Weekly macroeconomic and market update 11.07.16

Weekly macroeconomic and market update 11.07.16

An update on our separation

Professional Services will now be known as S&W. Find out more.

Weekly macroeconomic and market update 11.07.16

A look back over macroeconomic events for the week ending 8 July 2016.

US non-farm payrolls continued to wrong-foot forecasters, beating estimates this month in similar magnitude to the miss last month. The US added 287,000 jobs in June, with forecasters expecting a more moderate 175,000. At the same time, May’s miss of 38,000 (164,000 had been expected) was further revised down to just 11,000.

This data point may have eased some short-term concerns, but it was far from an upbeat data release overall. Unemployment increased more than expected, up 0.2% to 4.9% (though the participation rate was also up by 0.1% to 62.7%). Average hourly earnings grew at half the expected rate, increasing 0.1% month on month (from 0.2% in the previous month and forecast).

Whilst the latest release clearly suggests the May figure is an anomaly, to my mind there is still no coherent signal coming from the US labour market, and as covered last week, broader economic indicators are still painting a concerning picture on the sustainability of the current market cycle.

UK economic activity data for May showed resilience in industrial production and particularly manufacturing. However, June measures for services and construction were a disappointment – presumably due to referendum worries.

Although year-on-year industrial production slowed from 2.2% to 1.4% in May, this was ahead of forecasts (for 0.5%). This suggests the sector was able to shrug off a period of weakness in late 2015/early 2016 and return to the reasonable growth levels that have been evident since the start of 2014.

Manufacturing growth also unexpectedly picked up from 1.5% year on year in April to 1.7% in May (a fall to 0.7% was forecast). However, data for June showed construction PMI fell more than expected to 46 (from 51.2), whilst services PMI slipped from 53.5 to 52.3. Both measures continue to deteriorate year-to-date.

Although equity markets seem to be sending contradictory signals, other asset classes are now flashing clear warning signs about the global economic outlook. This is particularly clear in the bond market, where sovereign bond yields are falling and credit spreads are widening, and more locally in commercial property. This illiquid and UK-centric asset class has seen valuations revised down and a number of funds have been forced to gate access, an event which our analyst team has written on and will continue to monitor.

The near-term risk of the global economy tipping into recession now seems a live possibility. Whilst we continue to believe the result of the UK’s referendum on EU membership should not, in isolation, change the long-term economic fundamentals, it may have brought forward the onset of a downturn across Europe and the UK. Alongside this, the broader challenges facing a late-cycle US economy is a factor we’ve highlighted previously.

The gathering economic stormclouds have been a central aspect of our house investment strategy over the last year or so, during which time we have taken steps to de-risk our portfolios. We have reduced equity and bond exposure and increased exposure to alternative asset classes, such as absolute return funds and gold, as well as holding tactical positions in cash. We therefore consider the recent movement in the markets to be the result of more investors coming round to our point of view.

We have also generally been more dovish than the market on the trajectory for both US Treasuries and UK Gilts, with our view that December’s US interest rate hike could have been a 'one and done' event. This seems to be coming closer to reality, with US interest rate expectations now pushed out into 2017. In the UK, after the Bank of England Governor signalled further monetary easing, markets are now pricing in an 80% chance of a 25 bps cut (to 0.25%) on Thursday, with a 20% likelihood that there will be a cut to 0 at the meeting after.

From our point of view, it seems more feasible that the Monetary Policy Committee will want to see the effect of a single cut and give the markets time to adjust. Even then, there are more policy tools than just cutting interest rates to zero that could be employed, such as restarting the quantitative easing asset purchase programme. And of course, expect a very large dose of rhetoric in the mix as well.

With much of this move priced in we have reduced our target weights in UK Gilts, after recent gains, as markets came around to our point of view. However, we retain significant exposure to this asset class and to US Treasuries in our core investment strategy, particularly as these assets could continue to generate a return if the economic outlook deteriorates.

In place, we have increased our exposure to gold, which is typically not highly correlated to equities or broad bonds. Gold could also be expected to be sought as a store of wealth, particularly if governments are forced to engage in competitive global currency devaluation and additional fiscal stimulus to replace ailing monetary stimulus programmes. We believe the diversification benefits of gold exposure (‘physical’ rather than gold mining equities) are particularly attractive in the current environment.

