Jason Hollands, Managing Director at the Tilney Group, looks at which funds proved most popular with clients using the group’s Bestinvest Online Investment Service in May.

At a glance: The most popular funds selected by clients using the Bestinvest Online Investment Service in May 2017:

*As a matter of policy Tilney does not star-rate its own in-house managed Multi-Asset Portfolio funds. However each of these invests in a diversified selection of circa 20 top-rated underlying funds selected by the Tilney research team.

Hollands comments: "Once again in May it was funds primarily focused on equities that proved most popular with Bestinvest clients and the list continued to be dominated by funds managed by seasoned active managers. Interestingly, Neil Woodford’s new fund, the Woodford Income Plus Fund, which was only launched in March and catapulted into our top ten last month, dropped out of the top rankings this month, although overall clients continue to favour his existing CF Woodford Equity Income fund which remained in the top five.

“The most popular fund with our clients, Fundsmith Equity has remained unchanged for the past twelve months. Terry Smith has an invest-and-hold strategy focused on a concentrated portfolio of 30 quality growth stocks from across developed markets. He sums this up as: “Buy shares in good companies; don’t overpay; do nothing.” With one of the fund’s top holdings, US medical equipment firm CR Bard, being bid for, Smith has been building new positions which he will reveal when complete. The fund has a high weighting to consumer staples, 31.7%, healthcare, 29.1%, and technology, 23.7%.

“The Tilney Bestinvest Growth was the second most popular fund and is a ready-made portfolio for investors with a long investment time horizon. It invests into a portfolio of funds and ETFs selected by our research team and includes the likes of JO Hambro UK Opportunities, Liontrust Special Situations, Majedie UK Equity, Vanguard S&P 500 ETF and Artemis European Opportunities. 57% of the portfolio is invested in equities, with the remainder in absolute return funds, bonds, commercial property and gold.

“The Threadneedle UK Equity Income fund is another popular choice for core UK equity exposure. Manager Richard Colwell has a pragmatic approach, focused on total return rather than yield per se. The fund is currently very underweight financials and overweight industrials compared to its FTSE All-Share benchmark. Companies within its top ten holdings include healthcare multinationals GlaxoSmithKline and AstraZeneca, and consumer goods companies Unilever and Imperial Brands.

“The Tilney Bestinvest Aggressive Growth Portfolio takes a more adventurous investment approach than the Growth portfolio, with a larger exposure to shares in small companies and overseas companies. It is also designed for investors with a high tolerance for risk and a long investment time horizon.

“The eponymous CF Woodford Equity Income fund, managed by Neil Woodford has been drifting in and out of favour with our Bestinvest clients of late. His flagship fund is nestled bang in the middle of our most popular funds. Woodford has adopted a more bullish stance to companies exposed to the UK domestic economy recently arguing that people are “too downbeat on the UK”, prompting a pre-election investment spree in housebuilders, construction and property companies. His optimism remains undaunted by June’s shock General Election which resulted in a hung parliament, arguing if anything it may be supportive if it results in a more stimulative fiscal policy and the potential for a softer Brexit.

“One fund which continues to be popular within the emerging market and Asia space and continues to draw support from clients however is the Stewart Investors Asia Pacific Leaders, a longstanding top rated fund. The fund, managed by David Gait, focuses primarily on investing in large companies with sustainable cash flows and robust balance sheets. Its highest weighting remains India (32.4%) followed by Taiwan (18%) but it has negligible exposure to China where concerns persist about the growth of debt.

“The Threadneedle European Select fund is consistently in our top 10 list. The fund retains a bias to the consumer goods, healthcare and consumer services sectors. The fund aims to seek out companies with strong brands that are less sensitive to price-based competition and as such the fund invests heavily in firms such as the world’s largest brewer Anheuser-Busch InBev and beverage company Pernod Ricard. It also holds large positions in consumer goods companies L’Oreal and Unilever.”

“The Jupiter India fund burst into the top selling list in May for the first time this year, coinciding with the third anniversary of the election of Prime Minister Narendra Modi’s reformist, BJP-led Government. The fund is managed by Avinash Vazirani who has over twenty years of experience investing in Indian equities, and while although he is based out of London he visits India several times a year. Vazirani adopts a GARP style of investing, where he targets companies which he believes to have strong growth prospects but have often been over-looked by the market. The fund has its biggest weighting in consumer goods and financials.

“Managed by Julian Fosh and Anthony Cross, the Liontrust Special Situations fund has long held a highly coveted five-star rating from our research team and has managed to achieve both significant and consistent outperformance over the long term, but with less volatility than the UK market. The fund follows a well-articulated process, called the Economic Advantage approach, that looks for companies able to sustain a higher than average level of profitability for longer than expected. The companies the fund invests in have distinct characteristics, like ownership of intellectual property, strong distribution channels or significant recurring revenue streams whether they are large, medium sized or smaller companies.

“The Lindsell Train Global Equity fund recently celebrated its fifth birthday. The fund, run by experienced management duo Michael Lindsell and Nick Train, has a strategy from a concentrated portfolio of equities deemed to be durable, cash-generative business franchises which are held for the long term. The biggest holdings in the fund are the likes of Nintendo, Heineken and Diageo, which although they note are often deemed to be ‘boring’ highlight that they are durable and over the long term ‘boring’ wins out.

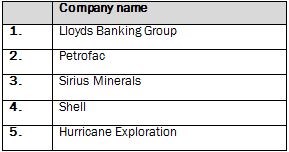

Investors continue to ride the rollercoaster of the Lloyds shares after the Government sells its remaining shares

“While Bestinvest clients predominately choose funds, they can also purchase shares and investment trusts through the service. Lloyds Banking Group continued to be the most popular stock for the second month running. In May it was announced that the Government was to sell off its last remaining shares in the bank eight years after pumping £20bn into the company to prevent the bank’s collapse. Petrofac had a turbulent month in May as its COO was suspended amid a corruption probe with the Serious Fraud Office.”

Important Information:

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. This press article does not constitute personal advice. If you are in doubt as to the suitability of an investment please contact one of our advisers. Past performance is not a guide to future performance.

Different funds carry varying levels of risk depending on the geographical region and industry sector in which they invest. You should make yourself aware of these specific risks prior to investing. Smaller companies shares can be more volatile and less liquid than larger company shares, so smaller companies funds can carry more risk.

Underlying investments in emerging markets are generally less well-regulated than the UK. There is an increased chance of political and economic instability with less reliable custody, dealing and settlement arrangements. The market(s) can be less liquid. If a fund investing in markets is affected by currency exchange rates, the investment could both increase or decrease. These investments therefore carry more risk.

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.