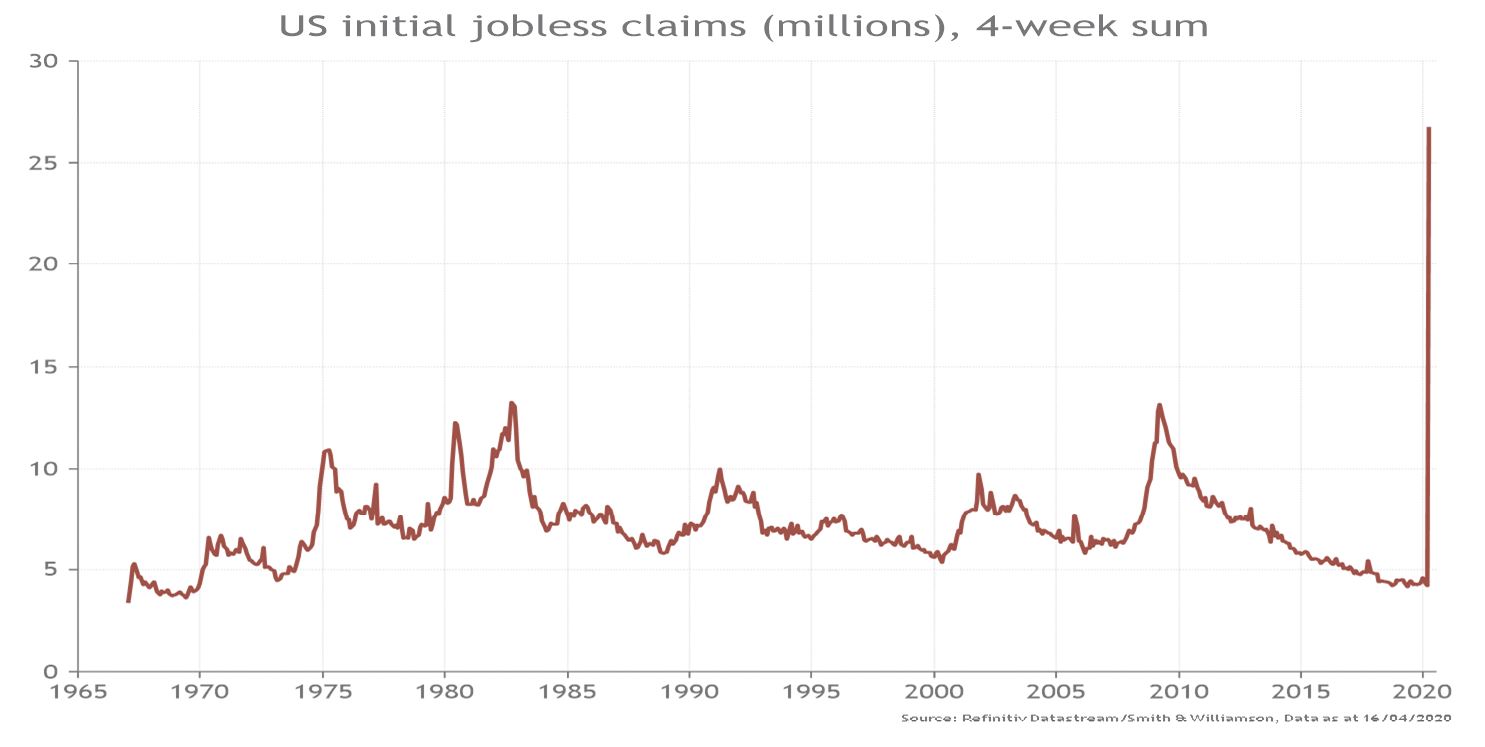

This move to state capitalism harbours the risk of propping up unprofitable “zombie” companies, erodes price discovery in markets, creates moral hazard in taking risks and leads to a never ending rise in leverage (public and private) that is likely to weigh down on the economy over the long term. Nevertheless, a more pressing risk is to what extent government lockdowns from COVID-19 will have on labour markets, domestic demand growth and debt defaults. US initial jobless claims (an early read of the unemployment rate) have risen by a staggering 26m cumulatively over the past 4 weeks (chart 3). Higher unemployment is already leading to lower domestic demand. For instance, retail sales fell by 8.7% in March, the biggest decline on record from data going back to the early 1990s. Less demand is likely to lead to rising private-sector debt default rates, which instils uncertainty in financial markets. Though the Fed can’t remove corporate default risk, it can keep the market to be fully funded and reduce upside in spreads from a lack of liquidity.

Chart 3: Rising unemployment is a risk for the corporate bond market

The bottom line is that with the Fed becoming more actively involved in the corporate bond market and commercial banks providing another line of financing for firms, downside risk in credit markets has been lessened. This will further lower the risk of investing in the corporate bond market relative to equities. For income investors, look to Fed-backed US corporate credit as an alternative to low-paying dividend stocks.

Source: All datapoints quoted from Refinitiv Datastream, data as at 15 April 2020

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

Please remember investment involves risk. The value of investments and the income from them can fall as well as rise and investors may not receive back the original amount invested. Past performance is not a guide to future performance.

Evelyn Partners Investment Management LLP

Authorised and regulated by the Financial Conduct Authority.

Registered in England No. OC 369632. FRN: 580531

Evelyn Partners Investment Management LLP is part of the Evelyn Partners group.

© Evelyn Partners Group Limited 2021

Ref: 56420eb

Disclaimer

This article was previously published prior to the launch of Evelyn Partners.