Markets quiet ahead of Central bank activity – weekly update 19 March

Markets quiet ahead of Central bank activity – weekly update 19 March

A look back over macroeconomic and market events for the week ending 16 March 2018. Markets were generally fairly quiet ahead of the Central bank activity this week. US data were mixed, whilst the Chinese data surprised to the upside, but still marked a clear multi-year slowdown. Markets are expecting another rate hike from the US Federal Reserve this week, but the latest forecasts will be of more interest, along with whether the median dot moves from 3 to 4 hikes for 2018.

Mixed US economic data

US economic data were mixed once again. CPI inflation came in as expected with a marginal 0.1% increase to 2.2% year on year (yoy) causing minimal market impact. The slight fall in Treasury yields seemed more driven by the coincidental news that Secretary of State, Rex Tillerson, was being replaced.

Retail Sales also failed to pick up once again, falling -0.1% month on month (mom) against hopes for 0.3% growth. Although the previous month was revised up (from -0.3% to -0.1%), this marks the third consecutive contractionary reading, raising questions about the health of the US consumer. We will have to see whether tax breaks start filtering through to the end consumer or whether, like the UK, they are becoming tapped out.

There was better news from US industrial production, which rebounded from a revised down January slump of -0.3% mom to 1.1% growth in February (0.4% was expected). This translates to a bumper 4.4% yoy level, the fastest since 2011 with capacity utilisation rising to 78.1%. These data should allow the Federal Reserve to continue its path of gradually tightening policy, without adding pressure to accelerate.

Chinese data came in ahead of expectations

The latest batch of data from China came in broadly ahead of expectations, but still point to a slowing trend. The data no doubt cheered China’s leadership at the annual National People’s Congress, showing China had a decent start to the year despite wider tensions.

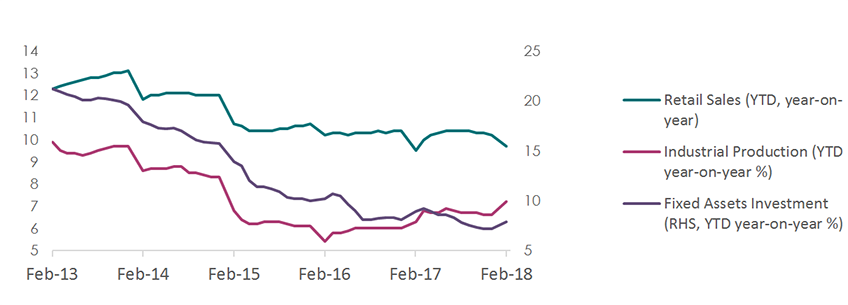

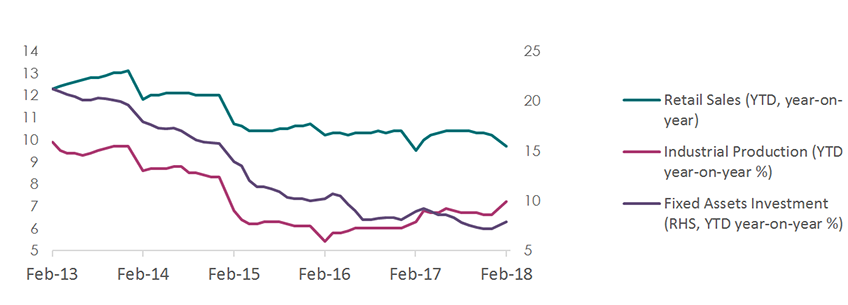

Year-to-date industrial production defied forecasts for a fall, instead rising from 6.6% to 7.2% yoy (6.2% expected) whilst fixed-asset investment accelerated to 7.9% growth from 7.2% (7.0% was forecast). The only main data to buck the trend were Retail Sales which rose 9.7% yoy, from 10.2% (9.8% forecast).

In the short term, beating expectations is likely to be taken as a positive, but these small beats are in contrast to a multi-year slowdown (see chart below). They come as Chinese authorities appear to be meaningfully cracking down on excess debt and trade relations with the US are deteriorating.

Chinese economic data

Last week’s other events

- US real average weekly earnings increased from 0.4% to 0.6% yoy growth in February, and business inventories rose 0.6% in January (as expected, from 0.4%). Import prices increased 0.4% mom (from 1.0%, 0.2% expected) and export prices rose 0.2% (from 0.8%, 0.3% expected)

- Japan saw core machine orders increase 2.9% yoy in January (from -5.0%, -0.7% expected), with machine tool orders growth slowing from 48.8% to 39.5% yoy

- Eurozone industrial production slipped from 5.2% to 2.7% yoy growth (4.4% expected)

The markets

It was a subdued week for major markets with investors seeming to pause before this week’s Central bank activity.

Equities

European equities (MSCI Europe ex-UK) were flat, whilst UK equities slipped -0.9% (MSCI United Kingdom) and the US fell -1.2% (S&P 500). Japan bucked the trend, with 1.2% growth (as measured by the TOPIX) and the MSCI emerging markets index returned 0.7%.

Bonds

UK 10-year gilt yields were down 6 basis points (bps) to 1.43%. The equivalent US Treasury yields were down 5 bps to 2.84% and 10-year German bund yields fell 8 bps to 0.57%.

Commodities

Brent crude oil rose slightly to US$66.21 per barrel, and gold was slightly weaker to US$1,314.24 per ounce. Copper was fractionally down to US$3.09 per lb.

Currencies

Sterling was stronger on the week with the Japanese yen being the other main booster on the week. Sterling finished at US$1.39, €1.13 and ¥148 on Friday.

The week ahead

There is plenty more excitement due this week and the centrepiece should be the conclusion of the Federal Open Market Committee (FOMC) meeting on Wednesday. It is not only expected to come with an interest rate hike (higher than 99% probability as at the close on Friday), but will also see the latest forecasts from committee members and the first press conference for the new Federal Reserve chairman. The Bank of England (BoE) Monetary Policy Committee (MPC) meeting concludes on Thursday, though this could be more of a sideshow with no change expected. Elsewhere, there is quite a lot of output from the UK, including UK CPI inflation on Tuesday. It is expected to have slowed from 3.0% to 2.8% yoy with a similar move in core CPI from 2.7% to 2.5%. Then, average weekly earnings numbers on Wednesday (2.6% from 2.5% expected) and Retail Sales on Thursday (a slowdown from 1.6% to 1.4% is expected). We also have PMI numbers from the US, Eurozone and Japan through the week and on Friday, the US gives us Durable Goods (a rebound from -3.6% to 1.7% mom is expected). The daily breakdown is as follows:

Monday: UK house prices from Rightmove are reported early in the morning, then in the afternoon readings for the Eurozone’s trade balance and construction output are released.

Tuesday: UK CPI inflation is out at 9:30 and the reading, along with the associated inflation measures, are the main data of note for the day. The only other release of note is the ZEW survey of Eurozone business sentiment released later in the day.

Wednesday: UK data in the morning will see average weekly earnings as well as unemployment, jobless claims and public sector net borrowing. Ahead of the FOMC decision in the evening, the US will also release Mortgage Banks of America mortgage applications and existing homes sales data.

Thursday: Early in the morning, Japan will release manufacturing PMI numbers, followed by the all-industries activity index and store sales data. Later we will have Eurozone PMI numbers ahead of the UK’s Retail Sales figures. After the BoE monetary policy decision, the US reports PMI readings from Markit before Japan updates the latest CPI numbers just before midnight UK time.

Friday: The only notable release is the US Durable Goods Orders, though Friday also marks the latest deadline for the US to avoid another government shutdown.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.