Macro conditions could provide a winning formula for value-related stocks

Any Formula One driver with an instinct for self-preservation recognises the need to understand the weather conditions of the road before hurtling off down the track. It’s no use being a great driver if you’re using the wrong tyres in the rain. It is not dissimilar for the average fund manager, they need to understand the investment track before they can decide how fast to drive.

Any Formula One driver with an instinct for self-preservation recognises the need to understand the weather conditions of the road before hurtling off down the track. It’s no use being a great driver if you’re using the wrong tyres in the rain. It is not dissimilar for the average fund manager, they need to understand the investment track before they can decide how fast to drive.

Given the myriad risks facing investors, from elevated inflation to slowing growth and rising interest rates, coupled with geopolitical uncertainty, we believe asset managers should be cognizant of the macro conditions. That probably means tilting a portfolio towards value-style stocks, which generally include energy, materials and financial companies. Equities in these sectors tend to do well when an economy moves towards a more inflationary environment – see our recent piece, What works when? The impact of changes in growth and inflation on equities, 7 April 2022.

We believe taking this approach makes more sense than opting for predominantly growth-style portfolios, which would encompass areas such as information technology, consumer discretionary and communication services sectors. These growth areas of the market typically perform better in a low inflation and low interest rate environment.

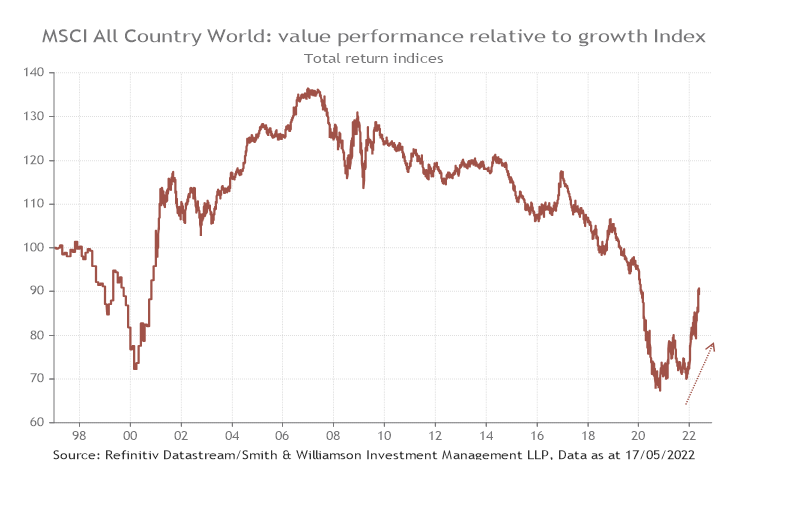

Investors are slowly coming round to the idea of holding previously unloved value stocks. Year-to-date, the MSCI All Country value index has gained 3% in GBP total return terms, materially outperforming a 17% decline seen in the growth index1. Nevertheless, value still has some way to go to catch up with its previous peak against growth in late 2006.

Opportunities in value-related stocks

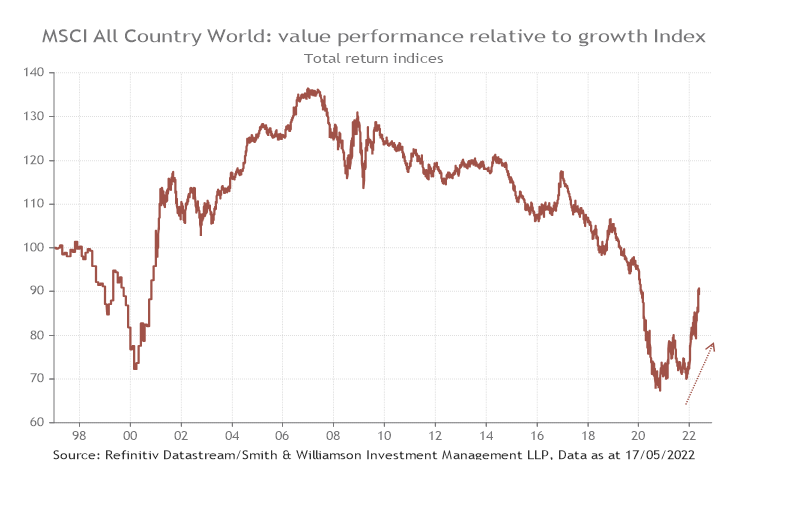

We screened several macroeconomic indicators to determine what has driven the fundamental relative performance of value and growth styles since the Global Financial Crisis in 2008. Our findings show that the crude oil price, the global manufacturing Purchasing Managers Index (a proxy of world growth), the US yield curve and US dollar explain around 70% of relative performance for these two investment styles over this period2. Given that energy prices are holding up, the global economy has been expanding and the yield curve is steepening (a signal for improving growth prospects – see Is the yield curve signalling recession?, 4 May 2022), it appears the fundamental drivers generally support value-style stocks, with only the recent strengthening in the US dollar acting as a drag.

In terms of quantifying how much value stocks could outperform growth, we mapped the four macro indicators described above against the value over growth index to establish a ‘fitted’ model and compared it with the actual performance of these investment styles. As it stands the actual price of the value/growth equity index is 32% below the fitted model3. Assuming the model relationship still holds, this creates a fundamental opportunity for investors to tilt somewhat towards value-style stocks.

