Weekly macroeconomic and market update - 14 November 2016

Weekly macroeconomic and market update - 14 November 2016

Weekly macroeconomic and market update - 14 November 2016

Another political upset has further muddied the waters for the economic outlook, with a surprise win for Donald Trump in the US presidential elections defying forecasts and providing yet another example of anti-establishment politics. While we believe little has fundamentally changed, the unexpected outcome – coupled with a lack of clarity over the President-Elect’s policies – has added to uncertainty in the market.

There have been some noteworthy shifts in assumptions though. Chief among these is that a Trump presidency, backed by the Republican-controlled Congress, is likely to see an accelerated and larger fiscal stimulus than previously thought, incorporating both infrastructure spending and tax cuts. It seems improbable that this stimulus will be equally offset by measures such as incentivising the repatriation by corporations of overseas profits.

The resulting burgeoning deficit, fuelling a pro-inflationary policy, makes for a poorer outlook for US Treasuries and the prospect of further and/or faster monetary policy tightening. Long-term inflation expectations have already pushed higher. Against this, Mr Trump’s clearly-articulated hostility to global trade deals spells bad news for many emerging market economies in the short term, and could ultimately derail global economic growth in the longer term.

Away from the political excitement, the UK released some more subdued economic data. Industrial production slowed to 0.3% year on year in September, down from 0.7% in August and against expectations of an increase to 0.8%. Manufacturing production was also weaker, slowing from 0.5% to 0.2%, though this was higher than expectations of a 0.1% fall. Construction output slowed too, down from 0.8% to 0.2%, but again ahead of the -0.4% forecast.

These figures show a clear deterioration during the second half of the year in some key lagging economic indicators, even as leading indicators such as PMI numbers and sentiment indicators have been surprisingly robust. Of the two, leading indicators are clearly more useful, but it remains to be seen if expectations manifest in reality.

