With the start of May on the horizon, seasoned investors might recall the old adage ‘Sell in May and go away, don’t come back till St. Leger Day’ which advocates selling out of the stock market for the summer months and returning in the autumn.

The saying is believed to have its origins from the days when stockbrokers left the City for ‘The Season’, a period of sporting and social events including Royal Ascot, Wimbledon, the Henley Royal Regatta, Cowes Week and ending with the St Leger flat race in mid-September. Yet over time it has come to be associated with a belief that the summer months are a dangerous period for investors, with a high incidence of market sell-offs. But should investors pay heed to this old maxim?

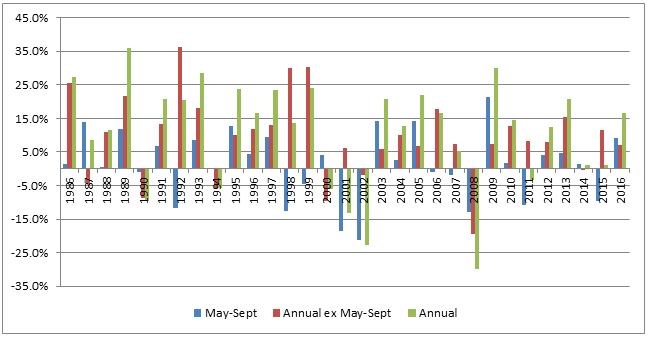

Looking at 31 years of total return data for the FTSE All Share Index (including dividends reinvested), the period since the “Big Bang” reforms which ushered in the age of electronic trading, research from Tilney Group reveals that during the period between 1 May and the second week of September, the FTSE All Share Index has delivered positive returns in 20 out of the past 31 years, meaning 65% of the time investors would have made positive returns by staying invested over the summer. This compares to markets rising 77% of the time across the full calendar years over this 31 year period.

It is also true that the summer months have seen seven steep sell-offs over the last 31 years, these being 1992 (-11.6%), 1998 (-12.6%), 2001 (-18.4%), 2002 (-21.2%), 2008 (-13.0%), 2011 (-10.9%) and 2015 (-9.6%).

Jason Hollands, Managing Director at Tilney, said: “The days of City professionals packing up shop for a long summer sipping Pimm’s and champagne at social events are a distant memory: not least because accepting lavish corporate hospitality is now frowned upon. These days, if a City professional is off on summer holiday, they’re almost sure to be forever checking news from the markets on a mobile phone or tablet, as information is now incredibly accessible. Therefore when putting seasonality theories such as ‘Sell in May’ to the test, it is probably more relevant to only consider data since the 'Big Bang' deregulation of the City in 1986 rather than longer periods when the London markets operated as a gentleman’s club. And over this 31-year period, there isn’t a compelling case to systematically exit the market every year between May and mid-September, a move which could also incur trading costs or potentially crystallise capital gains tax liabilities.

“That said true believers in the ‘Sell in May’ mantra can undoubtedly point to notable summer sell-offs – some of which actually came in the early weeks of September. However, selective memory might mean ignoring the soaring summers of 1987, 1989, 1995, 2003, 2005, 2009 when the markets posted double digit returns.”

Hollands concluded: “With stock markets currently riding high but volatility eerily low, it’s easy to so see why some investors might be wary of the outlook for markets this particular summer. But in truth it is nigh impossible to predict short-term market setbacks and the good times could well roll on for some time yet as global growth is picking up, business sentiment surveys have edged up and global earnings revisions have been positive this year. Investors with a long-term time horizon should stay invested rather than fret about what might happen over a few months.”

Source: Tilney

All data includes dividends reinvested

ENDS

Important information

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. This press release does not constitute personal advice. If you are in doubt as to the suitability of an investment please contact one of our advisers. Past performance is not a guide to future performance.

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.