With just days to go until the end of the 2014/15 tax year, last minute investors up and down the UK will be busy deciding where they should invest their ISA. It’s a difficult decision to make at the best of times with literally thousands of investments to choose from, but at the end of the tax year the task can seem particularly perplexing because of the cacophony of expert ‘tips’ and views.

For first time investors in particular, it is all too easy to end up being drawn into cherry-picking a fund that is currently in vogue, either swayed by recent past performance or whatever markets currently appear to be attractive. This can lead the novice investors into taking unnecessary risk, rather than choosing a diversified approach that will stand them in good stead for the long-term.

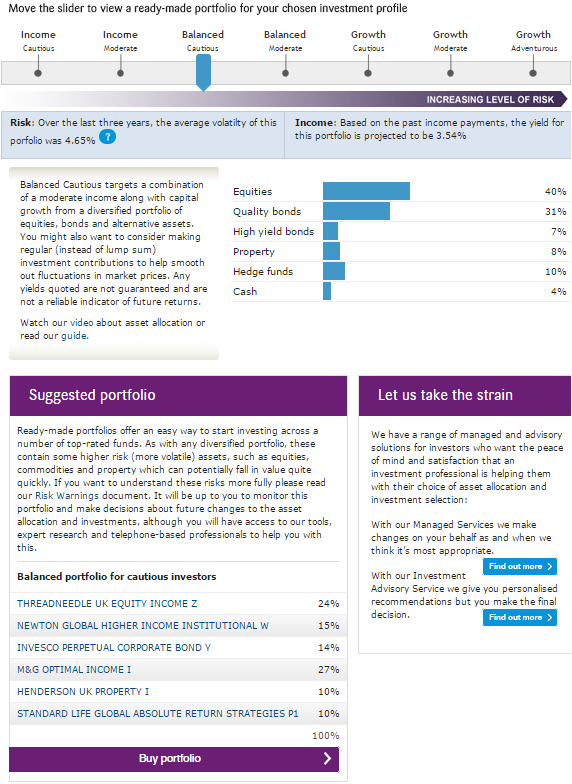

To help new investors who are branching out into stocks and shares ISA investing for the first-time, leading investment group Tilney Bestinvest has designed seven ‘Ready-Made’ portfolios each of which aims to meet the needs of a different goal and risk profile from a cautious income seeker to an adventurous growth investor.

The Ready-Made portfolios each typically contain 6 funds, hand-picked by the firm’s research team, and can be used for a lump sum ISA contribution of £5,000 or more. These funds have been selected to meet a diversified asset allocation model with all information freely available on Tilney Bestinvest’s website at bestinvest.co.uk/ready-made

An easy to use slider tool enables first-time investors to move through the different Ready-Made portfolios to see how the balance between equities, bonds, property, absolute return funds and cash changes, as well as the current yield and historic volatility (a measure of risk) for each portfolio. Below this, the specific fund ideas are provided with click-through research notes and performance analysis on each.

Jason Hollands, Managing Director of Tilney Bestinvest commented: “Numerous academic studies have repeatedly demonstrated the importance of ‘asset allocation’; the process of how you split your investments between shares, bonds, property and other types of investments, in successful investing.”

“Yet this is an area often overlooked by ‘DIY investors’ who can be drawn into selecting individual funds, with many so-called direct investing platforms providing little in the way of helpful information or guidance on how to build a well-diversified portfolio but instead focusing on lists of preferred funds or fund selection tools based on past performance or charges. Fund selection is important, but should be a secondary step once you have decided on an appropriate asset allocation strategy.

“Our Ready-Made portfolios incur no additional costs over and above making your own fund selections, and aim to provide a useful starting point for those investors who want to build their long-term investment strategy on the firm foundations of a well-balanced approach, but who are also happy to take the responsibility for managing their own investments.

“It is of course important that investors who manage their own investments periodically consider rebalancing their ISA portfolio, so that their asset allocation does not drift into a different risk category over time and once invested we provide with asset allocation analysis to help them do this.”

For those who do not have the time or inclination to manage their own investments and rebalance periodically, Tilney Bestinvest also offers a range of Multi-Asset Portfolios (MAP), which are managed funds of funds, each which has around 20 holdings. The minimum investment into Tilney Bestinvest’s MAP range is £500.

- ENDS –

Below is an example of the information our ready-made service provide our clients, in this case for those looking to pursue a ‘Balanced Cautious’ approach.

Important Information:

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. This press release does not constitute personal advice. If you are in doubt as to the suitability of an investment please contact one of our advisers. Prevailing tax rates and reliefs are dependent on your individual circumstances and are subject to change.

Press contacts:

Roisin Hynes

0207 189 2403

07966 843 699

roisin.hynes@tilneybestinvest.co.uk

Matthew Gray

0207 189 2492

matthew.gray@tilneybestinvest.co.uk

About Tilney Bestinvest

Tilney Bestinvest is a leading investment and financial planning firm that builds on a heritage of more than 150 years. We look after more than £9 billion of assets on our clients’ behalf and pride ourselves on offering the very highest levels of professional client service with transparent, competitive pricing across our entire range of solutions.

We offer a range of services for clients whether they would like to have their investments managed by us, require the support of a highly qualified adviser, prefer to make their own investment decisions or want to take more than one approach. We also have a nationwide team of expert financial planners to help clients with all aspects of financial planning, including retirement planning.

We have won numerous awards including UK Wealth Manager of the Year, Low-cost SIPP Provider of the Year and Self-select ISA Provider of the Year 2013, as voted by readers of the Financial Times and Investors Chronicle. We are pleased that our greatest source of new business is personal referrals from existing clients.

Headquartered in Mayfair, London, Tilney Bestinvest employs almost 400 staff across our network of offices, giving us full UK coverage, and we combine our award-winning research and expertise to provide a personalised service to clients whatever their investment needs.

The Tilney Bestinvest Group of Companies comprises the firms Bestinvest (Brokers) Ltd (Reg. No. 2830297), Tilney Investment Management (Reg. No. 02010520), Bestinvest (Consultants) Ltd (Reg. No. 1550116) and HW Financial Services Ltd (Reg. No. 02030706) all of which are authorised and regulated by the Financial Conduct Authority. Registered office: 6 Chesterfield Gardens, Mayfair, W1J 5BQ.

For further information, please visit: www.tilneybestinvest.co.uk

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.