Weekly macroeconomic and market update 04.04.16

Weekly macroeconomic and market update 04.04.16

Weekly macroeconomic and market update 04.04.16

A look back over macroeconomic events for the week ending 01/04/2016. Whilst Federal Reserve (Fed) Chair Yellen tried to quell hawkish thoughts, US economic data appeared to be picking up, along with improving global PMI data. Markets were fairly quiet, aside from tightening in core government bonds, and the week ahead will be fairly quiet as well.

Recent improvements in US economic data

Economic data out of the US has certainly improved over the last couple of weeks, relative to the more mixed picture we’ve been used to seeing in recent months. Non-farm payrolls came in at 10,000 jobs ahead of expectations, with a reading of 215,000 jobs added in March. This is a continued sign of strength in the jobs market, despite being somewhat lower than the bumper 245,000 reading in February.

Average hourly earnings were up slightly more than expected at 0.3% month on month (2.3% year on year), and the main point of contention was the unemployment rate increasing from 4.9% to 5.0%. However, this is likely to be driven by the latest uptick in labour force participation which has been steadily increasing from last September, and is now at 63.0%. Although this fits nicely into a narrative around improving conditions drawing people back into the workforce that had previously given up hope, participation remains some way below the pre-global financial crisis level.

The latest global PMIs

Global PMI numbers were improved after recent weakness. In the US the Markit Composite PMI, which had been teetering on the edge of a contraction signal at 50.0, strengthened to 51.1. This was helped by an improvement in the services reading from 49.7 to 51. Markit Manufacturing PMI was slightly improved from 51.3 to 51.5 (but slightly behind expectations for 51.8). Nonetheless, there was a clear improvement, and the Market signals were corroborated by PMI numbers from the Institute of Supply Management (ISM). The ISM manufacturing figure improved more than expected, coming in at 51.8 from 49.5 previously and ahead of forecasts of 50.7, to confirm a significant improvement trend. New orders were particularly strong, with a reading of 58.3 from 51.5 previously.

Eurozone figures were also improved, with Manufacturing PMI increasing from 51.2 to 51.6 and Services PMI up from 53.3 to 54.0, both ahead of expectations. The story was the same in China, where the official manufacturing PMI improved from a contractionary 49.0 to slight expansion at 50.2, whilst non-manufacturing PMI picked up from 52.7 to 53.8. The private measure from Caixin also showed improvement in the manufacturing numbers, still contractionary at 49.7 but much better than 48.0 previously and ahead of expectations for a much softer increase to 48.2.

“Proceed cautiously” says Yellen

Despite the positive economic numbers, Fed Chair Janet Yellen used a speech at the Economic Club of New York to shoot down some of the hawks by reiterating the need to “proceed cautiously” in hiking interest rates amid the growing uncertainty and risks in the global economy and global financial markets. Yellen highlighted concerns over China and the oil price, weakness in some US inflation measures and the mixed nature of some of the economic data coming out of the US, particularly the challenges in a manufacturing sector which is struggling in the face of a strong dollar.

The comments came shortly after some other Fed committee members had issued more upbeat assessments, and was interpreted by markets as an attempt to quell the idea of another hike in April or June. Clearly the speech had the desired effect, with markets now pricing in less than a single further rate hike this year.

Last week’s other events

The markets

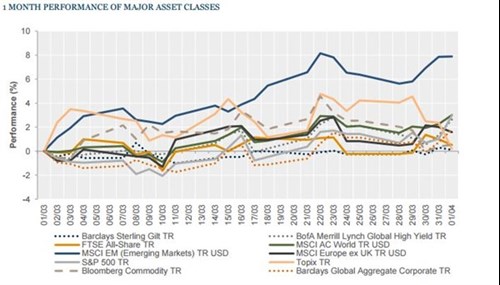

Bonds generally rallied on the soft monetary policy noise. Although US equities benefited somewhat from this, equity markets were generally quiet around the Easter period, whilst commodities gave up some of their recent strength. The US dollar and UK sterling were generally weaker, whilst the euro was the main appreciator

Equities – Major markets had a fairly uneventful period overall, though Japanese equities fell heavily on Friday, accounting for almost all of the -3.3% fall for the period. The US had the best return of the major markets after Yellen’s comments, but the market was only up 1.1% over the two weeks. In the UK, the FTSE All-Share slipped -0.6%.

Bonds – Most major bond yields continued to tighten. 10-year US Treasury yields were last seen at 1.77% whilst in the UK the equivalent bonds closed at 1.41%, and German 10-year Bunds finished last week at 0.13%. Japanese 10-year government bonds remain negatively yielding at -0.06%.

Commodities – Oil slid further, particularly in the last session, with Brent crude back below US$40 at US$38.67/barrel. It was a similar story for copper, which slipped to US$2.17 per lb, and gold also drifted lower to finish at US$1,222.50 an ounce.

Currencies – In light of Janet Yellen’s comments it was no surprise that the US dollar was the main weakener, slipping -2.0% last week alone against the generally strengthening euro. Sterling was generally weaker, except against the US dollar. At close on Friday, the GBP exchange rate was US$1.42, €1.25 and ¥158.83.

The week ahead

A quiet week this week, which could see markets drift. There will no doubt be a lot of attention paid to the details of last month’s monetary policy meetings when the US Fed releases the meeting minutes on Wednesday, with the European Central Bank (ECB) following suit on Thursday. In the UK, we have industrial and manufacturing production data out on Friday, both of which are expected to improve – from 0.0% to 0.2% year on year for industrial production and from -0.7% to -0.1% for manufacturing production. Elsewhere:

On Monday UK construction PMI is expected to have slipped from 54.2 to 54.0, whilst Eurozone unemployment figures are expected to be unchanged at 10.3%. In the afternoon, the US reports Factory orders (expected to fall -1.7% from+1.6% month on month) and Labour Market Conditions.

On Tuesday morning UK Services PMIs are out, and are forecast to have improved from 52.7 to 54.0. Later in the morning Eurozone retail sales figures are released, and are expected to be a little softer (from 2.0% year on year in January to 1.9% in February). In the afternoon, the ISM releases non-Manufacturing PMI (expected to increase to 54.0 from 53.4). JOLTs job openings data are also released.

On Wednesday morning we will see the overnight update of Caixin PMI data for Chinese services. Otherwise there is little of note until the Federal Open Market Committee meeting minutes are released at 7pm.

Then, after a quiet Thursday morning the ECB monetary policy meeting minutes are released at lunchtime. In the afternoon, US initial jobless claims could attract a little attention. Finally, on Friday UK industrial and manufacturing production figures end a rather quiet week.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.