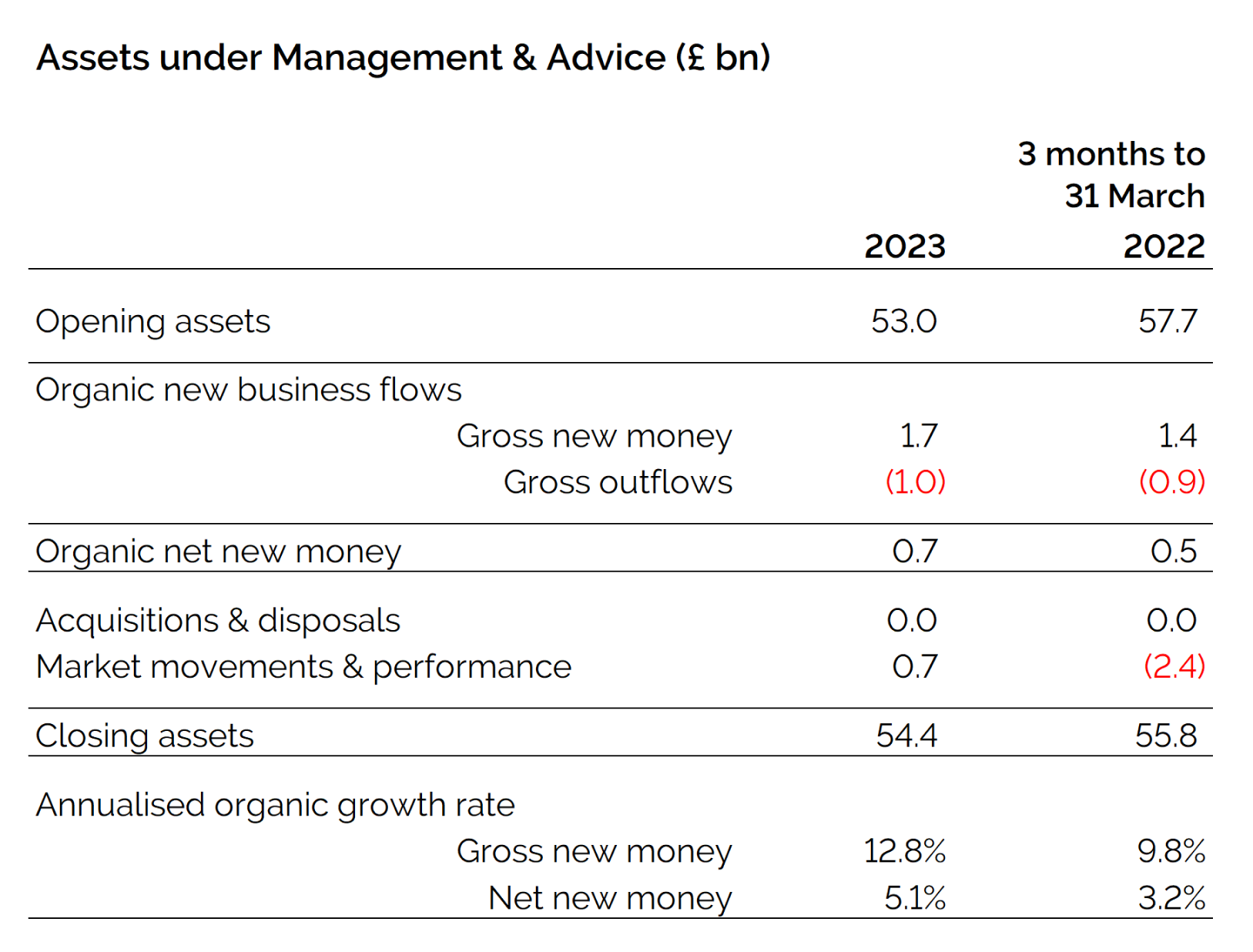

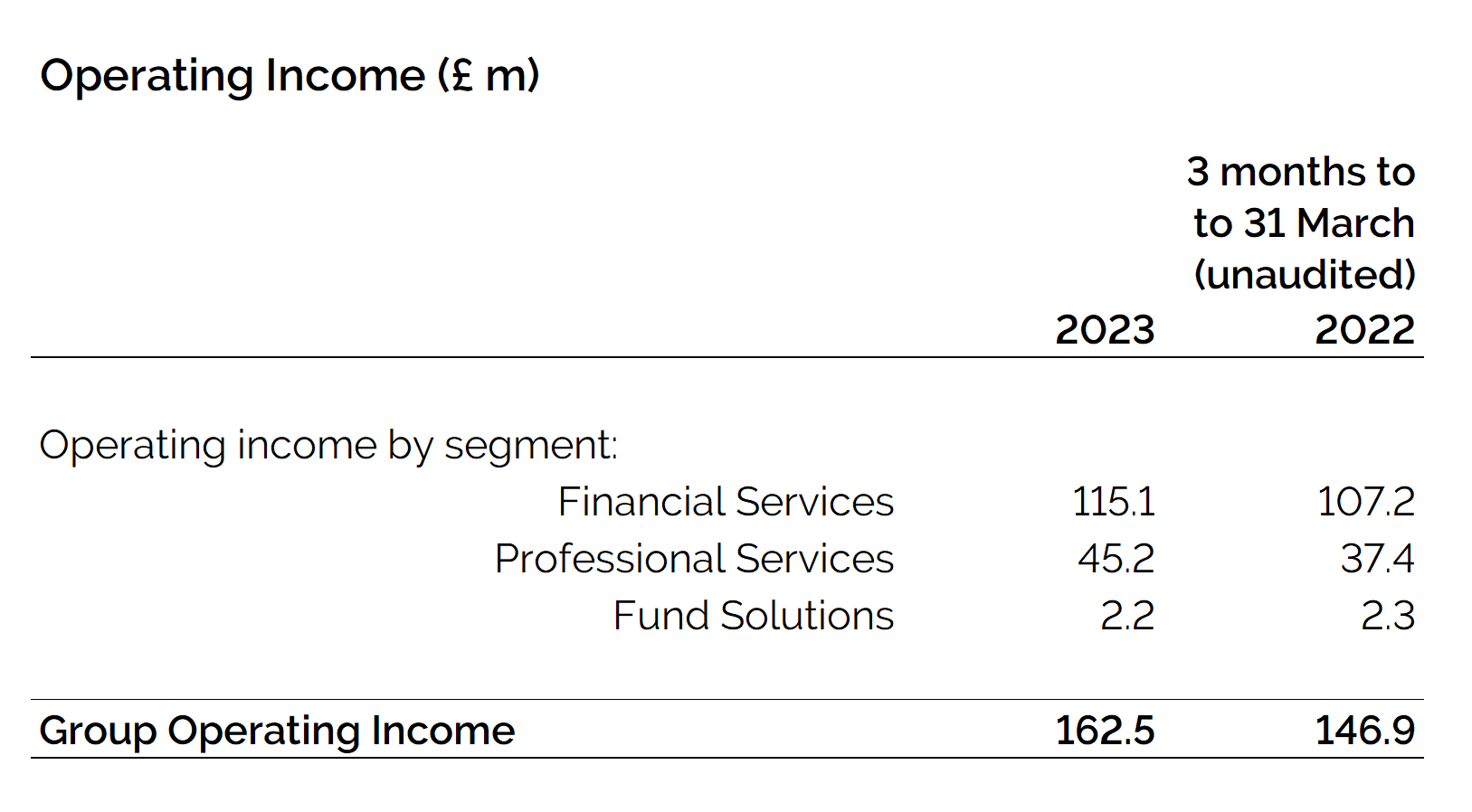

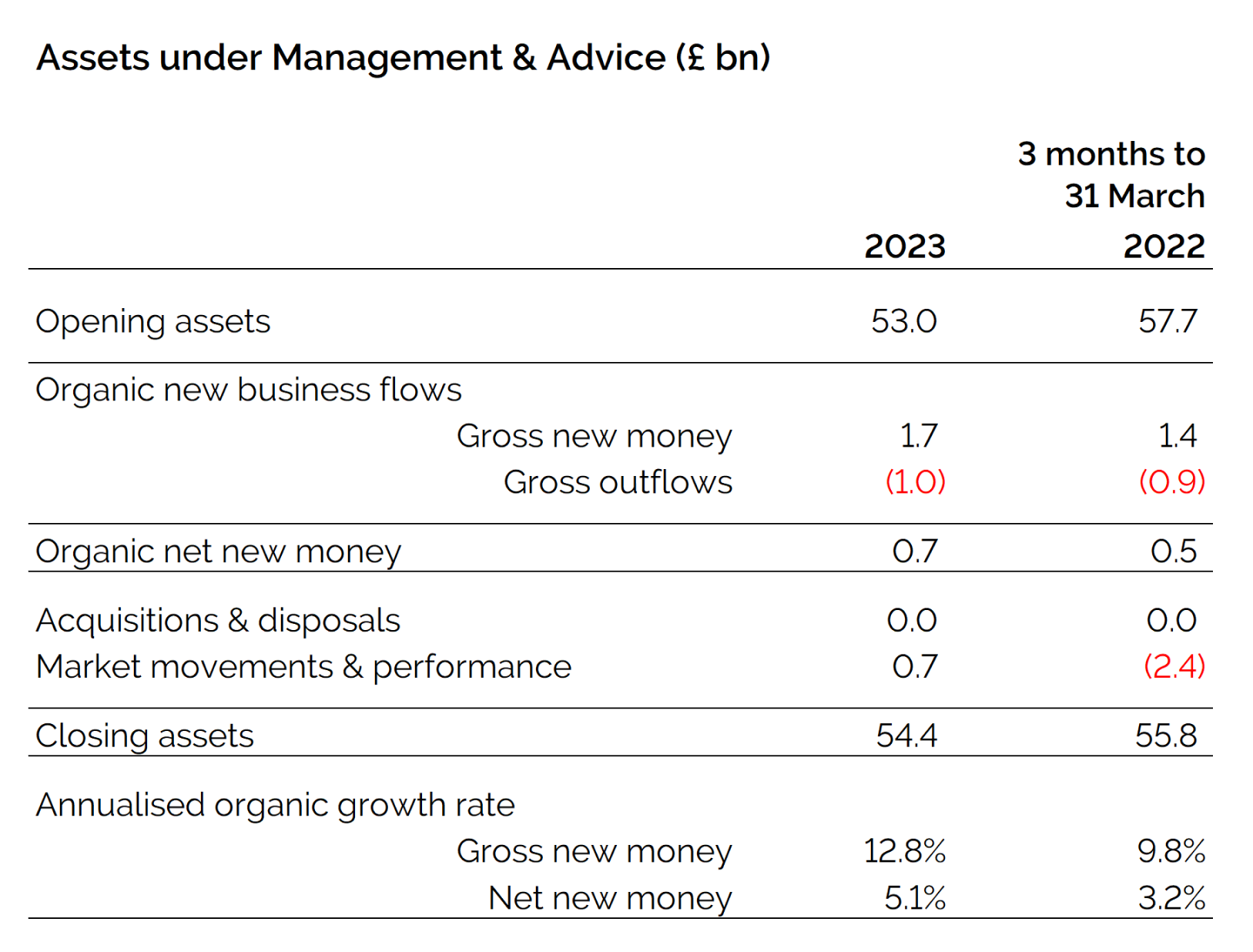

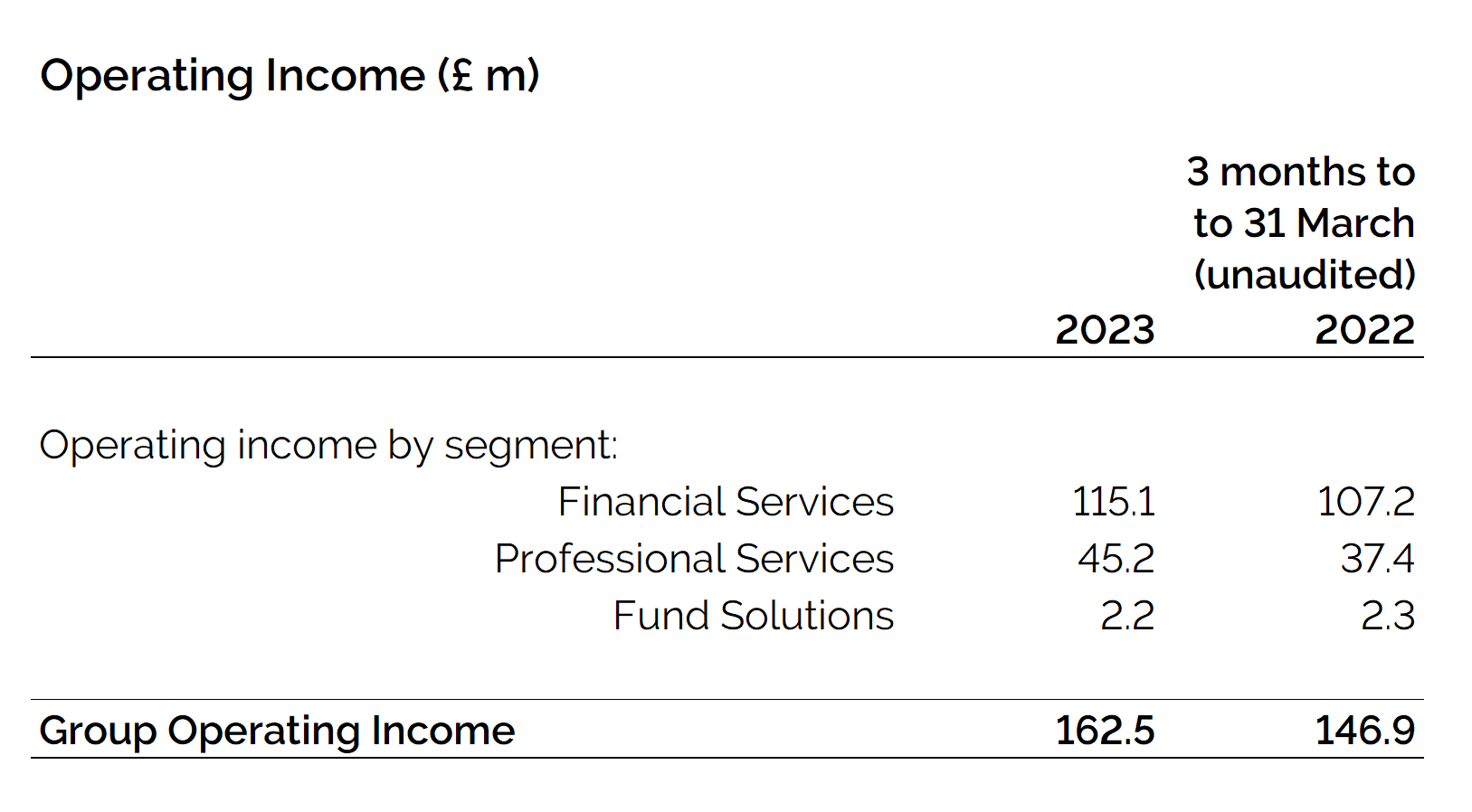

Evelyn Partners is pleased to announce a trading update for the three months ended 31 March. The quarter saw a record £1.7 billion of gross new assets added and net inflows of £673 million were 45.1% higher than the prior year, growing at an annualised rate of 5.1%, a significant increase from the 3.2% reported for Q1 last year. Operating Income grew by 10.6% year-on-year, with strong performance in both Financial Services and Professional Services.

Highlights

- Group operating income in Q1 of £162.5 million, up 10.6% from £146.9 million in the same period last year, with strong performances from both the Financial Services and Professional Services businesses.

- Gross inflows of new assets in Q1 were £1.7 billion, up 20.3% versus last year and equivalent to an annualised growth rate of 12.8% on opening assets.

