Weekly macroeconomic and market update, Monday 4th July

Weekly macroeconomic and market update

Weekly macroeconomic and market update

A look back over macroeconomic events for the week ending 1 July 2016. As the dust settled on the immediate post-referendum period, assets prices recovered markedly as sterling slipped lower. We now look to refocus on some of the major issues which have been in the background for the last month, particularly the slowdown in the US, which will be framed by the non-farm payrolls due out on Friday.

As the dust settled in the week following the Brexit referendum, markets have been exceptionally volatile as investors have tried to digest the rapidly changing landscape. Uncertainty has reigned both on the potential economic impact, which we still believe will be limited in the grand scheme, and even more so on the increasingly bitter infighting engulfing the two main political parties.

Sterling took a pounding, but after the initial shock global equity markets – including the FTSE 100 – actually rallied along with sovereign bonds. The yield on ten-year gilts tumbled below 1% and two-year yields briefly flashed below zero for the first time ever. Whilst we would normally limit our comments here to purely macroeconomic rather than market-related factors, the scale of the shifts are such that there is a strong risk of a feedback loop, most notably through Central bank activity.

One of our major investment themes this year has been the growing risk of politics as a driver in investment markets, and these developments clearly play into that theme. Whilst the Chancellor has backed away from the idea of some sort of emergency Budget, Bank of England Governor Mark Carney suggested a downturn could be on the way, and that further monetary policy easing would “likely be required over the summer”. This would probably mean a cut in interest rates (though a move to negative rates seems unlikely in the short term) and potentially even a restarting of quantitative easing.

Highlighting the economic concerns that Brexit could have, the UK fell out of the top tier of credit-worthy ratings. The last ‘AAA’ rating from S&P was downgraded two notches to AA, whilst other agencies consider downgrading their own assessments – though you wouldn’t have thought it looking at bond yields this week. S&P also cut the credit rating for the EU by one notch to AA.

The final revision to US GDP saw an improved reading of 1.1% annualised from the previous estimate of 0.8%. But this was hardly a rate that inspires enthusiasm, and is the lowest rate since the start of 2015, which was notable for one-off weather-related impacts. On its own this is not too significant – the quarterly data are prone to isolated weak periods – but of more concern is the slowing trend witnessed over the four quarters. This brings into question the underlying strength of the US economy and, in turn, the valuations being placed on the US equity market.

Whilst Brexit will continue to make headlines for some time to come, our investment strategy remains focused on the bigger picture. In particular, our concerns over US monetary policy and slowing growth in the world’s largest economy, with the risk of uncontrolled debt winding in China also a concern. The inherent impact of Brexit on investment portfolios diversified by both asset class and geography is likely to be fairly limited overall, with the main risk being that the event triggers wider concerns – as we saw with worries over China at the start of the year.

A lot of clients have been asking whether we are considering adding US equities as a relative ‘safe haven’ – the answer is that nothing has changed in our fundamental outlook on the US, and we remain underweight. With the talk this week around US non-farm payrolls, it’s worth taking a broader look at the US. Stepping back from the day-to-day numbers, it looks difficult to build a particularly positive picture for the US economy that we think would be necessary to justify decidedly optimistic valuations. Don’t get too carried away with some of the recent positive surprises, which are more related to low expectations than a strong economy.

Manufacturing and Services PMI have been on a downward trend since mid-2014 and are now hovering close to neutral. At the same time, capacity utilisation has also been falling (now below 75%) whilst lacklustre retail sales growth means it is unlikely the domestic consumer is going to substitute for a slowing overseas demand from a slowing global economy. In this environment, and with US corporate earnings falling along with productivity, it seems very hard to justify the premium valuation, just as a dovish shift in the US monetary policy seems likely to take the wind out of recent dollar strength.

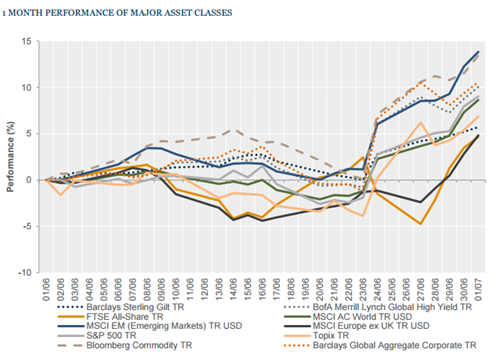

Another volatile week for assets, as equity markets appeared to go into denial with an aggressive rebound as bond yields fell to fresh lows. The main casualty was sterling.

Equities – FTSE 100 was the strongest major global market, gaining 7.2% on the week and closing at the highest level so far this year. The FTSE 250, which represents the more domestically-focused mid-cap companies, also gained 2.4% but remains below pre-referendum levels. Global markets were also up – in the US the S&P 500 was up 3.2%, European equities as measured by the FTSE Europe (ex-UK) returned 3.7%, the Japanese Topix gained 4.1% and the Hang Seng in Hong Kong was up 3.2%.

Bonds – government bond yields continued to reach new depths. In the UK the yield on the March 2018 gilt briefly turned negative before settling just below 0.2%. The yield on 10-year UK gilts was 23 bps lower on the week, finishing at just 0.86%. 10-year German bund yields are now solidly negative at -0.13% and US treasury yields also fell, finishing at 1.46% compared to 1.71% a month before.

Commodities – oil prices have appeared to stabilise, with Brent and West Texas crude range trading just at or below US$50 a barrel for the last few weeks. Copper has continued to strengthen up to US$2.22 per lb, and gold, of course, has benefited from the uncertainty, ending the week at US$1,336.70 an ounce.

Currencies – sterling weakened further during the week after the sharp fall immediately following the referendum result. The pound finished the week at US$1.33, €1.19 and ¥136.

The main scheduled event this week is going to be non-farm payrolls on Friday (180,000 expected, from 38,000 last month). This comes after the huge miss last month, partially distorted by striking Verizon workers. Clearly markets are expecting this to be an anomaly, so any disappointment could be felt hard. On Thursday, the UK releases manufacturing and industrial production figures for June, which should also be of interest. Estimates are for a rebound in industrial production to 1.6% year on year from 0.5% and to 0.8% from 0.7% in manufacturing. Elsewhere:

On Monday UK construction PMI is due, forecast to slow from 51.2 to 50.5. It is a quiet day elsewhere with the US celebrating Independence Day. Caixin Services PMI is released overnight on Tuesday, and is expected to be more positive than the manufacturing measure. Later in the morning the UK Services PMI is released, followed by Eurozone retail sales and then US factory orders in the afternoon.

We can look forward to some mid-level US data on Wednesday afternoon, followed in the evening by the Federal Open Market Committee minutes – but these were before the EU referendum vote, so have likely been superseded in terms of sentiment.

After UK industrial and manufacturing figures are released on Thursday morning, the ECB monetary policy meeting minutes are out in the UK at lunchtime, with some light US labour statistics in the afternoon. Friday afternoon then gives us the highlight of the week – US non-farm payrolls along with updates to the average earnings, unemployment and average hourly earnings figures.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.