Weekly macroeconomic and market update - 21 November 2016

Weekly macroeconomic and market update - 21 November 2016

Weekly macroeconomic and market update - 21 November 2016

A look back over macroeconomic events for the week ending 18/11/2016. There is renewed focus on China in light of Donald Trump’s protectionist rhetoric, whilst Chinese renminbi weakness versus the US dollar has accelerated. This week, the Autumn Statement on Wednesday will be closely watched for any indicators of fiscal policy loosening.

China released its latest batch of economic data, but investors now worry about a global trade war after the US elections. Data in the week showed that fixed asset investment had ticked up 0.1% to 8.3% year on year (forecast had been for no change), whilst industrial production was unchanged at a reasonably progressive 6.1% year on year (though forecasts had been for an increase to 6.2%). However, retail sales for October fell from 10.7% to 10.0% year on year (forecasts were for no change).

More broadly, there have been some signs of economic stability returning to China, with the Producers Price Index positive again for the first time since 2012 and more robust PMI readings than we saw earlier in the year.

Concern is now about how markets and economies outside of the US react to the protectionist rhetoric coming from the President-elect. Mr Trump has been particularly hostile towards China during his presidential campaign and has been vocal about implementing trade tariffs on the world’s second largest economy, in addition to his broader scepticism about global trade deals. Chinese currency devaluation is a theme we’ve been talking about for some time now, and a fresh spat between the US and China could accelerate that, as an early sign of any wider trade dispute.

Industrial production figures for the Eurozone and the US showed further slowing, similar to the UK release earlier in the month. The Eurozone reading for September showed a slowdown from 2.2% to 1.2% year on year, though this was slightly ahead of the 1.0% that had been forecast.

Over in the US, which reports on a timelier basis, October saw another contraction of -0.9%, following on from September’s -1.0% year on year reading. US Retail sales were also more subdued, growing at 0.8% year on year in October, from 1.0% in September but ahead of the 0.6% forecast.

