Comment from Jason Hollands, Managing Director at Bestinvest:

"Today saw the eagerly anticipated maiden Budget of the recently elected Indian government of Prime Minister Narendra Modi.

“Modi was swept to power in a decisive victory by the Hindu nationalist Bharatiya Janata Party (BJP) two months ago in a crushing defeat for the Congress party which suffered its worst electoral result ever. The BJP secured 282 seats out of 543 in the parliament; a majority which was further cemented by the support of other parties in the National Democratic Alliance which extended the seats stacked-up behind Modi to 343 - 63% of the parliament.

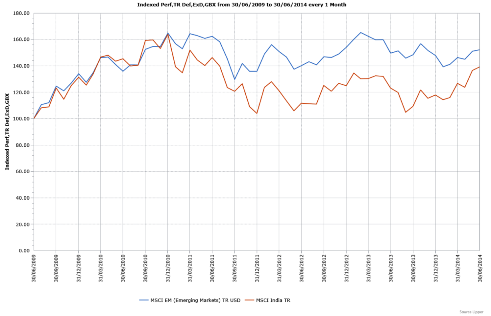

"Both the prospect of a commanding change of direction and the scale of the actual win has excited investors. As the chart below shows, after a period of lagging the broader emerging market indices, Indian equities have rallied strongly year to-date with the MSCI India Index rising 18% in the first six months of 2014 making it the best performing equity market on the globe over that period. By comparison the total returns from the both the MSCI Emerging Market Index and MSCI World Index have crept in at 3%.

"Expectations of this Government are running incredibly high, both at home and abroad. The strength of the new Government's mandate brings an end to years of crippling political gridlock which have frustrated the pace of much needed reform. Furthermore, Modi's record of economic management during his tenure as Chief Minister of Gujurat from 2001-14 is recognised as highly successful. Indeed for many Indians he is being seen as the saviour of the Indian economy.

"International investors have also become increasingly more bullish on the outlook for India with inflows into US mutual funds investing into Indian equities rapidly accelerating. According to Morningstar, Indian equity funds saw the highest organic growth of any sector in May. Many of the global emerging market managers we rate highly are also heavily overweight India, typically running positions that are more than double India's 6.3% weighting in the MSCI Emerging Markets Index.

"At a time when investors have become wary of emerging markets, India is currently seen by many as a relative bright spot among the so-called BRIC markets. Brazil has slipped into economic stagflation under the administration of President Dilma Rousseff who faces his own election in October, Russia has become increasingly isolated over its interference in Ukraine and policy of energy nationalism, while concerns continue about the deceleration in China’s growth story and the massive expansion of credit in the country.

"In today's Budget, Indian finance minister Arun Jaitley heralded a commitment to be robust on containing the deficit while announcing a raft of reforms aimed at delivering 7-8% GDP growth rates within three to four years. Among the announcements made were the intention of creating a unified tax system across Indian's 29 federal states; raising the level of Foreign Direct Investment permitted in the insurance and defence industries from 25% to 49% paving the way for major investment from US firms; and the intention to reignite stalled but much needed projects to improve India’s creaking infrastructure.

"Of course one of the major risks from here is that expectations are so great that any disappointments or policy set-backs would be ill-received. The Indian market is at an all-time high and with a forward P/E of 16.3x, it is one of the more expensive emerging markets.

"In our view, there is a lot to be positive about but investors need to recognise that investing in a single country emerging market fund is very high risk. Indeed Indian equity funds have typically experienced annualised volatility of 20% over the last three years - these are not for the feint hearted. We currently rate once such fund: Aberdeen Global Indian Equity GBP. This fund is a concentrated portfolio of circa 30 stocks and therefore its returns may vary from the MSCI India Index. Given the risks, most investors should get their exposure to India within a global emerging market fund or trust. Those we rate with a reasonably high India weighting which remain open to new investment are JP Morgan Emerging Markets IT (18.2%), JPM Emerging Markets Fund (17.4%) and Genesis Emerging Markets Fund (12.6%)."

- ENDS -

Important information

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. This article does not constitute personal advice. If you are in doubt as to the suitability of an investment please contact one of our advisers.

Underlying investments in emerging markets are generally less well regulated than the UK. There is an increased chance of political and economic instability with less reliable custody, dealing and settlement arrangements. The market(s) can be less liquid. If a fund investing in markets is affected by currency exchange rates, the investment’s value could either increase or decrease in response to changes in those exchange rates. These investments therefore carry more risk.

About Bestinvest:

Founded in 1986, Bestinvest has grown to become a leading private client investment adviser, looking after £5 billion of assets. We offer a range of investment services from the Online Investment Service for self-directed investors to Investment Advisory and Investment Management services for clients who do not have the time or inclination to manage their own investments.

All of our services are underpinned by rigorous research aimed at identifying those fund managers we believe will deliver long-term superior performance. We also have a team of expert financial planners with nationwide coverage to help clients with their pensions, retirement or Inheritance Tax planning. At Bestinvest, we pride ourselves on offering the highest levels of professionalism and expertise with transparent, competitive prices. We are pleased that our greatest source of new business is from personal referrals from existing clients.

Bestinvest has won numerous awards including Stockbroker of the Year, Low-Cost Sipp Provider of the Year and Self-Select ISA Provider of the Year at The Investors Chronicle and Financial Times Investment Awards 2013. Bestinvest also won UK Wealth Manager of the Year 2013 and Best Wealth Manager for Investments at The Investors Chronicle and the Financial Times Wealth Management Awards 2013.

Headquartered in Mayfair, London, Bestinvest employs more than 200 staff and has an extensive network of regional offices. For further information, please visit: www.bestinvest.co.uk

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.