Weekly macroeconomic and market update 26.04.16

Weekly macroeconomic and market update

Weekly macroeconomic and market update

More details on the ECB’s bond-buying programme

As expected, the ECB left monetary policy untouched at its April meeting after announcing a relatively aggressive stimulus package last month. Whilst insisting that monetary policy was working, bank President Mario Draghi warned that risks to the growth outlook remained on the downside.

Of particular note, further details of the corporate bond-buying programme were announced. We now know that it will include senior debt with maturities out to 30 years, and the Central bank will take up to 70% of a given bond’s issuance, trading in both the primary and secondary markets. Although banks are excluded from the programme, other financial corporations such as insurance will be included. Although the scope of eligible bonds surprised many, there was little overall effect on the market, aside from a brief spike in the euro.

Increased political interference in markets is one of our major themes for 2016, and with this in mind, it was interesting to hear Mr Draghi hit back at politicians in Germany who have been critical lately, reminding them that the ECB is required, by law, to target inflation for the whole Eurozone. Furthermore, he even suggested their challenges could undermine the effect of monetary policy if it was seen to damage or compromise the credibility of the ECB.

Worldwide manufacturing numbers fall

Global manufacturing numbers released at the end of the week were a source of concern, with Manufacturing PMI figures unexpectedly falling. US Manufacturing PMIs fell from 51.5 to 50.8, particularly disappointing in the face of market expectations for an increase to 52. The Philadelphia Fed Manufacturing Index gave the same signal, slipping from 12.4 in March to -1.6 in April (a slip was forecast, but only to 8.9). The Philly Fed index has now been negative for seven of the last eight readings.

Japan remains in contractionary territory for a second month as Manufacturing PMI fell from 49.1 to 48.0, and in Europe the measure was marginally lower, falling from 51.6 to 51.5 (51.8 was forecast). No clear recovery trend is forming, and after earlier signs of potential strength, we’re back to a decidedly mixed outlook. Focusing on Europe, Services PMI was slightly up from 53.1 to 53.2, but this is still behind the forecast 53.3.

Last week's other events

The markets

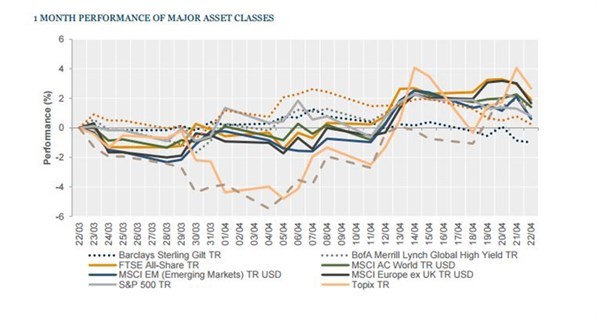

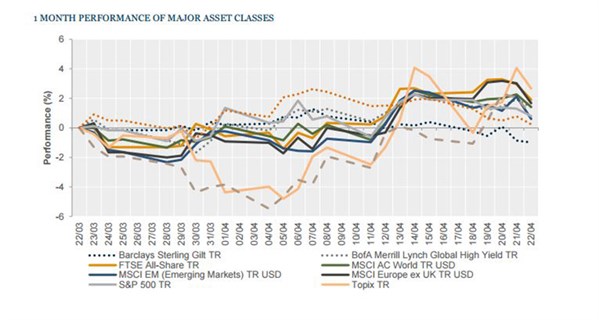

Equities were generally quiet for a second weak, aside from in Japan where the equity market rallied on fresh yen weakness. Sovereign bonds, on the other hand, were notably weaker with double-digit basis point shifts in UK, US and German benchmark 10-year bonds.

Equities – Japanese equities rallied 3.4% as the yen fell, but otherwise equities were relatively unmoved. In the UK, the FTSE All-Share fell -0.5%, whilst European equities (FTSE Europe ex-UK) were up 1.2% and US equities (S&P500) gained 0.5%, on the week. Elsewhere in the Far East, the Hang Seng index of equities in Hong Kong returned 0.7%.

