Bestinvest’s Managing Director Jason Hollands argues that the new generation of self-directed investors are looking for help not a hobby

Whether it is down to the withdrawal of the banks from the advice market, or a reluctance to pay the level of fees charged for advice, it is estimated that up to 5.5 million investors may have been orphaned from the world of financial advice over the last year, raising concerns over a growing “advice gap”.

A potential home for some of these investors is the growing arena of direct platforms and increasingly the expression “DIY investing” has entered the lexicon of personal finance to categorise those who make investments using such services.

Of course the DIY analogy will inevitably conjure up different images for different people, from the thrill of learning a new skill such as carpentry and sense of achievement in hand crafting a piece of furniture, to a decision to put together a self-assembly piece of furniture with a set of instructions that hopefully make sense. The same is undoubtedly true of the growing self-directed investment arena, where new platforms are proliferating but the services they offer differ wildly.

In our view it may be too much to expect those investors who had previously relied on an occasional visit to their bank or an IFA to suddenly transform into an investment hobbyist, analysing global markets and conducting primary research on companies or funds. Many may not have the time, inclination or confidence to undertake primary research on markets or funds themselves. After all, people with busy lives have other things to do with their evenings and weekends.

A helping hand in tackling the perils that face the ‘DIY’ investor

In helping to service the new wave of investors who had previously relied on an infrequent meeting with a bank adviser or IFA, we strongly believe investors need to be provided with tools, research and ideas to help them tackle the key perils that face the DIY investor:

1. Failing to understand their goals and objectives before diving into the process of investing

2. Not identifying an appropriate asset allocation strategy to suit their objectives, time horizon and risk appetite

3. “Self-miss-selling” by getting swayed by 'expert' tips, reacting to short term events or simply following past performance tables, which is like driving a car staring in the review view mirror and not looking at the road ahead

4. Choosing from a restricted investment universe, for example funds-only and not considering investment trusts and ETFs

5. Not monitoring and rebalancing a portfolio, resulting in creeping change to its risk profile

Most direct platforms offer access to a wide range of investments. However, the staggering choice these platforms boast can be daunting and can leave investors dazzled.

Before selecting individual investments, the first step for an investor should be to understand their goals and risk appetite and to choose an appropriate asset allocation strategy. Indeed numerous academic studies have consistently shown asset allocation is the biggest driver behind the differences in returns between different investment portfolios, not stock selection. Yet many “DIY” platforms provide little in the way of information or tools on asset allocation, instead presenting investors with a smorgasbord of fund choices. For anyone looking to build a portfolio, that might feel a little bit like receiving the parts for a piece of furniture but without a set of instructions.

Model portfolios: the ‘flat pack’ approach?

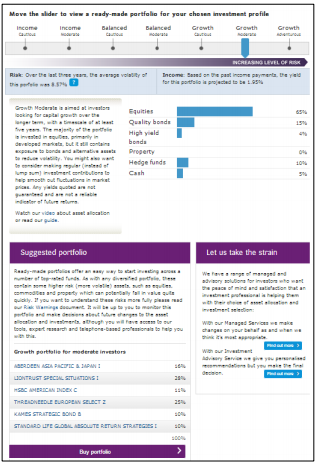

In developing our services for newcomers to self-directed investing we have built a number of ready-made portfolios that combine funds that our research analysts rate highly to achieve an underlying asset allocation mix to suit different risk and goal profiles. For each portfolio we show the current yield and the historic level of volatility, one measure of relative risk. For more information visit:

https://select7.uat.bestinvest.co.uk/investment-guidance/choose-a-ready-made-investment-portfolio (example below)

Of course an investor’s asset mix will naturally drift as returns in different markets will vary over time, potentially transforming the level of risk they are exposed to and one of the key perils facing DIY investors is failure to rebalance a portfolio. We therefore provide investors with analysis on their underlying asset allocation and the extent to which it differs from our nearest model, as well as analysis on how much volatility their portfolios is exposed to. This gives investors the information to enable them to better understand their portfolio, so that they can decide whether to rebalance it. And for those who don't want the responsibility of monitoring or rebalancing a portfolio themselves, a better option might be to opt for a managed or advisory service after all.

- Ends -

An example of Bestinvest's Ready Made Portfolios:

Important information:

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Restricted advice can be provided as part of other services offered by Bestinvest. This will be on a fee basis and is restricted to advice on portfolio management. Before investing in funds please check the specific risk factors on the key features document or refer to our risk warning notice as some funds can be high risk or complex; they may also have risks relating to the geographical area, industry sector and/or underlying assets in which they invest. Prevailing tax rates and relief are dependent on your individual circumstances and are subject to change.

About Bestinvest:

Founded in 1986, Bestinvest has grown to become a leading private client investment adviser, looking after £5 billion of assets. We offer a range of investment services from the Online Investment Service for self-directed investors to Investment Advisory and Investment Management services for clients who do not have the time or inclination to manage their own investments.

All of our services are underpinned by rigorous research aimed at identifying those fund managers we believe will deliver long-term superior performance. We also have a team of expert financial planners with nationwide coverage to help clients with their pensions, retirement or Inheritance Tax planning. At Bestinvest, we pride ourselves on offering the highest levels of professionalism and expertise with transparent, competitive prices. We are pleased that our greatest source of new business is from personal referrals from existing clients.

Bestinvest has won numerous awards including Stockbroker of the Year, Low-Cost Sipp Provider of the Year and Self-Select ISA Provider of the Year at The Investors Chronicle and Financial Times Investment Awards 2013. Bestinvest also won UK Wealth Manager of the Year 2013 and Best Wealth Manager for Investments at The Investors Chronicle and the Financial Times Wealth Management Awards 2013.

Headquartered in Mayfair, London, Bestinvest employs more than 200 staff and has an extensive network of regional offices.

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.