Weekly macroeconomic and market update 19.07.16

Weekly macroeconomic and market update

Weekly macroeconomic and market update

A look back over macroeconomic events for the week ending 15/07/2016. The Bank of England held fire on an expected interest rate cut, with a cut and a restart of Quantitative Easing (QE) now likely at the August meeting. We also look at the situation in China, where the currency has been gently depreciating without much notice. Looking to the week ahead, the ECB monetary policy meeting will be a highlight, as will PMI numbers released at the end of the week.

To the surprise of many in the City, the Bank of England left interest rates on hold at the Monetary Policy Committee meeting, but will now almost certainly act at the August meeting. While there has been no change to the Central bank’s view that the result of the EU referendum is likely to induce a near-term downturn, it seems the committee is looking to calibrate a meaningful response rather than appear to be panicking. Action in August would also coincide with the release of the quarterly inflation report, which would provide better framing for the measures, with the minutes showing that most committee members “expected monetary policy to be loosened in August”. While economists were disappointed that there was no action this time around, comments from the Central bank’s Chief Economist, Andy Haldane, talked about a package of measures and a radical response, which would likely include both an interest rate cut and a restarting of the ‘Quantitative Easing’ asset purchase programme – though the size and scope are still key variables. With the recent political changes, it also seems highly likely that monetary easing will be accompanied by fiscal stimulus from the new Chancellor, possibly at the time of the Autumn Statement. It’s worth highlighting that if we do see fiscal stimulus while the Central bank is buying government bonds, this would start to get conceptually rather close to helicopter money.

China’s second quarter growth rate held steady at 6.7% year on year, beating expectations of another 0.1% slowdown, helped both by continued strength in the property market – not the most positive of factors – and the government stimulus, which, as we’ve discussed previously, was front-loaded into the first half of the year. Interestingly, this was decomposed into slower investment contribution (from 2.9% to 2.5% contribution) and greater consumption contribution (4.2% to 4.9%, the difference being net exports), as the economy tries to rebalance. Reinforcing this point, retail sales increased to 10.6% year on year, ahead of expectations. Conversely, fixed asset investment slowed more than expected from 9.6% to 9.0% (9.4% was forecast) – outstanding loan growth also continued apace, at 14.3% year on year.

Chinese trade activity continued to fall, with exports in June -4.8% lower than the year before (from -4.1% and expectations for no change) and imports -8.4% lower (from -0.4%, forecasts of -5.0%). Industrial production improved from 0.2% to 6.2%, beating forecasts for a -0.1% slowdown.

European industrial production disappointed, with a year on year increase of just 0.5% in May, down from 2.2% in April and forecasts for a more moderate slowdown to 1.4%.

US inflation was unchanged at 1.0% on the headline rate, though core inflation ticked up 0.1% to 2.3% year on year. Month-on-month retail sales were also improved, up from 0.2% in May to 0.6% in June. Industrial production was also a positive surprise, up 0.6% month on month in June from a -0.3% fall in May, though this still represented at -0.7% contraction year on year.

UK construction output remained negative in May, falling -1.9% year on year and continuing a trend from March.

One of our key investment themes for the year revolves around China, where we remain concerned that long-term capital misallocation now poses a material risk to the banking system in the world’s second largest economy. While the shift towards a more sustainable economic basis of consumption is a positive in the long-term, it seems likely that the consequences of aggressive debt-fuelled growth will manifest quite painfully before the later-stage benefits are witnessed.

Interestingly, while markets were shocked by the one-off move that accompanied the change of the currency regime, which amounted to a 3.1% weakening, markets have paid far less attention to the steady devaluation that we’ve seen since. Following the initial loosening, the currency is now 4.4% weaker, and is 7.6% weaker than a year ago. This is in line with our view that the over-indebted and slowing economy will result in further (and accelerating) corporate defaults, devaluation of the currency and exported deflation. We’re already seeing the first two of these: devaluation of the currency as witnessed directly, and non-performing loans, which are reportedly on the rise.

