Consultation on UK Carbon Border Adjustment Mechanism

The latest consultation, titled “Introduction of a UK carbon border adjustment mechanism from January 2027”, aims to provide an insight into how the Government intends to structure and administer a UK CBAM; inviting interested parties to present their views until the deadline of 13 June 2024.

What is UK CBAM?

The UK CBAM will be a tax which is effective from 1 January 2027 and paid after import by importers of affected goods. The tax will apply to the embedded carbon emissions within the imported goods.

This differs from the EU approach, which is a regulatory regime and will require CBAM allowances to be purchased by importers.

The overarching goal is to address carbon leakage risk by levelling the playing field between domestic and overseas producers of affected goods, so that they face the same carbon price on the UK market, regardless of country of origin.

Which products will be within scope?

The sectors proposed to be within the scope of CBAM are:

- Aluminium

- Cement

- Ceramics

- Fertiliser

- Glass

- Hydrogen

- Iron & steel

There is a detailed list of commodity codes for products which are proposed to be within the scope of the tax set out in an Annex to the consultation. The Government is seeking views on the list of products in the Annex to ensure that it includes products which are at risk of carbon leakage, but does not add disproportionate burdens.

The inclusion of ceramics and glass within the scope of the tax is likely to bring a much wider range of businesses within its scope. Manufacturers and importers of products in each affected sector should carefully review the list to consider whether it is appropriate, whether there are any products missing, and whether there are products which should be removed.

Scrap material is specifically proposed to be excluded from the scope for the aluminium, glass and iron & steel sectors. The use of scrap in remaking new products contributes to lower carbon emissions, and there would be a great deal of complexity and uncertainty involved in try to attribute carbon emissions to imported scrap.

What carbon price will apply?

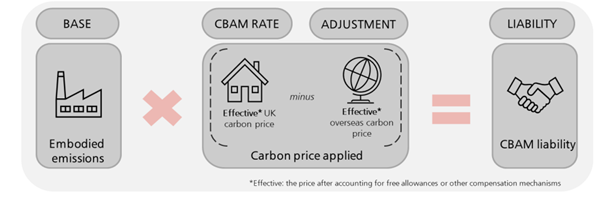

The UK CBAM will apply an effective carbon price to imports which matches the price that domestic producers are subject to. This will be based on the UK carbon price paid after accounting for adjustments, exemptions and compensation schemes and then adjusted for the local carbon prices paid for by overseas producers. An overview of the proposed approach to calculating CBAM liability is depicted below.

The taxable person will need to submit returns. The CBAM liability on the return will be calculated by multiplying the emissions value for the type of good and source by the effective UK carbon price, minus the overseas carbon price.

Because each sector benefits from differing amounts of free allowances, exemptions and compensation, there will be a separate rate of CBAM for each sector. This means that there will be seven individual CBAM rates in operation, which will be varied each quarter to account for price movements.

Evidence will need to be obtained and presented by the liable person for any adjustment for overseas carbon prices paid to apply.

There is no relief from UK CBAM for exported goods unless they arrive in the UK and are kept under special customs procedures such that they are never released into free circulation.

Calculating the imported embodied emissions

To determine the emissions embedded in imported CBAM goods, affected business will either use default values set by the Government or actual emissions data, where available and subject to further guidance to be released on prescribed methodologies.

Any default values will be in line with the global average of embodied emissions but weighted in line with the production volumes of the UK’s key trading partners. Further detail as to how the global average of emissions and weighting will be calculated is yet to be released.

At present, the Government aims to use default values at least for the initial period of 2027-2030, in order to allow other jurisdictions to transition toward accurate reporting of actual emissions data. Default values will be published by the Government in advance of this period. Post-2027, the Government proposes that a review be held to assess the functionality of default emissions values, with any subsequent changes to be implemented from 2031, at the earliest.

There is a change in terminology for the emissions included within the scope of CBAM, which will be:

- Direct emissions: those that are directly related to the production processes of the CBAM good; and

- Indirect emissions: emissions related to the production of electricity consumed during the production of the relevant good.

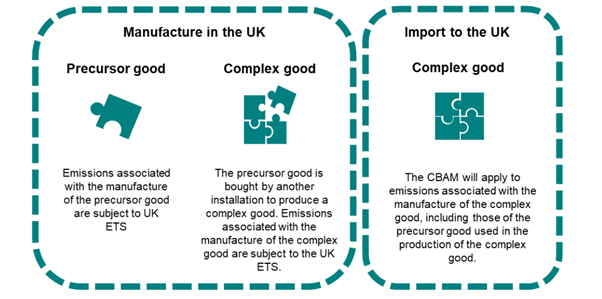

- The emissions of precursor goods are also included for imports of complex goods where both the precursor good and the complex good it becomes part of would both be subject to UK Emissions Trading Scheme (ETS) if made in the UK.

When are liable persons required to register for UK CBAM?

There is a proposed registration threshold of £10,000 value of CBAM goods imported into the UK per year.

There is currently no proposed consignment level threshold, unlike the EU CBAM, and affected businesses may wish to consider whether the introduction of a consignment level threshold should be proposed in their response to consultation if it would ease the administrative burden of reporting for peripheral items.

The threshold is proposed to be applied via two tests to determine whether a person is liable to register, the look forwards and look back tests as for other indirect taxes:

- Are the CBAM goods passing a tax point expected to reach or exceed the value of £10,000 over the next 30 days? If so, registration will take effect from the day the person is expected to meet the threshold.

- Have the number of CBAM goods that have passed the tax point on any given day met the £10,000 threshold over the last 365 day period? If so, registration takes effect from the date the goods met the threshold.

It is important to note that in both cases, CBAM liability applies to all CBAM goods imported from the effective date of registration.

With regards to compliance, a person must notify HMRC of any liability that crystallises within 30 days of the effective date of registration.

Once registered for UK CBAM, a person may only deregister in circumstances where they have no CBAM liability for four consecutive quarterly returns, even in circumstances where a ‘one-off’ import tips a business into a liability to register.

Compliance requirements

Registered business will be required to complete online tax returns. The first period will be 12 months, covering the 2027 calendar year and not due to be filed until 30 May 2028. This is a transitional arrangement to allow businesses to put processes in place with their suppliers for obtaining information about the carbon content and carbon price incurred for their goods.

Following periods will be calendar quarters, with the due date for filing being the last working day of the month following the end of the period. The first quarterly return (ended 31 March 2028) will not be due to be filed until 30 June 2028 as part of the transitional arrangements.

With regards to penalties and sanctions, the Government is considering alignment with the penalty points system recently introduced for the UK VAT system for late submissions of returns or late payment. A general penalty for any non-compliance specific to CBAM, such as failure to keep appropriate records, late registration or failure to provide information, will also be introduced.

How can we help?

We can help with understanding your exposure to EU CBAM or UK CBAM, preparing your quarterly reports for EU CBAM, and responding to consultations.

If you have any questions, want help with responding to the consultation or want to understand how CBAM affects your business, please contact our expert Jayne Harrold.

Approval: NTEH7042489

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication.

Tax legislation

Tax legislation is that prevailing at the time, is subject to change without notice and depends on individual circumstances. You should always seek appropriate tax advice before making decisions. HMRC Tax Year 2024/25.