Weekly macroeconomic and market update - 17 October 2016

Weekly macroeconomic and market update - 17 October 2016

Weekly macroeconomic and market update - 17 October 2016

A look back over macroeconomic events for the week ending 14/10/2016. Inflation concerns pushed sovereign bonds up, and fresh Brexit worries hit sterling and the euro. It was relatively quiet on the data front, with positive Eurozone numbers and US numbers in line with expectations. This week, the European Central Bank (ECB) monetary policy meeting will be closely watched, as will US and UK inflation figures.

There were some stronger economic data coming out of the Eurozone last week, with industrial production for August springing back from July’s negative reading to a better-than-expected 1.8% year on year (1.1% was forecast). The ZEW surveys of business activity also showed improving sentiment, increasing from 5.4 to 12.3 (6.3 forecast). This was the third straight month of improvement following the hit to sentiment in July from the UK’s EU referendum vote, with Germany showing particular strength.

US retail sales recovered in line with expectations, up from a -0.2% month on month fall in August to a 0.6% gain in September. PPI inflation was up from flat in August to 0.3% month on month in September, slightly ahead of the 0.2% forecast (core PPI was 0.2%, up from 0.1% with forecasts for 0.1%).

Overall no big surprises in the data, and the same is true of the Federal Open Market Committee minutes, released on Wednesday, which showed the decision not to hike was a close call. There is a clear split between those wanting to hike now (there were three dissenters in this regard) and those that wanted further data. Although the data coming out is still mixed, the current trajectory seems to be for a December hike, and we would probably need to see a clear deterioration in the data for that to change.

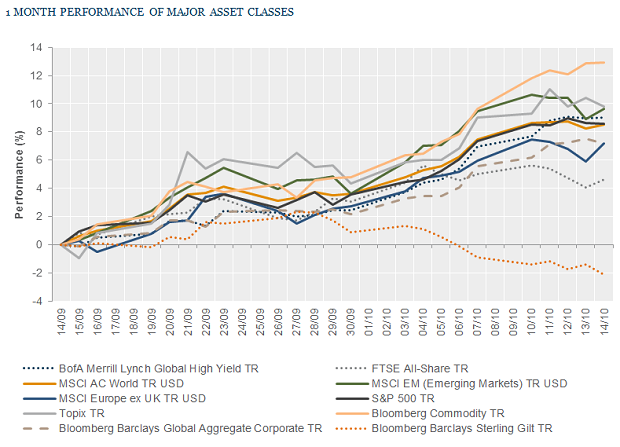

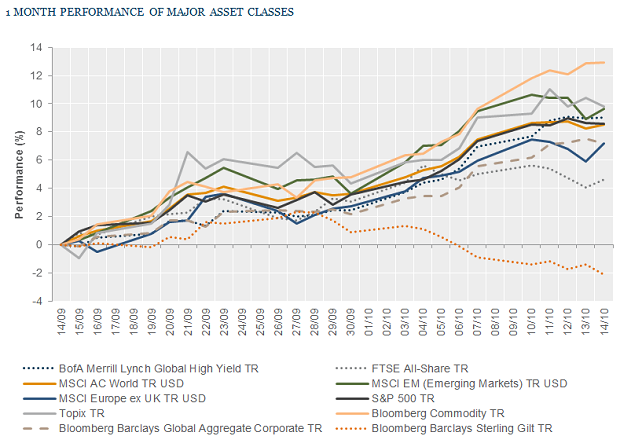

Sovereign bonds were again softer on the week as inflation concerns picked back up, whilst the pound and the euro were also weaker. Equity and commodity markets were much quieter last week.

Equities slipped in the US and across Europe, though with fairly limited magnitude. The FTSE All-share fell -0.4%, the S&P 500 slipped -1.0% and the FTSE Europe ex-UK was down -1.1%. Japan fared better, where the Topix gained 1.9%, and in Hong Kong the Hang Seng fell -0.2%.

Sovereign bond yields backed up again last week. UK 10-year gilt yields were back firmly above 1% at 1.09% (from 0.98% the week before). 10-year US Treasuries were 8 bps higher at 1.80% and German 10-year Bunds were 6 bps higher to 0.07%, though the short end remains firmly negative (1-month bonds are currently yielding -0.87%).

Oil has remained strong, sitting in the low US$50s for most of the week, and closing at US$51.95 a barrel. Copper was weaker on the week, falling to US$2.10 per lb and gold was little changed, ending the week at US$1,253.10 per ounce.

Sterling suffered general weakness again on further Brexit worries, dragging the euro down with it. Sterling ended essentially unchanged against the euro at €1.11, but slipped to US$1.22 and ¥127.

The calendar picks back up this week. On Thursday the European Central Bank (ECB) concludes its latest monetary policy meeting. No change to interest rates is expected, but with the recent rumours of a potential tapering of the quantitative easing programme, the press conference could be quite lively. On Tuesday, the UK and US report September inflation figures, both of which are expected to be sharply higher – up by 0.3% to 0.9% year on year for the UK, and up by 0.4% to 1.5% in the US, driven by similar effects to those discussed for China above. Speaking of China, we get a batch of data overnight Tuesday night, including third quarter GDP, fixed asset investment, industrial production and retail sales, which are all forecast to remain unchanged or marginally stronger. Elsewhere:

On Monday US Industrial Production is reported for September, along with the New York Empire State Manufacturing Index. Along with headline inflation covered above, on Tuesday UK core inflation is reported. Forecasts are for a 0.1% increase to 1.4%, whilst US core inflation is expected to be unchanged at 2.3%.

The overnight data from China will be interesting first thing on Wednesday. GDP is expected to be unchanged at 1.8% quarter on quarter and 6.7% year on year, and Fixed Asset Investment is expected to be 0.1% higher at 8.2%. Similarly industrial production is forecast at 6.4% (from 6.3%) and retail sales unchanged at 10.6%. Later in the morning, UK unemployment and average earnings are out along with Eurozone construction. In the afternoon, US building permits and housing starts data are released.

After the ECB announcement and the UK’s retail sales, Thursday afternoon has the Philadelphia Fed Manufacturing Index and existing home sales data due out. As we reach Friday, Chinese house prices data are updated early in the morning, then the UK’s Industrial Trends Orders from the CBI are reported. In the afternoon, the Eurozone Consumer Confidence index reading for October is released.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.