PRESS RELEASE

For immediate release

02 February 2016

Tilney Bestinvest announces the launch of new British Enhanced Income fund

Tilney Bestinvest announces the launch of a new multi-asset UCITS OEIC fund today, the IFSL Tilney Bestinvest British Enhanced Income (BEI) fund. It will have a fixed price offer period of 100p per share from 1 February to 12 February. The BEI fund will be managed by Gareth Lewis, Chief Investment Officer.

Aimed principally at UK investors at, or nearing, retirement the BEI fund has the objective to maximise income whilst managing risk. The fund will have a 0.75% annual management charge, and if investing through a platform there is a minimum investment of £500, along with monthly contributions. From a historic basis, it is projected that the fund will have a gross yield of around 4%, built from underlying holdings, although there are no guarantees.

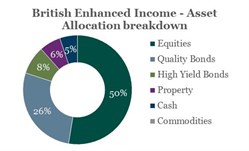

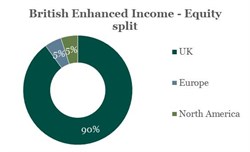

One of the key features of the funds’ strategy is its UK focus. Around 80% of the fund will be invested within the UK market with 20% overseas. The fund is primarily targeted at UK based investors, so will reflect the fund’s aim of an income in Sterling, as well as reducing currency risk. It has a multi-cap exposure in order to catch the universe of income producing funds, with 50% in equities, 34% in fixed income and the remaining allocation in property, absolute return and cash.

The fund is initially expected to invest in around 18 holdings, mostly made up of active funds due to the income objective of the fund. The BEI fund will be available on SEI, Cofunds and Pershing from launch, with further platforms in the process of being added.

Gareth Lewis, Chief Investment Officer and manager of the funds, commented: “It is clear that more and more people are driven by the income that their investments yield. This is partly due to people living longer and having to think of ways in order to fund their retirement. There has been a growing trend for this as the Equity Income Sector is one of the most popular sectors in the market, and indeed the largest proportion of our own Multi Asset Portfolios is within our Income and Income + Growth funds. As such we wanted to have a fund that appeals to those investors with these aims, and believe we have achieved this through the British Enhanced Income fund.”

-Ends-

British Enhanced Income Fund

Source: Tilney Bestinvest

Source: Tilney Bestinvest

Important information

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. Current or past yield figures provided should not be considered a reliable indicator of future performance.

This article is not advice to invest or to use our services.

Past performance is not a guide to future performance.

Current or past yield figures provided should not be considered a reliable indicator of future performance.

The Portfolio is administered by Investment Fund Services Limited (IFSL), a subsidiary of Marlborough, one of Europe’s leading financial groups, who also act as the Authorised Corporate Director (or “ACD”) of the Open Ended Investment Company. This brochure is designed for general information only and should be read in conjunction with the following document: *Simplified Prospectus for the IFSL Tilney Bestinvest Multi-asset Portfolio which contains details of full product information, including details of charges and risks associated with investing, copies of which are available on request or online at: www.ifslfunds.com

Press contacts:

Jason Hollands

0207 189 9919 / 07768 661 382

jason.hollands@tilneybestinvest.co.uk

Gillian Kyle

0203 818 6846 / 07989 650 604

gillian.kyle@tilneybestinvest.co.uk

About Tilney Bestinvest

Tilney Bestinvest is a leading investment and financial planning firm that builds on a heritage of more than 150 years. We look after more than £9 billion of assets on our clients’ behalf and pride ourselves on offering the very highest levels of professional client service with transparent, competitive pricing across our entire range of solutions.

We offer a range of services for clients whether they would like to have their investments managed by us, require the support of a highly qualified adviser, prefer to make their own investment decisions or want to take more than one approach. We also have a nationwide team of expert financial planners to help clients with all aspects of financial planning, including retirement planning.

We have won numerous awards including UK Wealth Manager of the Year, Low-cost SIPP Provider of the Year and Self-select ISA Provider of the Year 2013, as voted by readers of the Financial Times and Investors Chronicle. We are pleased that our greatest source of new business is personal referrals from existing clients.

Headquartered in Mayfair, London, Tilney Bestinvest employs almost 400 staff across our network of offices, giving us full UK coverage, and we combine our award-winning research and expertise to provide a personalised service to clients whatever their investment needs.

The Tilney Bestinvest Group of Companies comprises the firms Bestinvest (Brokers) Ltd (Reg. No. 2830297), Tilney Investment Management (Reg. No. 02010520), Bestinvest (Consultants) Ltd (Reg. No. 1550116) and HW Financial Services Ltd (Reg. No. 02030706) all of which are authorised and regulated by the Financial Conduct Authority. Registered office: 6 Chesterfield Gardens, Mayfair, W1J 5BQ.

For further information, please visit: www.tilneybestinvest.co.uk

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.