Global monetary policy

Global monetary policy was back in the driving seat last week as Fed Chairwoman Janet Yellen was quizzed – and at points grilled – during testimony before the US Senate. During the two-day session, Yellen conceded that global economic and financial conditions had deteriorated since December’s rate lift-off, but for the most part stuck to her guns over the strength of the US economy as it stands today. In particular, she highlighted solid employment data and the transient nature of current downward pressures on inflation.

Despite this, it was clear the world’s most powerful Central banker was keen to keep the door open to a policy reversal. She stated that “monetary policy is not on a preset course”, and was much less dismissive of the possibility of the next move being a cut – stating that it was simply “not… the most likely scenario”.

However, what really energised economists was the revelation that the Federal Reserve was once again looking at the workability of negative interest rates. Arguably this is just the sort of prudence we would expect from any credible Central bank, but the frank nature of the disclosure when markets are hyper-sensitive to rhetoric caused some waves. Markets were already primed to any talk of negative rates as the ECB and Bank of Japan (BoJ) have pushed further into negative territory, and last week also saw the Swedish Riksbank cutting to -0.5%.

Eurozone growth updates

The Eurozone economy grew 1.5% year on year in the fourth quarter – matching expectations but still a slight deceleration from 1.6% previously, as industrial production figures for December disappointed. Quarter-on-quarter growth for the region was steady at 0.3%, with Germany meeting forecasts at 0.3% but Italy providing a disappointing miss – it was barely positive at 0.1% growth (estimates were for 0.3%). Greece was also confirmed as being back in recession, with a -0.6% contraction following a -1.4% reading in the third quarter.

Germany’s on-target reading helped offset concerns when industrial production contracted unexpectedly by -1.2% month on month in December. Italian industrial production also disappointed with a fall of -0.7% month on month (+0.3% was forecast), as did France with -1.6% month on month growth against +0.2% expected. French GDP growth was also reported the week before and was in line with expectations for +0.2% month on month.

Last week’s other events

- Here in the UK, industrial production figures disappointed by showing a sharp fall in December. There was a contraction of -1.1% month on month (-0.4% year on year), compared to forecasts for a contraction of just -0.1% (+1.0% year-on-year), and worse than the previous -0.8% contraction. Manufacturing production was also worse than expected – they were down -0.2% month on month. This was better than November’s -0.3%, but markets had been expecting slight growth of 0.1%.

- Japan’s “Economic Watchers” index, based on survey perceptions of those who directly service economic agents (such as waiters and barbers) showed a fall in the current conditions survey in January – from 48.7 to 46.6. The more important outlook measures improved, coming in at 49.5 from 48.2.

- The US labour market conditions index fell sharply from 2.9 to just 0.4 for January. Aside from being briefly negative in March and April last year, the index has been consistently above 1 since the middle of 2012. More positive was the retail sales figure which showed a 0.2% month on month increase in January, matching the December reading and against forecasts of slowing to 0.1% – but still hardly a figure to get excited about.

The markets

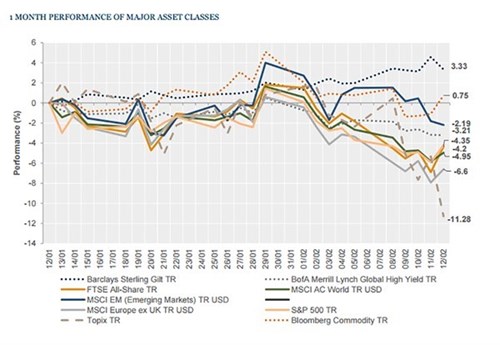

Further stress in equity markets was evident as sovereign debt rallied – with the notable exception of Japan where both equity and bond markets weakened together (although for overseas/unhedged investors the currency move offset some of the pain).

Equities – Another unpleasant week for equity markets, led by a rout in Japan where the Topix fell a very uncomfortable -12.6%, followed by Europe where Europe ex-UK fell -4.0% amid particular concerns over the European banking system. In the UK, the FTSE All-Share fell -2.6%, whilst the US managed to fare relatively well with the S&P 500 finishing down just -0.8%.

Bonds – After initially trading below zero, Japanese bond yields rose towards the end of the week just as equities suffered, with 10-year Government bonds finishing at 0.08%. Bonds elsewhere were up (i.e. yields fell) with 10-year UK Gilt yields 13 bps lower at 1.42%, and a similar move in the US (10-year Treasuries were down 10 bps to 1.75%). German Bund movements were more subdued, but were still 3 bps lower at 0.26%.

Commodities – The week was noisey for oil, but it was only slightly down by the end of the week and Brent was last seen at US$33.36 a barrel. Copper slipped to US$2.03 per lb whilst gold continued to rally, particularly after Chairwoman Yellen’s comments, finishing at $1,239.10/ounce.

Currencies – The Japanese yen surged as its equity and bond markets suffered, finishing up 3.2% against sterling and the US dollar. Sterling, in turn, was weaker against the Euro (down 0.8%) and flat against the US dollar.

The week ahead

We have another week that is relatively quiet in terms of big hitting items. Tuesday sees UK inflation figures, expected to be up 0.1% to 0.3% year on year. There is also the ZEW Economic Surveys in Germany, which forecasts suggest may have flatlined on the sentiment measure (to 0, from 10.2 last month). US Federal Reserve meeting minutes are published on Wednesday, with the ECB equivalent available on Thursday. Elsewhere:

On Monday we have overnight figures for Japanese GDP and Chinese trade data, and the only other event of note is the release of Eurozone balance of trade figures. On Tuesday afternoon, after the UK GDP figures and German ZEW surveys are released, the US has the NY Empire State Manufacturing Survey and NAHB Housing Market Index. Japanese Machine orders are then reported last thing at night – they are expected to have improved in December to 4.7% month on month from -14.4% in November.

On Wednesday morning the UK unemployment rate for December is released, and is forecast to have fallen from 5.1% to 5.0%. Average earnings are also released, with the market looking for a 0.1% moderation to 1.9% year on year. The afternoon has a reasonable array of US data, with housing starts, building permits and inflation as well as industrial production (which is expected to have slowed to a -0.4% month-on-month contraction in January from 0.3% growth in December).

Chinese inflation data is released early on Thursday morning, with expectations a tick up in January from 1.6% to 1.9% year on year (though PPI inflation is effectively certain to remain heavily negative, with a forecast improvement from -5.9% to -5.4% year on year). In the US, weekly initial jobless claims are released together with the Philadelphia Fed manufacturing index and the weekly EIA oil stocks update.

On Friday morning UK retail sales figures are expected to have improved from 2.6% to 3.6% year on year. In the afternoon, it’s the US’s turn for inflation. It is expected to have improved in January to 1.2% year on year (from 0.7%), whilst core inflation is forecast to remain steady at 2.1% year on year. Finally, in the afternoon Eurozone consumer confidence will be reported. This is expected to have fallen from -6.3 to -6.7.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.