Weekly macroeconomic and market update 09.07.2015

Weekly macroeconomic and market update

Weekly macroeconomic and market update

Conflicting economic data from the US

Another conflicting set of economic data came out of the US. GDP was revised up more than expected, from an annualised 2.3% to 3.7% in Q2 (from 0.6% in Q1), and unemployment fell to 5.1%. However, the all-important non-farm payroll numbers fell short of expectations, adding 170,000 jobs compared to expectations for 220,000.

The US balance of trade conditions also improved with the deficit falling from US$45.2 billion to US$41.9 billion. On the purely economic front, this leaves the Federal Reserve’s interest rate decision this month pretty finely balanced, but global events may well have taken over as the prime concern for the committee. At the time of writing markets appeared to be pricing in a roughly 30% chance of the Federal Reserve hiking rates next week.

Chinese economic figures continue to look weak

Following on from Black Monday (which we wrote about here), data regarding Chinese economic fundamentals continue to look weak, with the official PMI figures for the manufacturing sector dipping back below 50 for the first time since February, indicating economic contraction with a reading of 49.7.

The unofficial – but more widely trusted – Caixin/Markit Manufacturing PMI has been below 50 since March and has deteriorated to 47.3 for August. In response, China’s central bank once again cut interest rates 25 basis points to 4.6 and also cut the reserve requirement ratio by 50bps to 17.5%.

Last week’s other events

The markets

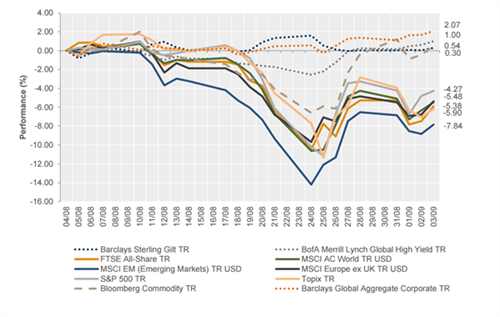

The effects of China’s ‘Black Monday’ were felt in equity markets across the globe over the last two weeks, with major markets falling across the board.

The week ahead

The week starts with Japanese leading economic index and German industrial production numbers. On Tuesday Chinese trade data are released early UK time, with expectations that the surplus will have increased by US$5 billion to US$48.2 billion. Germany also updates its trade balance, whilst Eurozone Q2 GDP revisions are also due.

The UK has most of the spotlight on Wednesday, releasing balance of trade data which is likely to be fairly steady at a £1.6 billion deficit for July, together with manufacturing and industrial production figures which are also expected to be fairly unchanged at 0.5% and 1.5% year on year respectively. The day finishes with US JOLTS Job Openings data, which are forecast to show 5.3 million job openings.

Japanese machinery orders are first up on Thursday, followed by Chinese inflation which is expected to be around 1.6% for CPI. We are also expecting another month of falling factory-gate price, which has been negative since the first quarter of 2012 but is expected to be falling at -5.5% – its fastest rate since the global financial crisis. In the afternoon the Bank of England releases the MPC decision and minutes simultaneously, as part of the new regime, although there is no press conference. On Friday we have a quiet end to the week. UK construction output is reported, then US PPI inflation data and Michigan Consumer Sentiment readings are released in the afternoon.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.