Does it pay to Sell in May

Does it pay to ‘Sell in May’?

Does it pay to ‘Sell in May’?

With the start of May just days away, investors will be reminded of the old adage ‘Sell in May and go away, don’t come back till St. Leger Day’, which advocates selling out of the stock market for the summer months. The saying has its origins from the days when brokers left the City for ‘The Season’, a period of sporting and social events including Royal Ascot, Wimbledon, the Henley Royal Regatta, Cowes Week and ending with the St Leger flat race in mid-September.

This year the St Leger race is set to take place at Doncaster on Saturday 12 September, and the total prize fund looks set to top 2014’s huge £650,000 pot. With the FTSE All Share Index of UK shares having already delivered an impressive total return of 8.9% since the start of the year, is now the time for fans of the seasonal investing approach to cash in their portfolios or could they find themselves caught in the starting gates?

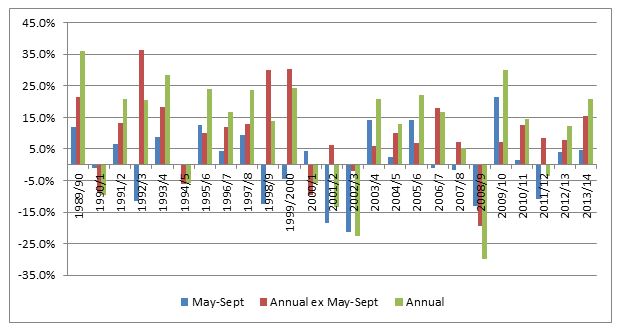

Looking over 29 years of data for the FTSE All Share Index (1986 was the year of the ‘Big Bang’ reforms which deregulated the City), research from Tilney Bestinvest suggests that while a number of market slumps have taken place over the summer months, a general strategy of exiting the market during this season is far from convincing.

During the period between 1 May and the second week of September, the FTSE All Share Index has delivered positive returns in 19 out of the past 29 years, meaning 66% of the time investors would have made positive returns by staying invested over the summer. This compares to markets rising 76% of the time across the full calendar years.

Percentage returns on the FTSE All Share Index

Source: bestinvest.co.uk / Thomson Reuters Datastream

Jason Hollands, Managing Director at Tilney Bestinvest, said: “The days of the City resembling a ghost town during the summer months are long gone. The investment markets themselves are of course very different these days too; securities trade electronically in nano-seconds and the big players in terms of trading volumes are now hedge funds and quantitative trading programmes, not traditional institutions such as company pension schemes.

“These days, if a City professional is off on summer holiday, they’re almost sure to be forever checking news from the markets on a mobile phone or tablet, as information is now incredibly accessible and the boundaries between working hours and personal time have eroded. Therefore when putting seasonality theories such as ‘Sell in May’ to the test, it is probably more relevant to only consider data since the 'Big Bang' deregulation of the City in 1986 rather than longer periods when the London markets operated as gentleman’s club. And over this 29-year period, there is not a convincing case that it makes sense to generally exit the market between May and mid-September.

“That said, true believers in this Old Wives tale can point to the fact that the summer months have seen six pretty steep sell-offs over these years: 1992, 1998, 2001, 2002 , 2008 and 2011. And this year, who knows what the markets have in store? A knife edge UK election on 7 May resulting in a fragile Government could potentially spook international investors and prompt some knee-jerk selling, likewise Greece is seemingly lurching towards an exit from the Eurozone. And there is also mounting angst over when the US will start to raise interest rates, as this could result in a liquidity squeeze across the globe piling the pressure on emerging markets. So there are plenty of reasons for investors to worry about a volatile summer.

“Ultimately though, long-term investors should not lose sight of the fact that bouts of market weakness – whatever the time of year – are buying opportunities, not a time to sell. Unless you have a crystal ball to predict short term market movements, or have a near term need to draw on your investments, it is best to stay focused on your long-term strategy rather than worry about the direction of the markets over a handful of months.”

- ENDS -

Press contacts:

Roisin Hynes

0207 189 2403

07966 843 699

roisin.hynes@tilneybestinvest.co.uk

Matthew Gray

0207 189 2492

matthew.gray@tilneybestinvest.co.uk

Important information

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. This press release does not constitute personal advice. If you are in doubt as to the suitability of an investment please contact one of our advisers. Past performance is not a guide to future performance.

About Tilney Bestinvest

Tilney Bestinvest is a leading investment and financial planning firm that builds on a heritage of more than 150 years. We look after more than £9 billion of assets on our clients’ behalf and pride ourselves on offering the very highest levels of professional client service with transparent, competitive pricing across our entire range of solutions.

We offer a range of services for clients whether they would like to have their investments managed by us, require the support of a highly qualified adviser, prefer to make their own investment decisions or want to take more than one approach. We also have a nationwide team of expert financial planners to help clients with all aspects of financial planning, including retirement planning.

We have won numerous awards including UK Wealth Manager of the Year, Low-cost SIPP Provider of the Year and Self-select ISA Provider of the Year 2013, as voted by readers of the Financial Times and Investors Chronicle. We are pleased that our greatest source of new business is personal referrals from existing clients.

Headquartered in Mayfair, London, Tilney Bestinvest employs almost 400 staff across our network of offices, giving us full UK coverage, and we combine our award-winning research and expertise to provide a personalised service to clients whatever their investment needs.

The Tilney Bestinvest Group of Companies comprises the firms Bestinvest (Brokers) Ltd (Reg. No. 2830297), Tilney Investment Management (Reg. No. 02010520), Bestinvest (Consultants) Ltd (Reg. No. 1550116) and HW Financial Services Ltd (Reg. No. 02030706) all of which are authorised and regulated by the Financial Conduct Authority. Registered office: 6 Chesterfield Gardens, Mayfair, W1J 5BQ.

For further information, please visit: www.tilneybestinvest.co.uk

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.