Financial challenges to new entrants

The Evelyn Partners Energy, Renewables and Natural Resources team have been working closely with companies in this sector for the last 30 years. The technological and innovation developments evident in the market, driven by de-carbonisation, government and EU policy means there is a significant demand for renewable energy sources not just from existing wind, solar, thermal and hydro, but from new novel startups seeking to disrupt and carve out a niche.

We work with market entrants providing advisory, fundraising consulting and outsource finance function solutions. The outsource finance solution provides the management team and investors with a professional industry experienced finance function at a fraction of the cost of building an in-house team at the early stages of development.

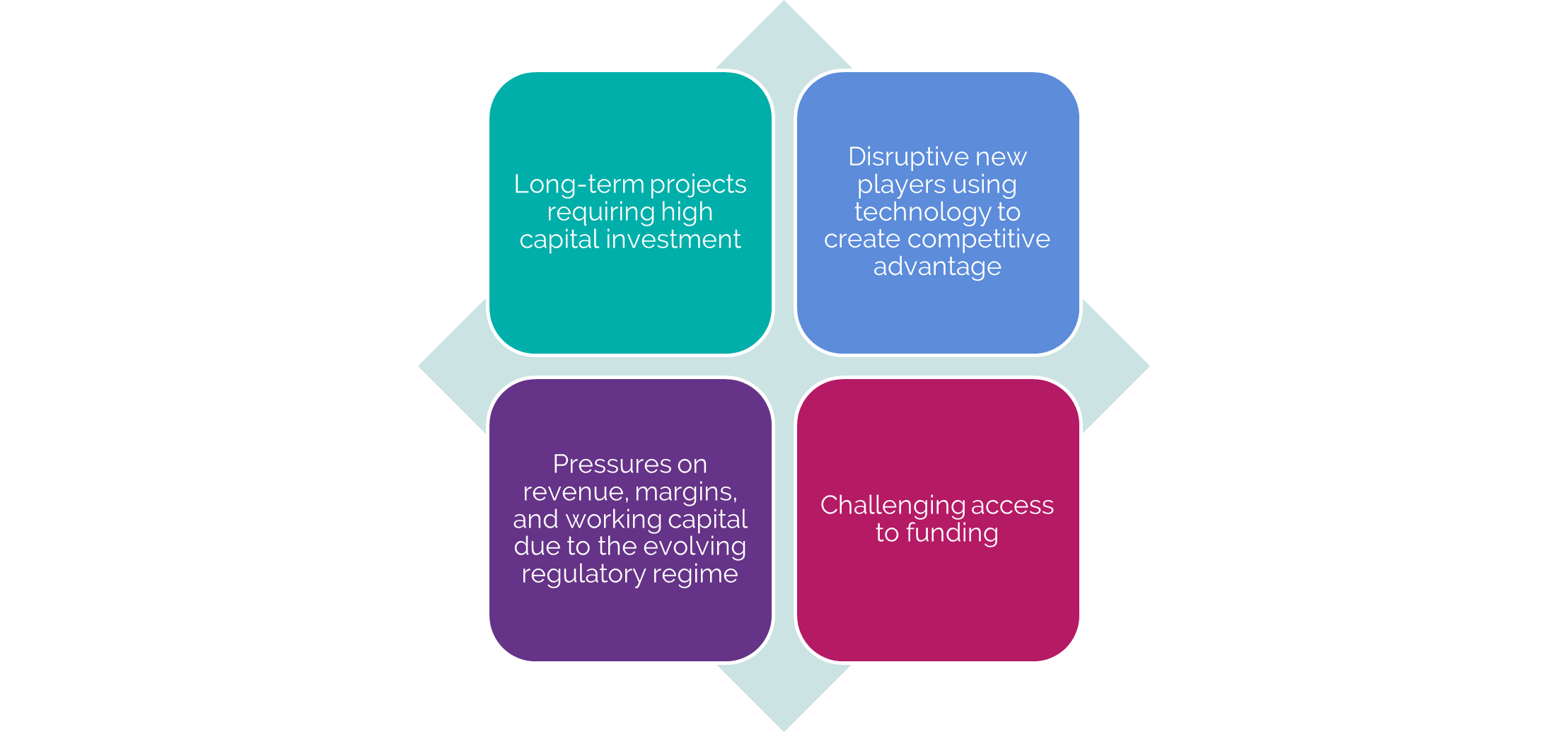

Challenges for new entrants

Despite increasing demand for energy, being a new entrant to the market is not easy. Industry new entrants face major challenges, and an uncertain investment and market landscape.

These challenges include;

“Cash is king” could not be more apt for any capital-intensive projects that requires medium and long-term investment.

New entrants are likely to be considered as being high-risk. They will be reliant on appropriate levels of finance as they seek to operationalise in the face of uncertainty. Project delays in the pre-income phase could mean having to consider additional sources of funding which may not be readily available given the perceived project risks.

