IFRS 16: All change for lease accounting – are you ready?

IFRS 16 is fully effective for accounting periods beginning on or after 1 January 2019 and brings about significant changes for lessee accounting.

IFRS 16 is fully effective for accounting periods beginning on or after 1 January 2019 and brings about significant changes for lessee accounting.

IFRS 16 is fully effective for accounting periods beginning on or after 1 January 2019 and brings about significant changes for lessee accounting.

Most companies use leases of some form, particularly property and retail space, as they can be a useful financing arrangement; providing business with access to use of assets without the initial capital outlay.

The changes being brought in by the new leasing standard will change the way in which companies that report under IFRS, account for assets held under lease contracts.

There is now a single lessee accounting model (effectively a finance lease model) requiring lessees to recognise assets and liabilities for all leases regardless of whether they were previously classified as operating or finance leases.

The requirements of the new standard are designed to eliminate virtually all off balance sheet accounting for lessees and will change the way in which financial KPIs, such as gearing, EBITDA and operating cash flow, are measured.

Whilst this may improve comparability, there is likely to be an impact on covenants, credit ratings and possibly borrowing costs. It is important for companies to understand the impact and engage with their shareholders and other stakeholders.

The changes are significant and the impact of these rules is expected to be substantial particularly to companies that rent property or retail space. To meet the new requirements, companies will need to review their business processes to ensure that they are able to access the required information and detail needed.

The new standard sets out a comprehensive model for the identification of lease arrangements and their financial treatment for both lessees and lessors.

Lessor accounting is, in fact, largely unchanged. However, lessees will now be required to recognise nearly all leases on the balance sheet which reflects their right to use an asset for a period of time and an associated liability for payments.

At a high level, the impact of recognising an asset and liability is such that the allocation of costs in the income statement will change from a single rent expense and replaced by depreciation of the asset plus the finance costs linked to the liability. This results in a front-loaded expense profile, decreased earnings and equity immediately after entering into a lease compared to an operating lease profile.

Under the new standard, the definition of a lease is driven by the question of which party to the contract controls the use of the underlying asset for the period of use. There are a number of factors, which may indicate control. Getting this assessment right is critical as it underpins the future accounting for the arrangement.

As a consequence, where current contracts meet the new definition of a lease, they will effectively be treated as finance leases.

There are additional exemptions (e.g. for short life (<12 months) and/or low value leases) and remain off-balance sheet.

The right to use the lease asset has a value to the business and should be recognised on the balance sheet reflecting the lessee’s right to use the leased asset for the lease term. This is classified as a Right of Use (ROU) asset.

A corresponding lease liability should also be recognised to reflect the obligation to make future lease payments.

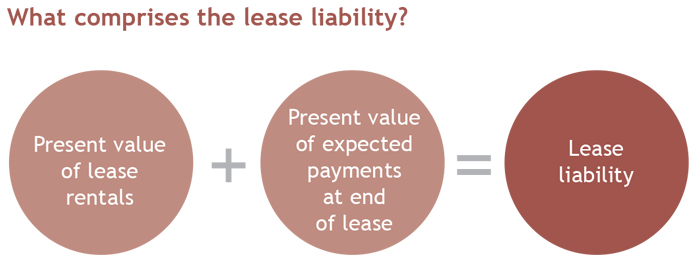

i) Lease liability

The lease liability is initially calculated as the present value of the lease payments over the lease term.

A key factor in the initial calculation of the lease liability is determining which future payments to the lessor should and should not be included. This often depends significantly on what is assessed as being the lease term.

The lease term is the non-cancellable period of a lease along with periods covered by an option to extend the lease if the lessee is reasonably certain to exercise that option and periods covered by an option to terminate the lease if the lessee is reasonably certain not to exercise that option. The use of judgement will be required to assess what is ‘reasonably certain’.

The lease payments shown as a liability are those that are not yet paid at the commencement date, with any prepaid amounts excluded. There are a range of payments to consider.

Fixed payments (and those that are in-substance fixed payments less any lease incentives receivable) need to be shown. These might include payments that must be made only if the asset is proved to be capable of operating.

Variable lease payments that depend on an index or rate, initially measured using the index or rate at the commencement date should be included.

There may be amounts expected to be paid by the lessee under residual value guarantees which capture any kind of guarantee made to the lessor that the underlying asset will have a minimum value at the end of the lease term.

The two remaining areas to consider would be the exercise price of a purchase option if the lessee is reasonably certain to exercise that option; and finally, payments of penalties for terminating the lease if the break clause is used in determining the lease term.

