A combination of political developments and global economic data continued to provide a positive backdrop and drive the performance of most risk assets in March.

Market commentary

- In the US, stocks ended the month flat, as the much-anticipated rate hike by the Federal Reserve (Fed) and the failure of the Trump administration to pass reforms to Obamacare were offset by data signalling that global growth appears to be picking up. Despite the US dollar having an up-and-down month, overall volatility in the first quarter of 2017 was one of the lowest on record

- Asia Pacific and Emerging Market equities rose again in March, while UK and European equities also ended the quarter positively with European equities topping the performance chart in March

- Fixed income market returns were relatively muted, while commodities were the laggards over the month, with oil prices notably weak as optimism regarding the effectiveness of OPEC’s attempts to rebalance the market appeared to fade

Chart of the month

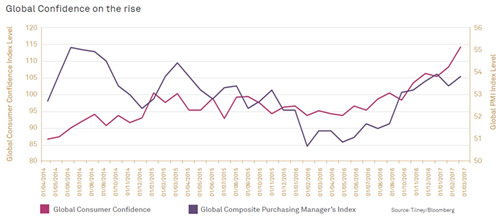

In our Chart of the Month, we highlight the recent rise in the more forward-looking surveys of confidence and activity in advanced economies.

Consumer confidence and Purchasing Managers’ Indices (PMI) are two of the main data series that are used by economists and markets when trying to forecast what future growth rates may be. Importantly for investors, these indicators of future growth rates are also key factors when analysing whether equity valuations are justified, as well as the outlook for monetary policies.

As you can see, consumer confidence in advanced economies has risen sharply in recent months, with consumer confidence in the US notably up to its highest level in March since 2000. Global PMI surveys have also continued their upward trend since mid-2016, with a reading over 50 signalling an expansion in business activity. Notably, the Euro Area Composite PMI, which accounts for both manufacturing and services, grew at its fastest pace in March since 2011, with a weaker euro and policy action by the European Central Bank seen as supportive.

Read our market and economic update

Our full market and economic update explores the above topics in further detail. You can read it here today.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.