In short, the Taylors have probably forgotten why they started contributing to their ISAs in the first place. Through excellent habits, they have achieved financial independence in retirement, thereby attaining a goal which motivates many investors. However, when one’s primary goal has been accomplished, it is sensible to divert surplus resources to other objectives. For the Taylors, this means passing wealth to loved ones on their death.

Remember that ISAs, whilst free of Income Tax and Capital Gains Tax (CGT) in life, are not exempt from Inheritance Tax (IHT) on death. The frugal Taylors, therefore, in contributing to their ISAs each year, despite these assets being surplus to their needs, may in fact be storing-up a larger tax-bill on death; significantly undermining the benefit of ISAs when considering Mr and Mrs Taylor’s intention to pass wealth on to their children. This latter point would be even more pronounced if any CGT were being incurred each year to move assets from taxable investments into the ISAs, given that there is no CGT on investments held at death.

Mr and Mrs Taylor have forgotten that, ultimately, the ISAs are there to be spent, not just accumulated. Now that they have attained financial independence, they are keen to ensure that they can pass as much of their wealth as possible to their children and grandchildren, but they have not changed their saving habits to reflect their change in priorities.

Instead of contributing further to their ISAs, the Taylors may be interested in some financial planning which I have undertaken recently with clients in a similar position. We would start by helping them to estimate the level of assets they require to meet their own needs, allowing of course for increasing expenditure over time due to the uncertainties of life. Having done so, they would have a far clearer picture of their surplus capital and income each year, and therefore of their theoretical budget towards their objective of inter-generational wealth transfer.

Let us say for simplicity that this theoretical surplus amount equals £40,000 per year – conveniently the same amount that had been put into ISAs in recent years. To be clear, this is an amount which we have identified as surplus even to the possible additional cost of future care home fees for Mr and Mrs Taylor. In this situation, we may consider life insurance held in Trust as a potential alternative to ISA contributions. If, instead of ISAs, the Taylors were to pay up to £40,000 per annum in premiums on a joint life insurance contract, which was then gifted to their chosen beneficiaries by way of a Trust, these annual premiums would effectively act as a tax-efficient savings plan for the next generation. This is because, with careful financial planning, the entire life insurance payout can escape IHT, being paid to the recipients on death outside of the deceased’s estate. By contrast, for clients who already enjoy surplus assets in their ISAs, continuing ISA contributions would merely result in a 40% loss to tax on death.

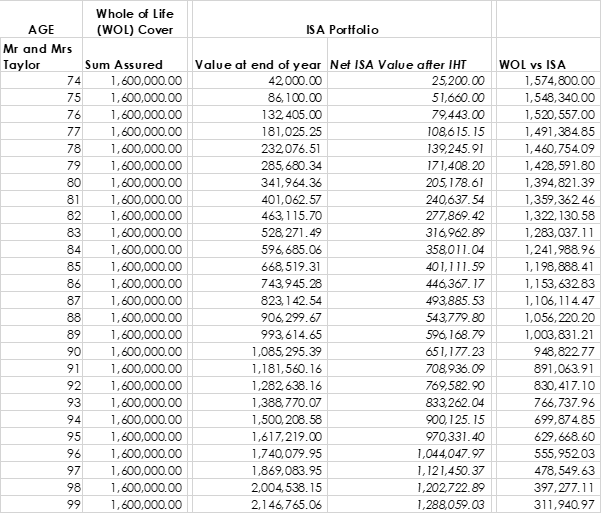

To illustrate this, at the time of writing a £40,000 annual premium paid by a couple aged 74 in good health could purchase around £1,600,000 of guaranteed whole of life insurance cover on a joint-life, second death basis (i.e. paid out on the last death of the lives assured). Importantly, the premiums would remain level at £40,000 throughout the life of the policy. Note that the cost of a given level of cover depends on individual circumstances and is subject to change over time.

Let us assume that both spouses live until age 100 and compare the “return” of the life cover contract with the alternative option of continued £40,000 per annum contributions to ISAs: at age 100, the couple would have accumulated additional ISA valued at £2,146,765 assuming 5% per annum investment growth and annual £40,000 contributions. Meanwhile, at age 100, the life cover contract would still provide a payout of £1,600,000 on death. However, after Inheritance Tax has been deducted, the additional ISA accrued from age 74 to age 100 is worth £1,288,059 to the deceased’s family (£2,146,765 less tax at 40%). Because the whole of life cover contract was established through careful advice, using a suitable Trust and ensuring there would be no IHT implications, the clients’ beneficiaries are able to immediately make use of the full £1,600,000 on death of the second life, which does not form part of the deceased’s estate for IHT. This represents a difference of £311,940 in the outcome for the deceased’s heirs – at age 100. The differential is of course far greater if death is earlier. This is illustrated further in the table below: