Evelyn Partners delivered record inflows, AUMA and operating income in 2023

Evelyn Partners today announces a trading update for the three months ended 31 December 2023. During Q4 the Group continued to attract significant inflows of new client assets, and benefitted from rising markets, resulting in record assets under management and advice (AUMA) of £59.1 billion at the end the quarter.

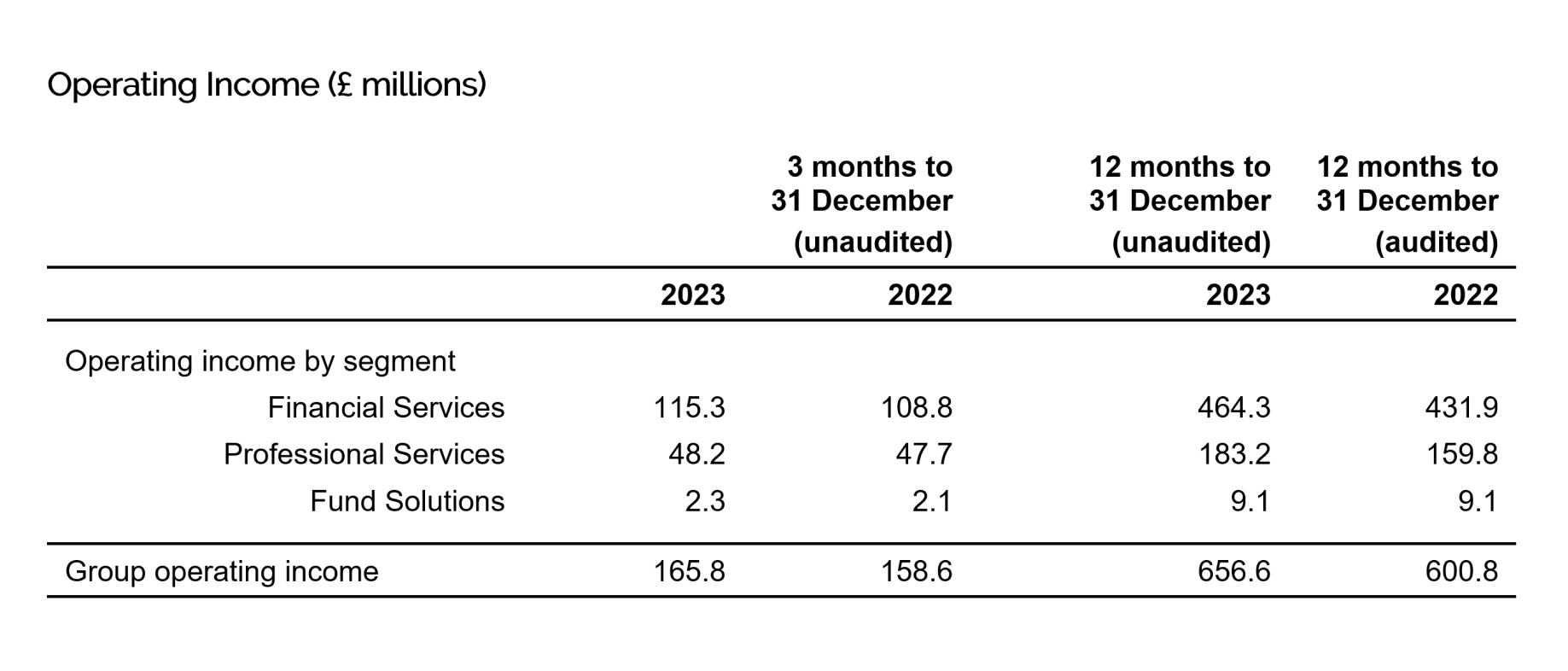

Evelyn Partners today announces a trading update for the three months ended 31 December 2023. During Q4 the Group continued to attract significant inflows of new client assets, and benefitted from rising markets, resulting in record assets under management and advice (AUMA) of £59.1 billion at the end the quarter. In the full year ended 31 December 2023 both the Group’s Financial Services and Professional Services businesses grew their operating income, driving Group operating income 9.3% higher to £656.6 million (2022: £600.8 million).

Financial Services Highlights

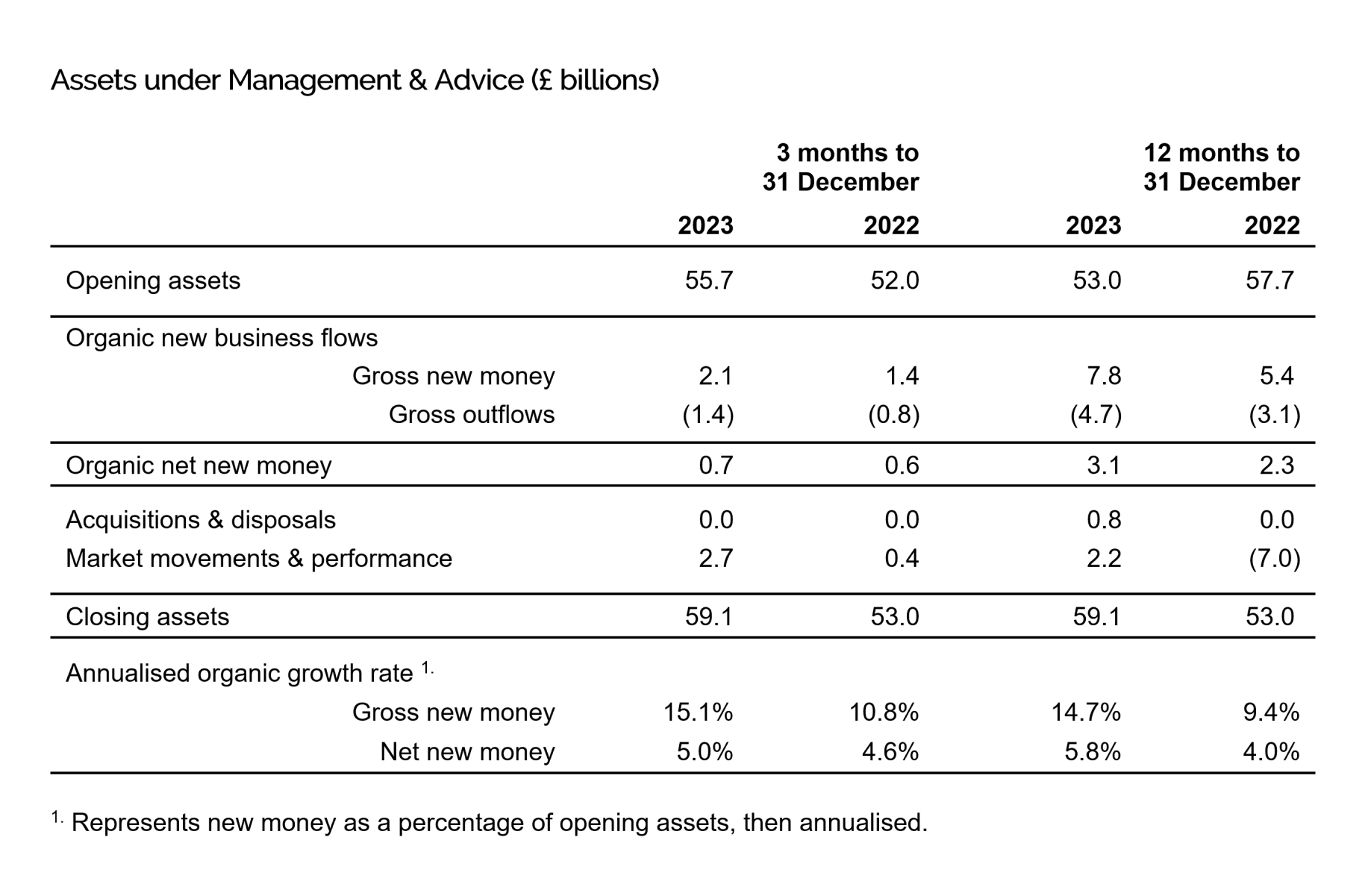

- Gross inflows of £2.1 billion in Q4 were 50.0% higher than the same quarter last year (Q4 2022: £1.4 billion) and equivalent to an annualised growth rate of 15.1% based on opening assets. For the 12-months ended 31 December 2023, the business achieved record gross inflows of £7.8 billion (2022: £5.4 billion).

- Net inflows increased to £0.7 billion in Q4 (Q4 2022: £0.6 billion), equivalent to an annualised growth rate of 5.0% based on opening assets. On a full-year basis, net inflows in 2023 were a record £3.1 billion (2022: £2.3 billion), a growth rate of 5.8% based on opening assets.

- The combination of strong net inflows of new assets and positive market movements in Q4 increased AUMA to £59.1 billion at the end of December 2023 (31 December 2022: £53.0 billion).

- Financial Services contribution to operating income was £115.3 million in Q4 (Q4 2022: £108.8 million) and on a full-year basis was £464.3 million (2022: £431.9 million).

Professional Services Highlights

- Professional Services operating income was £48.2 million in Q4 (Q4 2022: £47.7 million) and on a full-year basis increased 14.6% to £183.2 million (2022: £159.8 million).

- During Q4 the acquisitions of accountancy and tax advisory firms Creaseys and Harwood Hutton completed.

Paul Geddes, Group Chief Executive Officer, commented:

“We ended 2023 with a strong quarter, driven by rising markets and continued sizeable inflows of new client money which together increased our assets under management and advice by 6.1% to a record £59.1 billion at year end. Market movements added £2.7 billion to AUMA in Q4 and we also saw £2.1 billion of gross inflows in the quarter which, alongside Q2, was our joint best quarter since the merger of Tilney and Smith & Williamson in 2020. On a net flow basis, we delivered £0.7 billion of inflows.

“For the full year, we saw strong demand for our services and expertise during what was an undoubted time of uncertainty for the economy and markets, as well as a period where the tax burden increased. This demonstrates the value clients place on our services and the strengths of our two core businesses, Financial Services and Professional Services, in their respective markets.

“In our Financial Services business, we generated gross inflows of £7.8 billion and net inflows of £3.1 billion during 2023, both of which were record levels for the Group. Our focus here is to offer more of our clients, where it is appropriate for them, the option of being supported by both a financial planner and investment manager working together to provide a holistic wealth management service. Alongside this, we have also been making great progress growing our presence working as a trusted provider of investment services to IFAs.

“Our fast-growing Professional Services business had a good fourth quarter and registered another excellent year. Its full year operating income increased 14.6% to £183.2 million (2022: £159.8 million). Alongside strong organic growth in 2023, we also acquired four accountancy and tax advisory firms as part of our strategy of building out the regional presence of our Professional Services business. In Q4 this included the acquisitions of Creaseys in Tunbridge Wells and Harwood Hutton in Beaconsfield, both of which are now completed.

“While the economic outlook remains weak, the headwinds of last year are easing as inflation subsides and interest rate cuts are on the horizon. This should support both improved confidence from clients and the markets during 2024. Evelyn Partners has already performed well in tough market conditions and is well-positioned to benefit from improving sentiment given the strength and breadth of our propositions and the quality of our people. I would like to thank everyone at Evelyn Partners for achieving strong growth in assets and income in 2023 and for their ongoing dedication to our clients.”

About Evelyn Partners

Evelyn Partners is the UK’s leading integrated wealth management and professional services group, created following the merger of Tilney and Smith & Williamson in 2020. With £59.1 billion of assets under management (as at 31 December 2023), we are one of the largest UK wealth managers ranked by client assets and the seventh largest accountancy firm by ranked by Group fee income (source: Accountancy Age 50+50 rankings, 2023).

We have a network of offices in 30 towns and cities across the UK, the Republic of Ireland and the Channel Islands. Through our operating companies, we offer an extensive range of financial and professional services to individuals, family trusts, professional intermediaries, charities, and businesses.

Our purpose is to ‘place the power of good advice into more hands’, and we are uniquely well-placed to support clients with both their personal financial affairs and their business interests. Our personal wealth management services include financial planning, investment management, personal tax advice and, through Bestinvest, we have a multi award-winning online investment service for self-directed investors. For businesses, our wide range of services includes assurance and accounting, business tax advice, employee benefits, forensics

For further information please visit: www.evelyn.com