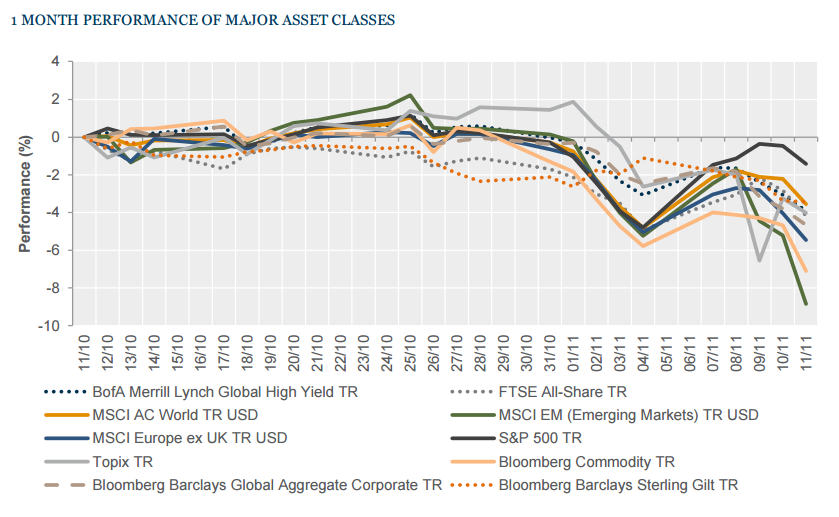

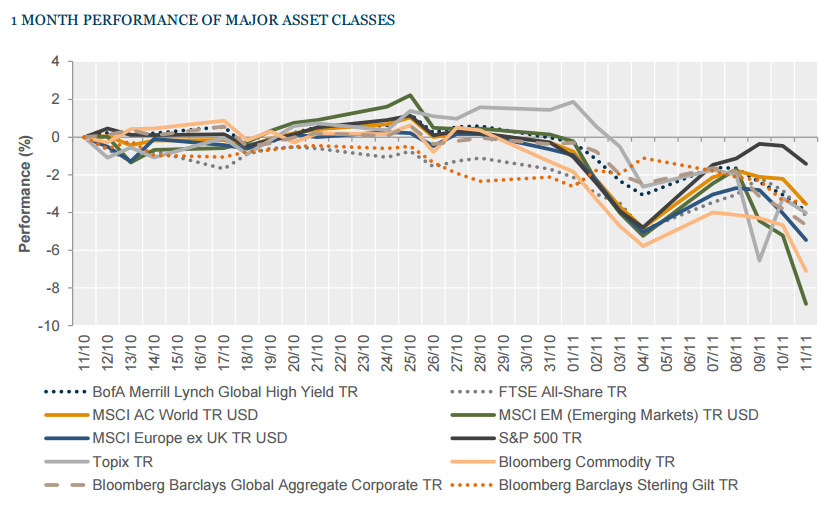

The US was the epicentre of market shifts last week. Equities rallied and treasuries fell as the likelihood of a near-term fiscal boost significantly increased with the US election result. The US dollar rallied, but not as much as sterling, whilst gold gave up some of its pre-election strength.

It was a strong week for US equities as the S&P 500 gained 3.8% amid hopes of fiscal stimulus in the US, though the effect outside of the US was more muted. In the UK, the FTSE All-Share finished the week 0.6% higher and Europe (excluding the UK) was flat. In the Far East, Japanese equites advanced 2.3%, though in Hong Kong the Hang Seng was down -0.6%, with weakness following the US election highlighting concerns that emerging markets may suffer under trade policies from a Trump presidency.

Recent weakness in sovereign bonds accelerated, centred in the US as bond investors focused on the renewed likelihood of fiscal stimulus. 10-year US Treasury yields increased a whopping 36 basis points, moving well above the 2% mark to sit at 2.14% by the end of the week. In the UK, 10-year gilt yields were 24 bps higher at 1.37% and in Europe 10- year German bund yields rose 18 bps to 0.32%.

Gold suffered, slipping to US$1,233.50 an ounce on the week, whilst copper rallied to US$2.51 per lb. The oil price continued to slip as the likelihood of any deal to cut production became ever more distant. Brent crude ended the week at US$43.41 per barrel.

Sterling strengthened on the week, notably against the euro, yen and even against the generally-stronger US dollar. The pound finished the week at $1.26, €1.16 and ¥134.

There are quite a few mid-level economic numbers coming out this week. Industrial production for the Eurozone and US are released on Monday and Wednesday respectively, though as usual Europe is reporting a month behind. Forecasts are for September industrial production to have slowed from 1.8% to 1.0% year on year, whilst US industrial production for October is expected to have recovered from the -1.0% reading previously. In the early hours on Monday morning, China will report a range of economic readings, including fixed asset investment (forecast as unchanged at 8.2% year on year), industrial production (forecast as up 0.1% to 6.2% year on year) and retail sales (forecast as unchanged at 10.7% year on year). Also overnight on Monday, Japan releases its preliminary Q3 GDP growth numbers, expected to have increased to an annualised 0.9% from 0.7% in the second quarter. Elsewhere:

The only noteworthy releases on Monday are covered above – Japanese Q3 GDP, Chinese data and Eurozone industrial production. UK inflation is then reported on Tuesday, with the headline rate forecast to have increased 0.1% to 1.1%. We will also have any revisions to the initial Q3 GDP reading from the Eurozone and the ZEW surveys of German business sentiment. In the afternoon, there is a host of economic data from the US, including import and export prices, the New York Empire State Manufacturing Index, Retail Sales and Business Inventories.

Wednesday begins with UK unemployment and average earnings, then in the afternoon the main point of interest will be the US industrial production figures. UK retail sales are then reported on Thursday morning. Early in the afternoon the ECB’s Monetary Policy meeting accounts are released, which could give further insight into the thinking of the governing council. Later, more economic data comes out of the US – this time including inflation, building permits, housing starts and the Philadelphia Fed Manufacturing index.

We have a quiet end to the week – in China, the House Price index is released first thing in the morning, then in the afternoon the US Kansas Fed Manufacturing Activity measure for November is the only notable update.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.