- Net inflows in Q1 were £673 million, up 45.1% compared to Q1 2022 and equating to an annualised growth rate of 5.1%.

- Assets under Management & Advice (AuMA) increased by £1.4 billion to £54.4 billion over the quarter (31 December 2022: £53.0 billion).

- Continued strong growth in Professional Services, with operating income of £45.2 million in Q1, up 20.9% compared to the same period last year.

Chris Woodhouse, Group Chief Executive, commented:

“The business has seen a very strong start to 2023. The three months to the end of March saw gross inflows of new assets at £1.7 billion, which was a record quarter for the business. Our net flows of £673 million were 45.1% up on the same quarter last year and equivalent to an annualised growth rate of 5.1%. Our fast-growing professional services business also experienced continued excellent momentum, generating 20.9% higher operating income in the first quarter than the same period last year.

“Our strong new business generation is testament to the strength of our advice-led model and the value that both private clients and businesses place on trusted expertise during a period of economic uncertainty and rising taxation. Evelyn Partners’ strength lies in our ability to give integrated advice: we believe that the combination of having financial planners and investment managers working together to support clients is very powerful. Similarly, the rising UK tax burden is generating demand for our Professional Services business across both our private client and business tax advice teams, where we are able to provide clients with joined-up thinking.

“In less than a year since the group re-branded to Evelyn Partners, our new brand has been quickly established, supported by marketing, advertising campaigns and media coverage, with awareness levels already at the same level as the legacy brands. Since relaunching last summer, Bestinvest, our digital business for self-directed investors, has gained increased recognition, winning eight awards in Q1 and earning an ‘excellent’ rating by Trustpilot.

“We believe in advising clients close to where they are based. To better support Professional Services clients in the North of England, we acquired accountants and tax specialists Leathers LLP during the quarter, further bolstering our presence in the region. In April, we also acquired Cambridge-based accountancy firm Ashcroft, as well as onboarding a leading forensic disputes team from KPMG UK to similarly grow and develop our Professional Services business. It is also benefitting from increased external recognition, including being named Accountancy Firm of the Year in March by City AM.

“We have consistently demonstrated the ability to grow the business through different market environments. Our strength is rooted in the quality of our people and our distinctive model which integrates investment management and financial planning and our ability to support clients with their personal wealth and business interests. We see the business as exceptionally well-positioned to continue growing at a time when there is high demand for expert advice from individuals, families and businesses.”

ENDS