Why now is the time to prepare for DORA

The Digital Operational Resilience Act (DORA) outlines the EU’s regulatory approach to improving digital operational resilience within the European Union's financial sector.

The Digital Operational Resilience Act (DORA) outlines the EU’s regulatory approach to improving digital operational resilience within the European Union's financial sector.

Endorsed in the Official Journal of the European Union on December 27, 2022, DORA comprises a regulation and three directives.

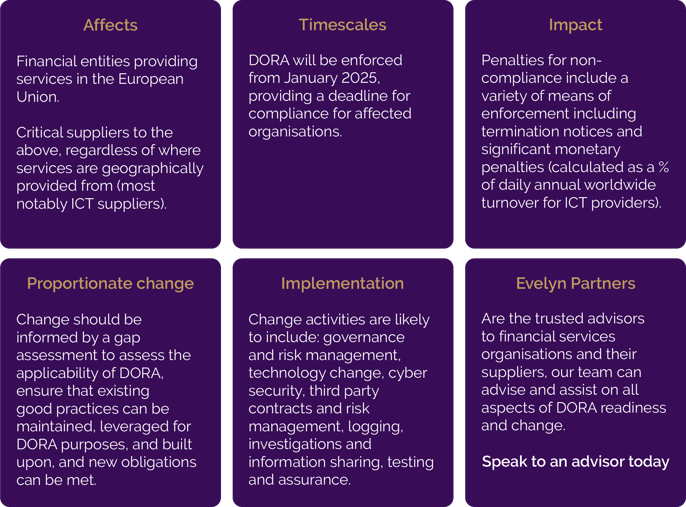

Financial entities and ICT Suppliers supporting financial organisations have until mid-January 2025 to achieve compliance.

DORA’s jurisdiction is EU-wide. It covers not only financial services entities operating in Europe but also providers of ICT services to the European Financial Sector, regardless of where services are provided from. A full list of financial entities subject to DORA can be found here.

It isn’t yet clear whether the UK will mirror the EU’s approach to Digital Operational resilience. Many financial organisations operating domestically will already be subject to the PRA’s supervisory statement SS1/21 (Impact tolerances for important business services).

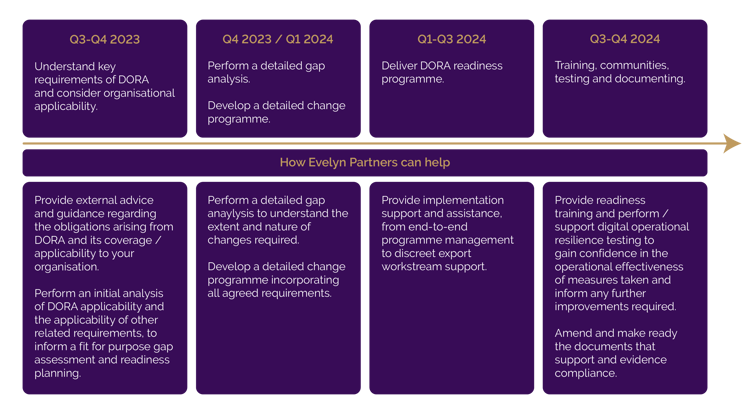

If you feel your preparation for DORA is not on track, there is still time to get ready if you act now.

Requirements and obligations arising from DORA include those relating to:

We expect that many organisations will need to incorporate elements of the following into their change and readiness programmes:

For all of the above, as well as providers of ICT services to the financial sector, it should be noted that DORA introduces obligations over contractual arrangements between financial entities and ICT third-party service providers as well as rules for an oversight framework for critical ICT third-party service providers that provide services to financial entities.

Approval reference 23119399

Whilst considerable care has been taken to ensure the information contained within this document is accurate and up to date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.