Calculating the present value

The discount rate that should be used to calculate the present value is the rate implicit in the lease, effectively the investor’s IRR, or if this cannot be readily determined, then the lessee’s incremental borrowing rate for a similar loan over a similar term and security to obtain an asset of similar value to the ROU asset. Thus, calculating an appropriate discount rate is complex and involves significant judgement. It can have a significant impact on the liability that ends up on the balance sheet and this is an area that is likely to draw challenge from auditors.

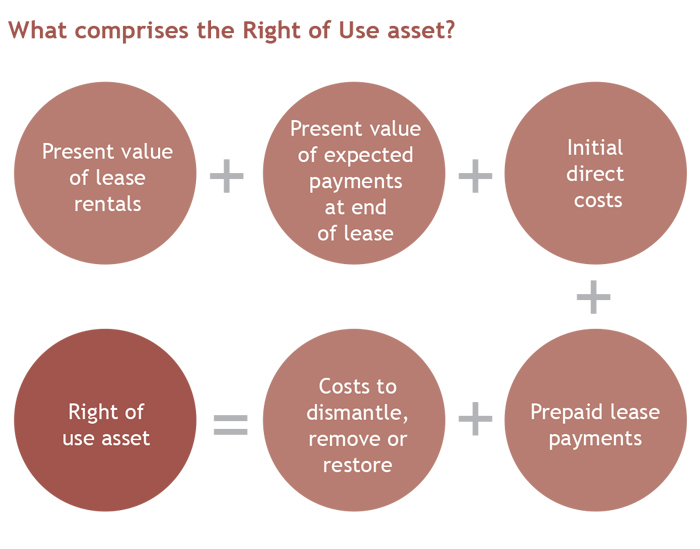

ii) Right of Use asset

The ROU asset is initially calculated with reference to all future payments due under the lease agreement (such as the lease liability, lease payments made in advance of the commencement date, less any lease incentives already received, initial direct costs and estimated cost of dismantling, etc).

After initial recognition, the ROU asset is either depreciated or revalued annually depending on whether the entity is applying the Cost or Revaluation model within IAS 16. At each reporting date, it will also be necessary to consider whether there are any indicators of impairment and apply the rules within IAS 36.

Lease liabilities increase for the effective interest rate and reduce for payments made.

Changes and modifications to the leased asset will require detailed consideration as these may trigger adjustments to both the lease liability and ROU asset or even require recognition of a separate asset and liability.

Lessees are permitted to choose either a full or a modified retrospective transition approach for leases existing at the date of transition. Under the modified approach, a number of transition reliefs are available to simplify the accounting and burden in the year of initial application. Careful assessment of existing lease arrangements and understanding of the transition options available is required.

The changes to the accounting treatment of leases also brings about significant tax implications, requiring complex analysis and parallel lease data.

This is particularly driven by the nature of the changes to the nature of the amounts hitting the P&L, i.e. depreciation of a ROU asset and finance costs will replace the historical rental costs of assets held under a traditional operating lease and the related transitional adjustments.

The key points to consider include:

Any transitional adjustment taken through equity will not be immediately tax deductible, but instead will be spread over the weighted average remaining life of the leases. This is a complex spreading calculation that requires a considerable amount of data and is likely to affect the not only the company’s deferred tax position, but also the current tax position over a number of years.

As noted above, the accounting changes will result in depreciation and interest expenses being taken through the profit and loss statement instead of historical rental expenses. However, these depreciation and interest expenses will be tax deductible in the same way as for finance leases.

Companies will have an increased interest expense under the new accounting rules. However, for Corporate Interest Restriction (CIR) purposes the financial costs incurred in relation to new and existing leases that would have been classified as operating leases under the old rules, will continue to be excluded from the qualifying finance costs. Unfortunately, operating lease accounting data will no longer be required under IFRS and a separate tax-only calculation will therefore need to be retained, tracking the associated finance cost that can be stripped out of the total interest expense.

Capital allowances will still be available for long funding leases, but a new test for finance leases has been introduced. The amount of capital allowances available has also changed; they are now based on the present value of the minimum lease payments remaining and therefore complex calculations may need to be performed. The tax treatment of existing long funding leases will not change.

The recognition of deferred tax should be considered for groups that apply IFRS in their consolidated accounts but have not adopted IFRS in company-only or subsidiary accounts. These groups will have to annually adjust for the difference in lease accounting between the non-IFRS standards and IFRS 16.

We recommend that anyone that utilises asset held under lease arrangements considers the possible accounting and tax implications as soon as possible to understand the impact that could be material to the business.

Engage with advisors to understand how the application of the new standard will affect you and understand the transition options available to you.

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

This article was previously published on Smith & Williamson prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.