Geopolitical concerns rattle

Geopolitical concerns rattle the markets, but don’t forget that accurately timing the markets is virtually impossible

Geopolitical concerns rattle the markets, but don’t forget that accurately timing the markets is virtually impossible

After a prolonged period of record low volatility and many stock market indices touching record high levels, geopolitical concerns have started to send ripples in asset prices. These include the crisis between Russia and the Ukraine, a bloody localised war between Israeli and Hamas in Gaza, chaos across Syria and Iraq and an unstable situation in Libya.

Inevitably market jitters and alarming news flow will prompt some investors to consider whether they should take risk off the table, or invest more on the back of weakness. Yet the reality is that successfully timing the markets is incredibly difficult to do.

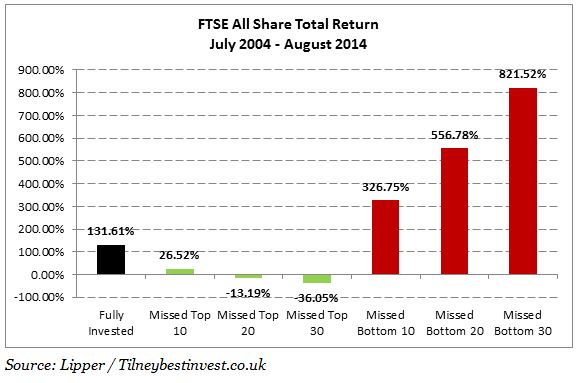

In order to analyse such an approach, Tilney Bestinvest has analysed the returns investors could have received had they missed the best ten, twenty and thirty days in the FTSE All Share over the past ten years - as well as the worst.

Jason Hollands, Managing Director at Tilney Bestinvest said: “The overall returns made over the last decade on the stock market have been hugely influenced by a relatively small handful of days when markets have seen big moves. While we would all have liked to have spotted the very worst days ahead of them happening and taken evasive action, the reality is that pinpointing shock events and aggressive market sell-offs with any degree of precision is impossible.

“The risk in trying to time the markets comes with missing the strongest days. If you had missed the top ten days in the UK market over the last decade your overall 10-year return would have shrunk from 132% to 27%. If you had missed out on the top 20 days, you would have actually seen a negative return overall.

“None of us has a crystal ball to predict short term market movements with accuracy and attempting to do so has the potential to seriously backfire. The returns above also don’t include the trading costs which an investor could incur.

“For most truly long-term investors, the right strategy is to keep calm and not get distracted by the white noise of current events and short term market movements. Owning a well-diversified portfolio that is periodically re-balanced and drip feeding any new cash in over time is a very sensible strategy for private investors to follow.”

-ENDS-

Important information:

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. This article does not constitute personal advice. If you are in doubt as to the suitability of an investment please contact one of our advisers.

Press contacts:

Jason Hollands

0207 189 9919

07768 661 382

Jason.hollands@tilneybestinvest.co.uk

Roisin Hynes

020 7189 2403

07966 843 699

Roisin.hynes@tilneybestinvest.co.uk

About Tilney Bestinvest

Tilney Bestinvest is a leading investment and financial planning firm that builds on a heritage of more than 150 years. We look after more than £9 billion of assets on our clients’ behalf and pride ourselves on offering the very highest levels of professional client service with transparent, competitive pricing across our entire range of solutions.

We offer a range of services for clients whether they would like to have their investments managed by us, require the support of a highly qualified adviser, prefer to make their own investment decisions or want to take more than one approach. We also have a nationwide team of expert financial planners to help clients with all aspects of financial planning, including retirement planning.

We have won numerous awards including UK Wealth Manager of the Year, Low-cost SIPP Provider of the Year and Self-select ISA Provider of the Year 2013, as voted by readers of the Financial Times and Investors Chronicle. We are pleased that our greatest source of new business is personal referrals from existing clients.

Headquartered in Mayfair, London, Tilney Bestinvest employs almost 400 staff across our network of offices, giving us full UK coverage, and we combine our award-winning research and expertise to provide a personalised service to clients whatever their investment needs.

The Tilney Bestinvest Group of Companies comprises the firms Bestinvest (Brokers) Ltd (Reg. No. 2830297), Tilney Investment Management (Reg. No. 02010520), Bestinvest (Consultants) Ltd (Reg. No. 1550116) and HW Financial Services Ltd (Reg. No. 02030706) all of which are authorised and regulated by the Financial Conduct Authority. Registered office: 6 Chesterfield Gardens, Mayfair, W1J 5BQ.

For further information, please visit: www.tilneybestinvest.co.uk

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.