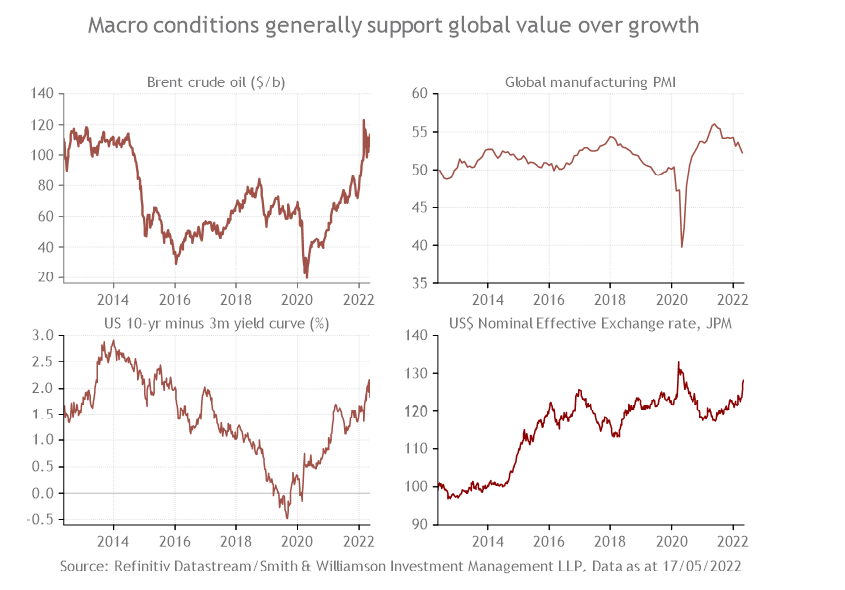

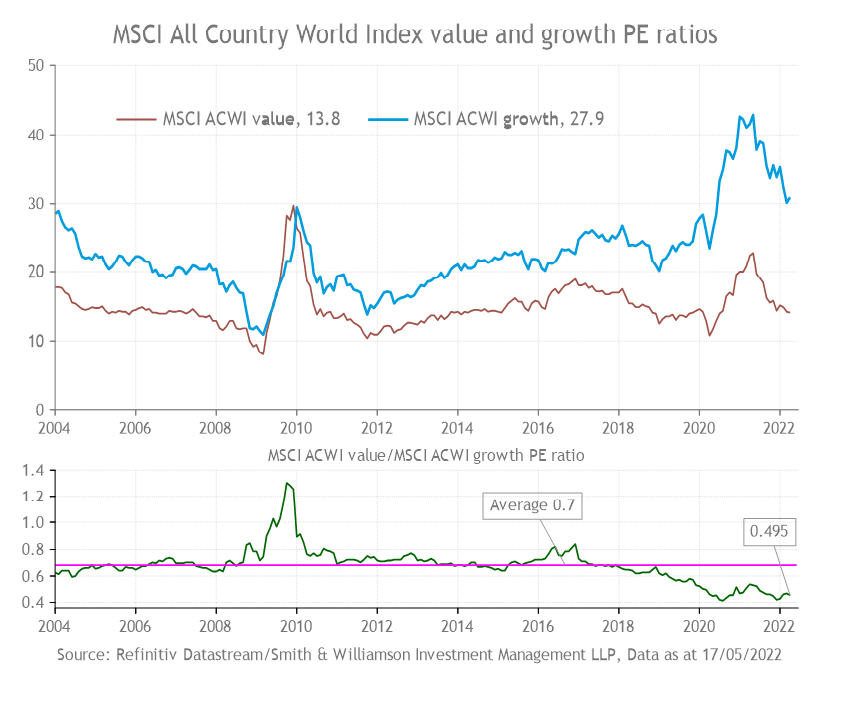

Aside from the fundamental drivers, another consideration for investors is that the growth parts of the market can arguably entail more risk than value in a rising interest environment. As interest rates rise, growth stock valuations can be expected to fall. That’s because growth stocks, which typically have long-term cash flow horizons compared to value companies, will see their earnings stream worth less in present value terms.

It really should not be a surprise that rising interest rates are helping a rotation from growth areas of the market to value-style stocks. This rotation creates market volatility (a measure of risk), particularly for growth stocks: the current 30-day volatility of MSCI All Country World growth index is 26%, as compared to 16% for the equivalent value benchmark4. Investors are recognising that owning growth stocks can come with higher risk.

Finally, over the very long term, value tends to outperform growth. The strength of growth companies is a relatively recent phenomenon, evident since 2007 when monetary policy changed in response to the global financial crisis. It has been significant and the valuation gap between growth and value stocks remains wider than historical averages. For example, the price-to-earnings ratio for value stocks is 13.8 times, roughly half the ratio for growth equities5. There is scope for this to close over the next few months, and particularly as interest rates rise.

Overall, investors need to consider the investment environment has changed. This means adopting a more cautious approach and reducing portfolio exposure to rate sensitive stocks, such as those characterised as ‘growth’ companies. In this environment, it makes more sense to navigate the investment track like Morgan Freeman in Driving Miss Daisy than hurtling around like Lewis Hamilton!

Sources

1,4,5 Refinitiv, 17 May 2022

2,3 Tilney Smith and Williamson, 17 May 2022

Important information

This document is solely for information purposes and is not intended to be, and should not be construed as investment advice. Whilst considerable care has been taken to ensure the information contained within this commentary is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information. The opinions expressed are made in good faith, but are subject to change without notice.

You should always remember that the value of investments can go down as well as up and you can get back less than you originally invested. Past performance is not an indication of future performance.

Smith & Williamson Investment Management LLP

Authorised and regulated by the Financial Conduct Authority

Smith & Williamson Investment Management LLP is part of the Tilney Smith & Williamson group.

© Tilney Smith & Williamson Limited 2022

Ref. 220510400

Disclaimer

This article was previously published on Smith & Williamson prior to the launch of Evelyn Partners.