CHINESE RENMINBI PER US DOLLAR

Source: Factset

Manufacturing PMI has been in contractionary territory since early 2015, industrial production has been falling and appears to be run more for cash-flows and interest payments than for economic productivity. Non-manufacturing remains expansionary, but has been steadily slowing for several years. While under ‘normal’ circumstances valuations may appear attractive, the sheer scale of the trouble in the banking system of this emerging economy are very difficult to price in, meaning these valuations could be illusory. Given the high level of overall debt, which is more than 250% of GDP, it is difficult to make a positive case for China in the medium-term, and on this basis we remain cautious and underweight to China specifically and Emerging Markets/Asia Pacific equities more generally.

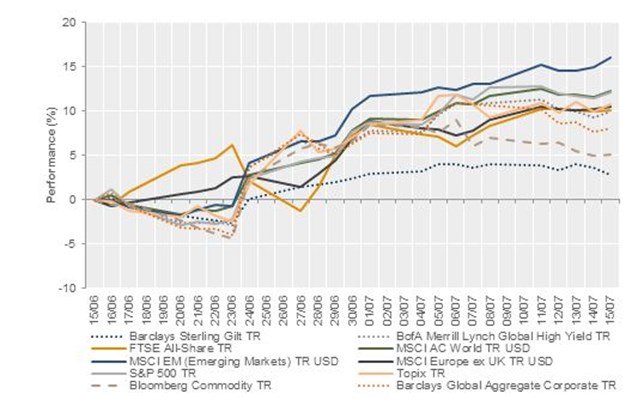

Markets were in a gentle ‘risk-on’ mode last week, with equities moving higher, particularly in the more cyclical regions, while government bonds and gold gave back some of their recent strength. Sterling also recovered some of its poise following the Bank of England’s lack of activity.

• Equities – FTSE All-Share +1.5%, S&P 500 +1.5%, FTSE Europe ex-UK +3.3%, Topix +8.9%, HangSeng+5.3%

• Bonds – 10-year UK gilts eased 11 bps to 0.84%, 10-year USTs yields were 20 bps up to 1.56%, and 10-year German bunds were also 20 bps up, ending the week with a zero yield

• Commodities – Oil rallied on the week, but remained below $50/barrel, with Brent crude ending the week at $47.61. Copper was also up on the week, last seen at $2.23/lb, while gold eased slightly to $1,326.50

• Currencies – Sterling recovered on the week, particularly after the Bank of England announcement, ending at $1.32, €1.19 and ¥139. The yen was weaker across the board.

1 MONTH PERFORMANCE OF MAJOR ASSET CLASSES

With the Bank of England holding fire last week, attention now turns to the European Central Bank’s meeting on Thursday. There is clear appetite for fresh stimulus, while in the background serious questions remain over the Italian banking system – the result and press conference will be watched with interest. On Tuesday, the latest UK inflation figures will be released, with expectations that inflation will have ticked up by 0.1% to 0.4% while core inflation is thought to have increased from 1.2% to 1.3%. The week ends with PMI data from the UK, Eurozone and the US, which will be the first set of readings following the EU referendum result. Elsewhere:

On Monday, after the Chinese GDP and associated data last week, overnight we get the latest Chinese house price data.

After the UK inflation data, Tuesday sees the Eurozone reports on Construction Output and the ZEW survey of Economic sentiment. In the afternoon, US housing start and building permit data are released.

On Wednesday in the UK, unemployment is forecast to remain unchanged at 5.0%; average earnings, including bonuses, are thought to have improved 2.0% to 2.3% year on year. In the afternoon, the latest Eurozone consumer confidence readings are reported.

Thursday morning, UK retail sales figures for June are expected to show a sharp decline from 6.0% to 4.9%. After the ECB monetary policy update, the US will provide the latest Philly Fed Manufacturing index and existing home sales.

And finally on Friday a range of PMIs are released, starting in the morning with Eurozone manufacturing and services PMI, forecast to have slowed from 52.8 in both cases to 52.1 for manufacturing and 52.5 for services. Straight after, it’s the turn of the UK – estimates suggest the indices will signal contraction, with the manufacturing PMI falling from 52.1 to 49.5, and services PMI slipping from 52.3 to 49.5. In the afternoon, the US will report manufacturing PMI, with estimates suggesting a marginal increase from 51.3 to 51.6. Friday will also see the start of the weekend meeting of G20 Finance Ministers and Central bank governors in China.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.