Weekly macroeconomic and market review – 6 March 2017

Weekly macroeconomic and market review – 6 March 2017

Weekly macroeconomic and market review – 6 March 2017

A look back over macroeconomic and market events for the period ending 03/03/17. A series of hawkish US Federal Reserve (Fed) speeches made a March hike in US interest rates all but certain, and means non-farm payrolls this week are even more important than usual. It’s a fairly busy week ahead, with the ECB meeting concluding on Thursday and the UK Budget on Wednesday.

While President Trump’s speech was a non-event from an investment point of view, members of the Federal Open Market Committee (FOMC) have clearly run out of patience, with hawkish comments from key doves dramatically shifting market expectations for a hike at this month’s meeting.

On Tuesday, before President Trump gave his address, William Dudley, President of the New York Federal Reserve and well-known dove, was speaking in an interview on CNN about above-trend economic growth. Crucially, he highlighted that “the case for monetary policy tightening has become a lot more compelling,” and that even without waiting for details, the path of fiscal policy was expected to be stimulative.

Other FOMC members were also speaking more hawkishly before the black-out period ahead of the FOMC meeting, including dove Lael Brainard, who talked about the need for an interest rate hike “soon” in her remarks mid-week. The turning of these two doves was enough to significantly shift market expectations, even before Fed Chairwoman Janet Yellen all but sealed the deal, highlighting that an increase at the March meeting “would likely be appropriate” based on the current data trends.

Such language might not seem dramatic to most of us, but within the world of monetary policy this is racy stuff, and triggered a surge in expectations for a rate hike from below 50% at the end of the previous week to 96% at the end of last week, driving government bond yields higher. Attention will now shift to the expected tightening path and the related Fed balance sheet reduction. Tightening monetary policy potentially removes a support for asset prices and could impact broader sentiment – while normalising interest rates into strength could be positive for sentiment, a fear that the Fed is getting behind the curve on inflation could turn sentiment negative. The only thing likely to stand in the way of a March hike now would be a catastrophic reading of non-farm payrolls on Friday.

However, they were generally strong enough to support the current optimistic mood in markets. Although Durable Goods beat expectations with 1.8% month-on-month growth in January (from a -0.8% fall in December and forecasts for 1.6%), this figure was somewhat distorted by a surge in aircraft orders. Stripping out transportation, durable goods actually slipped -0.2% month on month, from 0.9% in December and forecasts for a moderation to 0.5%. The PMI figures from the Institute of Supply Management sent conflicting messages relative to the Markit PMI figures we discussed last week – both readings increased, Manufacturing PMI from 56.0 to 57.7 and Non-Manufacturing PMI from 56.5 to 57.6 (no change was forecast). As a result, there is perhaps little to be read into these sets of short-term PMI numbers at this stage, suffice to say they both remain firmly expansionary.

Finally looking to the consumer, personal incomes rose 0.4% month on month in January (from 0.3% and expectations of 0.3%) though spending dipped more than expected, down from 0.5% to 0.2% (0.3% expected). Although that could imply people starting to save a bit more, confidence remains high with the Conference Board Consumer Confidence Index ticking up from 111 to 114.8. Overall, a lot of US economic data were out last week, though much was noise – it is clear that optimism remains high. A lot is already priced in to valuations, and data can turn quickly, so we continue to be wary, given our broader concerns.

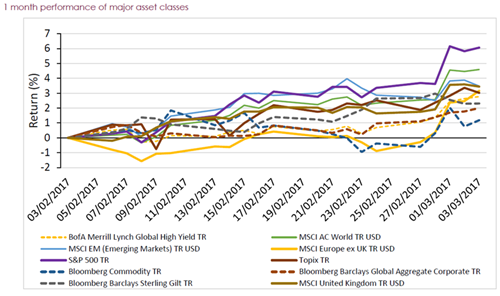

Equities largely had a good week but remain fairly subdued, while sovereign bonds sold off quite significantly.

Equities –European equities led the rally, with the MSCI Europe (ex-UK) index returning 2.3% on the week and in the UK the MSCI United Kingdom gaining 1.7%. It was the turn of the US to lag last week with the S&P 500 returning 0.7% while the Japanese TOPIX gained 0.5%. There was some weakness in Hong Kong where the Hang Seng shed -1.7%.

Bonds – German bunds were the most notable movers, with yields on the ten-year doubling to 0.36% (from 0.18%). US ten-year treasury yields were 15 basis-points (bps) higher as markets adjusted the latest Fed rhetoric, finishing at 2.48% while in the UK ten-year gilts also rose in sympathy, 9 bps higher to 1.18%.

Commodities – Gold gave up some of its recent strength, slipping to $1,225.50/ounce. Oil and Copper were relatively unchanged at $55.90/barrel (Brent) and $2.69/lb respectively.

Currencies – The US dollar and euro both surged on the week. Sterling finished at US$1.23, €1.16 and ¥140.

There are two big events on the global scene this week, as well as the UK Budget locally. On Thursday we get the latest monetary policy decision from the European Central Bank, which is likely to be feeling the pressure from high headline inflation. No change in policy is expected, though, as the Bank looks through to unchanged core inflation and a still-high unemployment rate. There could be some interesting discussions at the press conference though. On Friday, US Non-farm payrolls for February are released, with markets expecting 180,000 to have been added, from 227,000 in January – as discussed above, this is the last major piece of employment data ahead of the Fed’s March meeting. The UK Budget on Wednesday will be closely watched domestically, mostly for the impact on individuals, though the event rarely has any significant macroeconomic impact. Elsewhere:

Monday: Construction PMI from Germany is released in the morning, with US Factory Orders out in the afternoon.

Tuesday: Any revisions to Eurozone GDP for the fourth quarter are due out in the morning, as are German factory orders. The afternoon has US Balance of Trade data and the Economic Optimism indicator from the IBD/TIPP. Late in the evening (UK time), Japan reports on its Current Account for January along with final GDP figures for the fourth quarter.

Wednesday: Overnight Chinese trade data are released, and early in the morning the Japanese Coincident Index and Leading Economic Index are out, as are German Industrial Production numbers for January. In the afternoon, revisions to fourth quarter US employment data and wholesale inventories are scheduled for release.

Thursday: Chinese inflation data are out very early in the morning, then it is fairly quiet until the ECB meeting output, which will start coming out from lunchtime in the UK (12:45pm for the main release, then 1:30pm for the Press Conference, all UK time). The afternoon will also see reports on US import and export prices for February.

Friday: The morning has a reasonable amount of data being reported for the UK for the month of January. This includes Balance of Trade, Consumer Inflation Expectations, Construction Output (forecast at 0.1% year on year from 0.6%) and Industrial and Manufacturing Production numbers (forecasts are 3.3% from 4.3%, and 3.0% from 4.0% respectively), which should help provide some more insight into the state of the domestic UK economy. The afternoon hosts the non-farm payroll numbers discussed above, which will have added significance after the dramatic shift in interest-rate expectations over the last week. As well as the headline non-farm payrolls, the other data released alongside will also be of interest – average earnings are expected to have improved from 0.1% to 0.3% month on month and unemployment is forecast to have fallen 0.1% to 4.7%.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.