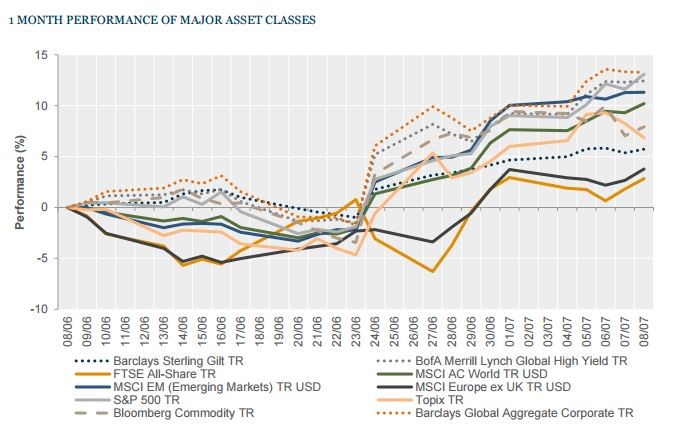

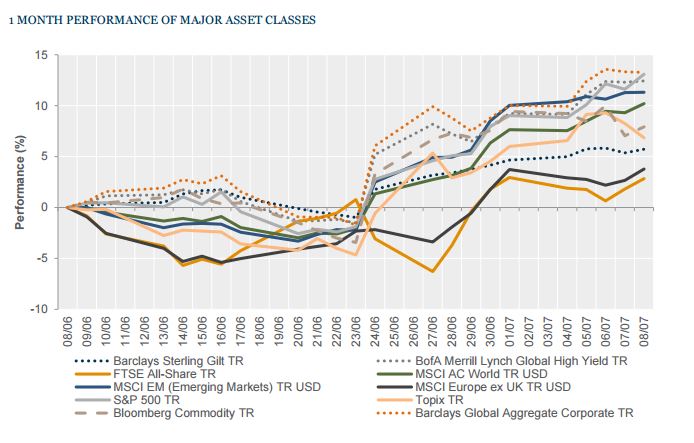

Sovereign bonds continued to rally through the week, whilst equities were mixed though fairly muted in magnitude.

Equities – in aggregate, UK equities were flat on the week as measured by the FTSE All-Share. Breaking this down we saw a slightly positive large-cap performance (FTSE 100 was up 0.3% on the week) offset by weakness in smaller companies, as the FTSE 250 mid-cap index fell -1.6%. Elsewhere, US equities gained 1.3% (as measured by the S&P 500), whilst Eurozone worries pushed the FTSE Europe ex-UK index to a -2.1% loss. In the Far East, the Topix index of Japanese equities fell -3.5% and in Hong Kong the Hang Seng index was also down -1.1%.

Bonds – bond yields fell again this week. 10-year Gilt yields were another 13 bps lower to 0.73%, whilst the equivalent US Treasury yields finished the week 10 bps lower at 1.36%. German Bunds pushed further into negative territory with the 10-year another 7 bps down on the week to -0.20%, and everything out to 15-years now negative.

Commodities – oil slipped during the week, with Brent last seen at US$46.76 per barrel. Copper was also lower during the week, ending at US$2.12 per lb. Gold ticked up last week, and finished at US$1,356.60 an ounce.

Currencies – sterling came under fresh pressure, falling to below US$1.30 against a strengthening US dollar but ending the week dead on US$1.30. Against the euro, sterling finished weaker again to €1.17 and ¥130.

Thursday sees the first Bank of England Monetary Policy Committee meeting following the EU referendum vote, coming after the Governor Mark Carney clearly signalled further monetary easing is on the way. Expectations are high for a quarter-point rate cut at this meeting. At the end of the week, on Friday we’ll also be looking closely at the economic releases from China as it reports its second quarter GDP results. Forecasts are for another small slowdown by 0.1% to 6.6% year on year. Elsewhere:

On Monday morning China releases its year-to-date foreign direct investment data, followed in the afternoon by the US Labor Market Conditions Index. Tuesday will be a quiet day, with little of note in the morning and only the JOLTs US job openings data in the afternoon.

Overnight on Wednesday Chinese trade data are released, which could be interesting as we look towards the data at the end of the month. Expectations are already fairly dismal – forecasts are for exports to remain unchanged at a -4.1% year on year fall, and for imports to have fallen from -0.4% to -5%. Later in the morning Eurozone industrial production for May is released and is expected to have slipped from April. In the evening the US Federal Reserve releases its Beige Book of anecdotal economic reports.

The main event on Thursday will come from the Bank of England. The market is clearly expecting a quarter-point rate cut but perhaps little else from this first post-Brexit meeting, and perhaps the first time ‘Super Thursday’ will have real impact with the minutes being released at the same time as the decision. In the afternoon, the US releases producer price index figures.

Along with the Chinese GDP data, China also releases other useful economic data on Friday, including fixed asset investment, retail sales and industrial production. In the afternoon the US releases a fresh batch of economic data which will include inflation, retail sales, industrial production and consumer sentiment, so plenty to sink our teeth into next week.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.