Bonds – sovereign bond prices were sharply lower on the week. 10-year UK Gilt yields increased almost 20 bps on the week to end at 1.60%, and equivalent US Treasury yields were 14 bps higher to 1.89%, whilst German 10-year Bunds finished at 0.54%, 12 bps higher.

Commodities – oil essentially remained range-bound during the week, with Brent staying in the early-to-mid $40s, ending the week a little higher than it started at US$45.11 a barrel. Copper was also higher, finishing the week at US$2.28 per lb while gold was relatively unchanged, finishing at US$1,232 an ounce.

Currencies – sterling appreciated on the week, to finish at US$1.44 (up 1.4%), €1.28 (+2.0%) and ¥161 (+4.7%). The Japanese yen was notably weak.

The week ahead

We have a busy week ahead, with further Central bank meetings, Q1 GDP estimates and a host of other economic data. The US Federal Reserve meeting concludes on Wednesday, and although we will get the statement, there is no scheduled press conference and talk of a potential April hike was decisively shot down by recent comments from Yellen. A few hours later, in the early hours of Thursday morning, it’s the Bank of Japan’s turn, where credibility is clearly very thin on the ground. Expectations are that the BoJ will look to add further stimulus in the near future, but whether that is this time or an a subsequent meeting is less clear – unlike his counterparts at the Fed, BoE and ECB, the BoJ’s Governor Kuroda has a penchant for taking markets off-guard. On the data front, the US releases a host of data through the week with Services PMI, Durable Goods and S&P/Case-Shiller Home Prices out on Monday, and PCE, personal income and spending, and employment cost readings on Friday. We also have a number of Q1 GDP early estimates, including UK GDP on Wednesday (a slowdown from 0.6% to 0.4% quarter on quarter expected), US GDP on Thursday (expected to have slowed from 1.4% to 0.8% quarter on quarter) and Eurozone GDP on Friday. Elsewhere:

On Monday morning it’s the turn of the Ifo surveys for German Business Climate and Current Conditions. In the afternoon, US reports on New Home Sales and the Dallas Fed Manufacturing index.

On Tuesday lunchtime US Durable Goods orders for March are released, with forecasts expecting a rebound to 1.7% month on month from the -2.8% fall in February. Slightly later, the S&P/Case-Shiller Home Price measure is expected to come in at 5.6% year on year (from 5.7%) and US Services PMI is likely to remain in the low 50s, having been 51.3 in March. Also in the afternoon, the Conference Board US Consumer Confidence index is published.

After the initial estimate for UK Q1 GDP is released on Wednesday morning, the CBI Business Optimism Index for Q2 is published, then in the afternoon it’s US Pending Home sales as well as oil and gasoline stocks before we get the US Fed decision in the evening.

On Thursday, along with the Bank of Japan decision on Monetary Policy, overnight Japan will also release the latest batch of its economic data. This will include inflation (core inflation is expected to have fallen from 0 to -0.2% year on year), household spending, unemployment and industrial production (where markets are hoping for a rebound of 2.9% month on month in March from the -5.2% fall in February). Later in the morning, after UK house price data (expected at 5.0% year on year) Eurozone business and economic sentiment data are released, whilst in the afternoon the US GDP estimate for Q1 comes out.

Just after midnight, in the early hours of Friday morning the UK’s Consumer Confidence measure is released, then later in the morning Eurozone inflation and Q1 GDP numbers are released, as well as the unemployment rate for March. In the afternoon is another data-dump from the US, which will include personal income and spending (both expected to have increased by 0.1% to 0.3% and 0.2% month on month respectively). These are accompanied by PCE inflation data (the Fed’s preferred measure) and the employment cost index, Chicago PMI and Michigan Consumer Sentiment confirmed numbers.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.