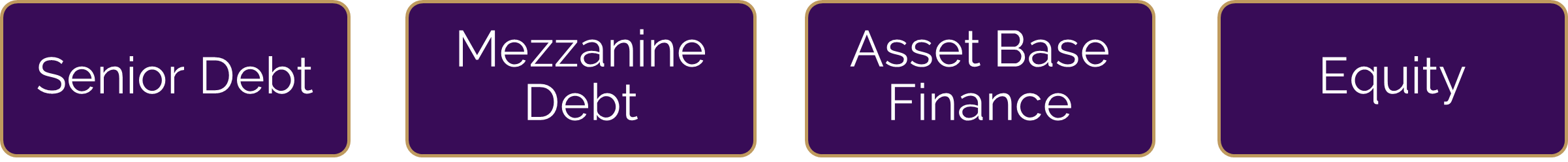

Funding types

During the pre-operational phase, new entrants funding options can carry a cost premium commensurate with its perceived risk profile. As projects advance and, where there is increasing confidence around financial forecasts, other sources of funding are likely to become available.

The most common sources of funding are considered to be:

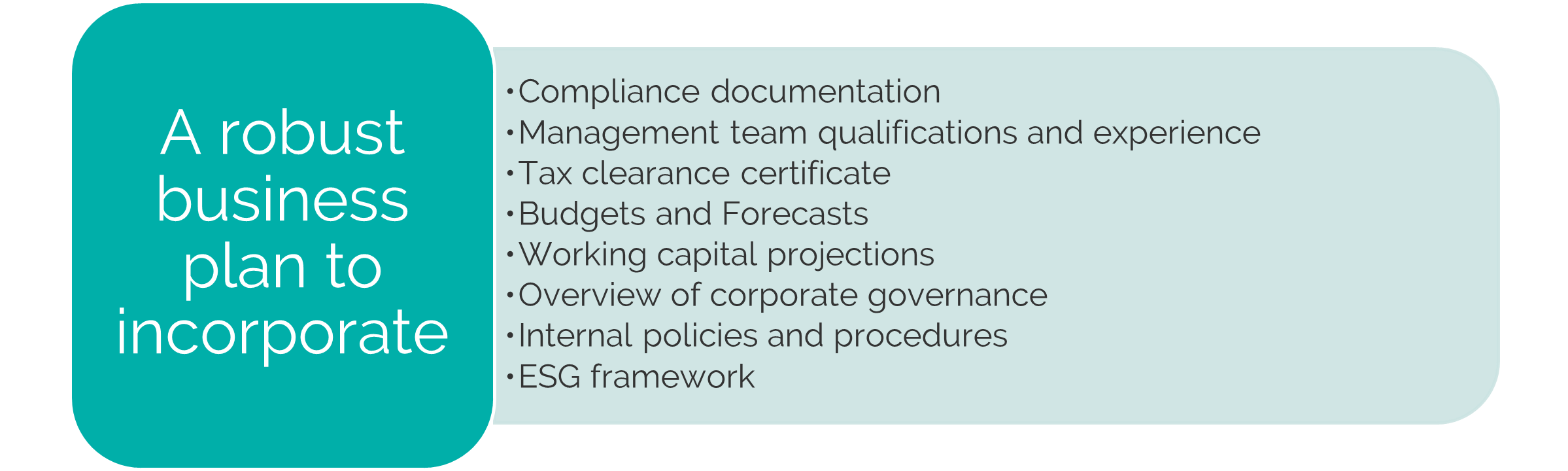

Funding requirements

Regardless of the type of funding, all investors and lenders aim to mitigate their risks and maximise their returns. The list below are examples of the type of documentation that may be required by investors and lenders.

The team at Evelyn Partners provides consultancy services to ensure that all of the above requirements are professionally delivered.

Preparing for funding

Specific funding activities are commonly supported by advisory and legal professionals who play a key role in obtaining the right funding at the right cost.

Gathering and preparing the information required by investors and lenders can be challenging and time consuming. Early-stage business may have difficulty in attracting talent with the right experience at the right cost. Using advisors like Evelyn Partners can provide cost effective professional support during this phase. It is normal that the funding process would require a multi-disciplinary approach involving finance and legal professionals.

We have experienced a move by startup companies in this sector to outsource bookkeeping, accounting, tax, company secretarial and related compliance activities while they build scale.

Engaging expert advisors at an early stage is key when seeking funding.

Con Casey

Partner – Head of Energy, Renewables and Natural Resources

Evelyn Partners has a deep knowledge of the operational and financial challenges that impact the Energy, Renewables and Natural Resources sector. Through Partner-led delivery and a team of dedicated sector experts across Ireland and the UK, advising on and dealing with the financial aspects of businesses, enabling the promotors to focus on operational challenges.

Our solutions include; Turnkey Business Outsource Services; Funding Advisory; IPO Advisory; M&A; Tax Consulting and wider business consulting services