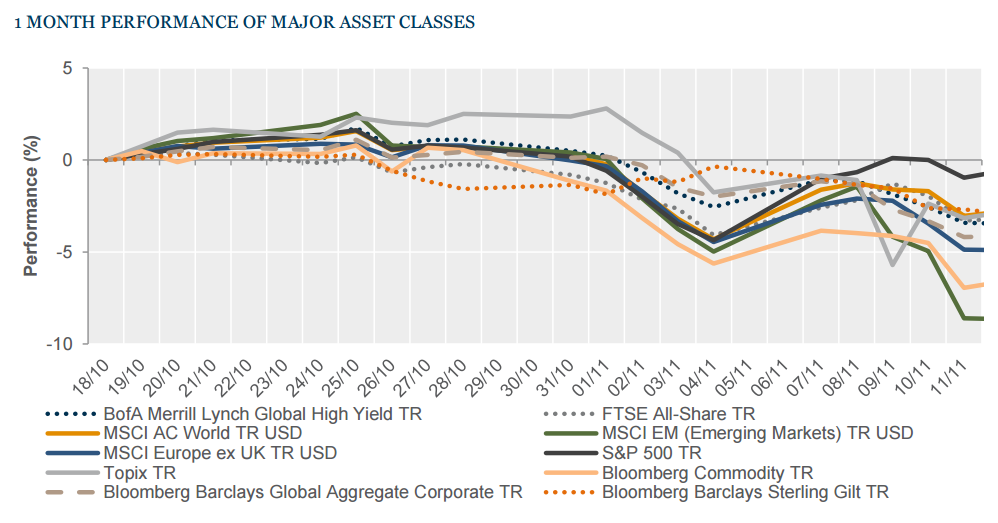

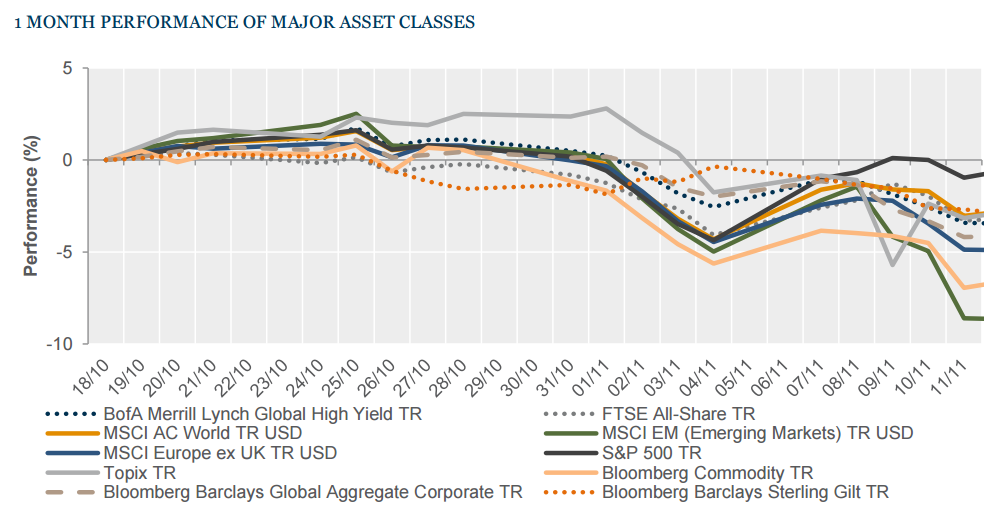

It was another tough week for sovereign bonds and gold, whilst equity markets were relatively subdued.

It was a mixed bag in equity markets, with UK and US equities barely changed. Both gained 0.8% on the week, as measured by the FTSE All Share and S&P 500 respectively. European equities suffered, with FTSE Europe ex-UK falling - 1.4%. Over in the Far East, Japan’s TOPIX index had a strong week, advancing 3.7% whilst the Hang Seng in Hong Kong fell -0.8%.

We saw another horrid week for US Treasuries, as the ten-year yield increased another 21 basis points (bps) to 2.35%. UK gilt yields also rose by 10 bps to 1.47%, whilst German ten-year bund yields were slightly higher, by 4 bps to 0.28%.

Oil regained some poise on the week, with Brent Crude finishing at US$46.86 per barrel. Gold was weaker again, slipping to US$1,208.50 per ounce. Copper was marginally lighter at US$2.46 per lb by the end of the week.

The US dollar gained against most major currencies as markets started pricing in tighter monetary policy. As a result, sterling was weaker versus the US dollar, but rebounded against other major currencies, to end the week at $1.23, €1.16 and ¥137.

There is not a huge amount in the diary to get excited about this week, leaving markets to fixate on political developments. The most obvious, for the UK, is the Autumn Statement on Wednesday. This will be watched closely for any indication that the Government is contemplating fresh fiscal stimulus. Also on Wednesday the US will update its Durable Goods Orders, where there are hopes it will have rebounded from the previous -0.1% month-on-month fall to a 1.1% gain for October. Later in the evening the minutes of the latest Federal Open Market Committee meeting are released. We also have PMI readings out of the Eurozone and the US. On Wednesday morning the Eurozone numbers are forecast to show Services PMI increasing 0.2 to 53.0 and Manufacturing slipping 0.3 to 53.2. In the afternoon, US manufacturing PMI is expected to be unchanged at 53.4, with Service PMI on Friday also expected to be unchanged at 54.8. Elsewhere:

There is nothing in the calendar on Monday, although there are speeches from officials at the Bank of Japan, US Federal Reserve, Bank of England and European Central Bank. On Tuesday the UK’s CBI reports industrial trends in the morning, then in the afternoon the flash reading on the Eurozone Consumer Confidence measure comes out, followed by US existing home sales.

We have a busy midweek. As well as the releases mentioned above, on Wednesday the US will also report new home sales, jobless claims and energy reserves. On Thursday the German Ifo business survey results are updated, along with the GfK Consumer Confidence measure. Late in the evening, Japanese inflation is reported. Finally, on Friday, the first revision to UK third-quarter GDP is due, as well as UK business investment for September and US PMI numbers.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.