With the start of May next week, it is that time of year when some investors choose to follow the old adage ‘sell in May and go away, don’t come back till St. Leger Day’. This year, they will do so against the backdrop of an exceptionally strong start to the year with UK shares having posted the best beginning to a year since 1998 and with the US market this week hitting a record high.

The saying originates from a time when stockbrokers would hang up their bowler hats and leave the City for the summer to enjoy a slew of sporting and social events known as ‘The Season’. This calendar of events included Royal Ascot, Wimbledon, Henley Royal Regatta, Cowes Week and ended with the St Leger flat race in Doncaster in mid-September. However, over time the rhyme has become associated with a theory that the summer months are a dangerous period for investors, with a high incidence of market sell-offs. Believers in this theory of stock market seasonality advocate selling out of shares and investment funds for the summer and buying back into the market again in the autumn.

A smart way to invest in the modern age?

Bestinvest, the online investment service for fund and share dealing, has put the theory to the test, looking at the performance the UK stock market(1) during the months of May, June, July and August in the three decades since the “Big Bang” reforms to the City. Introduced by Margaret Thatcher in October 1986, these measures opened up the financial markets, modernised the City and introduced electronic trading.

Based on analysis of more than 30 years of data (1987-2018), Bestinvest has found that over this period, UK share prices declined across these four months 50% of the time and rose 50% of the time, indicating no strong overall pattern of either losses or gains. However, when dividends payments were included, as well as price movements, the months of May to August have delivered a positive total return for investors 62% of the time.

Nevertheless, analysis of the last 30 years of average monthly returns does reveal that June has been the worst month overall with an average decline in UK share prices of 1.35%. Returns have also been negative in August and meagre in May, with only July standing out as a strong summer month. In contrast, December has proven the best month for returns, a phenomenon known as the Santa Rally – though the month did not bring any Christmas cheer in 2018 when UK shares sunk by -3.7%.

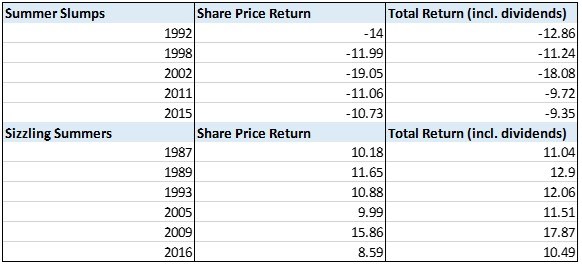

There is no doubt that there have been some notably turbulent summers in the past. However, as we show below, the number of times when the stock market has posted a double-digit loss for investors during May-August have been more than matched by sizzling summers when shares surged by 10% or more over these months.

Source: Bestinvest/Lipper. Returns on MSCI United Kingdom Index, May-end August. Total Return includes impact of dividends reinvested.

Jason Hollands, Managing Director of Bestinvest, commented: “While there have certainly been some volatile summers for stock markets in the past which have likely shaped perceptions, there have also been numerous times when thumping returns have been made during May to August. In our view, the case for systematically selling your shares each May and buying them back in September is far from convincing and it can also result in unnecessary trading costs or potential tax charges.

“In truth, unless you have a magic crystal ball to see into the future, trying to accurately predict what the markets might do over a short period of a few months is incredibly difficult. If you have a long-term time horizon for when you will need to use your investments, it is far better to stay invested and let the passage of time in the market do its work rather than gamble on theories of seasonality. Big market moves are typically triggered by surprise news shocks and panic selling: they are not something that can be conveniently scheduled into a calendar alongside the Chelsea Flower Show or Wimbledon.”

Hollands continued: “This year, it is easy to see why some may be tempted to bank profits made on the stellar gains made so far this year. However, these gains represent a rebound from the sharp declines experienced at the end of 2018. While there is always the potential for further bouts of volatility, there are plenty of reasons why shares can make further headway from here. These include interest rates remaining very low across the globe, the Chinese economy showing signs of picking up again and the potential for the US and China to reach an agreement in their trade dispute. For investors in the UK stock market, the recent strengthening of the oil price is another positive tailwind, given the oil and gas sector represents over 14% of the market.

“UK shares are not expensive despite the recent rally and the case for continuing to back UK equities is underpinned by a very healthy gap between dividend yields of 4.7%, and the below inflation yield of 1.2% offered by 10-year government bonds.

“A key risk of selling up for the summer is that you might unwittingly miss out on any dividends paid if you end up selling ahead of the “record date”, the point at which an investor must still own their shares to remain eligible for the next dividend. For example, investors selling HSBC shares before 17 May will lose eligibility to receive the interim dividend scheduled to be paid on 5 July.

“Dividends received and potentially reinvested during the summer months are a particularly important consideration in a market like the UK, where there is a strong emphasis on paying pay-outs to shareholders. Over the long-term, dividends have made up most of the real return on the UK stock market, so care should be taken not to accidentally forgo these, especially in pursuit of a tenuous theory like ‘Sell in May’.”

ENDS

- As measured by the MSCI United Kingdom Index, which represents the 96 largest companies.

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.