The bursting of the Chinese equity bubble over the summer intensified on Monday prompting the official Xinhua Chinese news agency to dub the event ‘Black Monday’. Whilst China has been at the epicentre, the shockwaves have reverberated across global markets.

What happened?

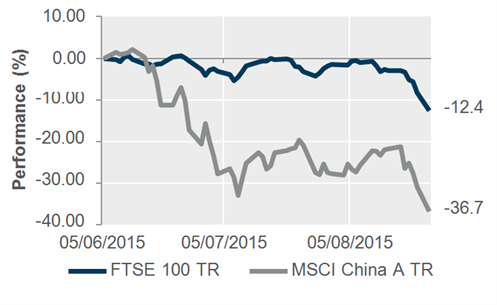

Domestic Chinese equities (‘A’ shares) were decimated last week (week ending Friday 21 August), as the Shanghai and Shenzhen indices both shed 12% amid a fresh bout of selling after authorities started to withdraw earlier supports. The magnitude of these moves, combined with worries from the Chinese yuan devaluation the month before, were enough to cause the sell-off to spread to other equity markets. Most major equity bourses were therefore materially down on the week, with the FTSE 100 dropping 5.5%.

After the weekend stocks resumed their slump, with the 8.5% fall on the Shenzhen index precipitating a fresh global equity rout on Monday and driving sovereign bonds up as investors sought out perceived safe havens.

PERFORMANCE FROM NEAR-TERM CHINA A SHARE PEAK

Put simply, the two main reasons for these falls are the bursting of a debt-fuelled equity bubble, and devaluation of the Chinese yuan, the combination of which has spooked complacent global investors.

In the twelve months prior to the bubble bursting, Chinese equities were on a tear, driven by borrowing and encouraged by a skewed perception of risk thanks to a long history of government intervention that has given rise to a chronic misallocation of capital. Taken together with ballooning debt and a rapidly slowing economy, the situation was clearly not sustainable, though timing of when the market would come unstuck was virtually impossible to determine.

The initial falls in June were halted by aggressive government intervention to inject money into the system and cajole major participants back into the market (as well as threatening them into not selling). This artificial intervention prevented proper price discovery, and as the measures have been withdrawn markets are once again seeking a true clearing price for the Chinese equities.

The second factor is the surprise devaluation of the yuan on 11 and 12 August, which we wrote about previously, and the declared intention to allow the currency to start floating more freely. Whilst this may help improve the competitiveness of the Chinese economy, there are concerns that this could also lead to a global wave of deflation, damaging consumption and increasing real debt burdens.

Is this really a global problem?

Yes, both through economic and market channels. China is not only the world’s second largest economy, it alone has driven more than 50% of global economic growth following the global financial crisis. It now seems likely that economic growth is significant slower than the official 7% rate – probably closer to 4% and slowing. Given the increasingly desperate actions of the authorities, there is now a distinct possibility that the Chinese economy will suffer a hard landing. That would be a

significant loss to the global economy, and could cause serious problems for Chinese social cohesion. The slowdown in this economic powerhouse has also given rise to a collapse in global commodity prices, which has hurt markets such as the FTSE 100 which has significant exposure to basic material producers.

What happens next?

It is unclear what will happen from here. Already expectations of the first US interest rate hike have been pushed back once again, whilst authorities in Japan will be wary of China joining a global currency war. More generally there is a risk that, in the face of a fresh slowdown in the global economy, authorities revert to extraordinary monetary policy, such as quantitative easing, which is rapidly becoming discredited as a tool for boosting economic recovery.

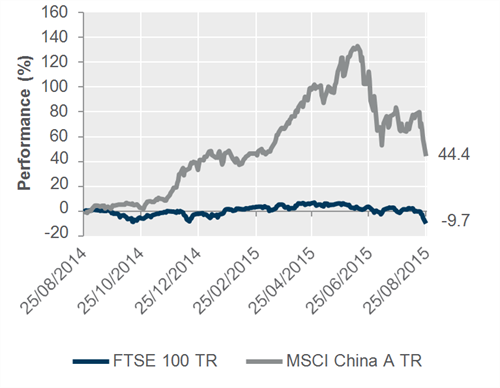

What we do know is that China is still in the very early days of addressing serious structural problems – despite the recent falls, the domestic equity market is still up 40% from a year ago. At the same time, estimates suggest the yuan is more than 15% overvalued, whilst the recent devaluation amounted to just under 4%, so we expect further devaluation is on the cards in the near future. Authorities in China will want to limit market impact as they try to address these structural issues, but the direction of travel – towards deleveraging and devaluation – seem clear.

IN CONTEXT – TWELVE MONTH PERFORMANCE

Chinese equity valuations are far in excess of levels elsewhere in the world and completely divorced from economic reality. While slowing Chinese growth is a global problem, this has already been widely discussed and should already be recognised. This, in turn, suggests that in the short term contagion will be limited at least until the true extent of the weakness in the Chinese economy is properly understood.

However, the magnitude of the mark downs at opening in the US on Monday highlight how thin market liquidity is. Valuations may be stretched but General Motors down 21% at the opening bell suggests the absence of anyone prepared to put up a sensible risk price. We have highlighted this across all asset classes. It is probably worth highlighting that the absence of liquidity massively amplifies movements in either direction.

Our view

The fallout in China, like the collapse in industrial commodities, is symptomatic of wider global structural issues borne out of the post global financial crisis response. Asset prices have been artificially boosted by Central bank interventions and in China we have seen a worrying leveraging up of positions in equity markets just as the economy is thought to be heading towards a hard landing. The unwinding of the leverage in the system will be painful but is ultimately needed along with broad market reforms to rebalance the Chinese economy back onto a footing that is sustainable in the long term. Given the turbulence in the market, it remains to be seen whether the authorities will be tempted to intervene once again.

In a global context, events in China have shocked markets into recognising the flaws in extraordinary monetary policy, and that these policies alone don’t create a sustainable global recovery. It is unclear how other Central banks will respond to these latest developments, and the risks of policy error remain high.

We would caution investors against making knee-jerk reactions. Within our managed portfolios we have been becoming incrementally more cautious over the last 12 to 18 months, reducing equity and bond exposure in favour of property and absolute return vehicles as alternative asset classes. Most recently, we have also been building tactical cash positions. Furthermore, we have actively avoided exposure to China as well as the wider emerging markets. We believe that this is still an appropriate portfolio stance to hold, and we are not rushing to increase market exposure, choosing a cautious wait-and-see approach. However, whilst we are cautious, and have plenty of concerns over both China and the global economic recovery, these issues are likely to take some time to resolve and we don’t believe exiting markets entirely is an appropriate response. Long-term investors should remain invested through carefully selected investments.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.