The headlines

With the excitement of Christmas and the new year, last week was relatively quiet in terms of macroeconomic updates. Of note was an increase in US jobless claims, which rose to 287,000 – an update that remains relevant given the Federal Reserve’s current focus on employment.

Here in the UK the latest government borrowing figures came in at £14.2 billion for November. This leaves total borrowing at £66.9 billion so far in the current fiscal year, just behind the Office for Budget Responsibility’s public borrowing target for the whole year. There doesn’t seem to have been much of a reaction in the UK government bond markets, although the sterling is weaker.

The markets

US stocks finished the year close to where they started it. Earnings contracted over 2015, mainly as a result of the deterioration experienced by mining and natural resource companies. Meanwhile, multiples for the market as a whole are higher than they were this time last year. The median forward price-to-earnings ratio of stocks in the S&P 500 is now 17x, while on a trailing earnings basis the index is trading at 19x. This is compared to 18x a year ago – leaving the S&P 500 at the top of its historic range.

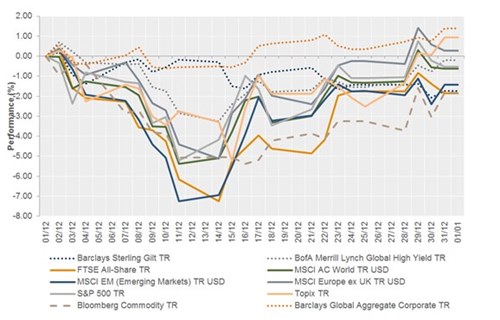

Equities – global equity markets finished the year on a weak note. The S&P 500 fell 0.8% in the last two weeks of December, the FTSE 100 fell 0.2% and in Japan the Nikkei fell 1.7%. China has kicked off the new year on a very weak footing with the CSI 300 down more than 7%.

Bonds – UK 10-year yields rose 4bps over the week to 1.96%, whilst in the US 10-year yields are at 2.25% – 2bps higher than a week ago and pretty much where they were at this time last year.

Currencies – the sterling was weaker over the last week against the dollar, euro and yen. The sterling is now at £0.679 to the US dollar, whilst the euro is now at €0.9185 per US dollar.

Commodities – with the West Texas Intermediate benchmark at US$37.8 per barrel, oil has picked up slightly on news concerning Iranian and Saudi Arabian relations. Meanwhile gold has recovered slightly to US$1,065 an ounce.

The week ahead

In the US the minutes from the FOMC’s December meeting should shed some light on the latest views from the Federal Reserve, and potentially the future path of interest rates. An update on US employment should also offer some insight into the labour market. On Friday the change in non-farm payrolls is expected at 200,000 following last month’s 211,000 figure. Also on Friday, unemployment figures are expected in at 5% and average hourly earnings at 0.2% month on month.

US vehicle sales might offer some further insight into US consumption, and ISM manufacturing activity is also expected in at 49 for December following the last reading of 48.6. Finally, factory orders are expected by consensus to have fallen by 0.3% following an increase of 1.4% in November.

In China the Caixin Manufacturing PMI has already been released this week, falling back to 48.2 in December (from 48.6 in November). This was weaker than consensus expectations and is the latest signal of soft manufacturing activity in China. Later this week we get an update on China’s foreign reserves, which will be timely as the renminbi potentially comes under further pressure.

In the Eurozone, December CPI inflation is expected to rise to 0.4% year on year, and we can also expect Eurozone manufacturing PMIs and consumer confidence figures for December. Throughout the week we also have CPI inflation, factory orders, industrial production and exports figures from Germany. In Spain, negotiations continue between political parties to form a new government.

Here in the UK net consumer credit figures are due, followed by manufacturing and services PMI readings. Finally, as we look towards the end of January keep an eye out for negotiations with the EU on a deal that might offer further insights into the Brexit debate.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.