Evelyn Partners Group Limited Interim results for the six months ended 30 June 2023 (unaudited)

Evelyn Partners is pleased to announce its interim financial results (unaudited) for the six months ended 30 June 2023. During the period, the business delivered record growth in both gross and net new assets, increased operating income including excellent momentum in Professional Services fee growth, while continuing to progress its M&A strategy and innovating its service proposition to meet the evolving needs of clients.

Evelyn Partners Group Limited Interim results for the six months ended 30 June 2023 (unaudited)

Evelyn Partners is pleased to announce its interim financial results (unaudited) for the six months ended 30 June 2023. During the period, the business delivered record growth in both gross and net new assets, increased operating income including excellent momentum in Professional Services fee growth, while continuing to progress its M&A strategy and innovating its service proposition to meet the evolving needs of clients.

Financial Highlights

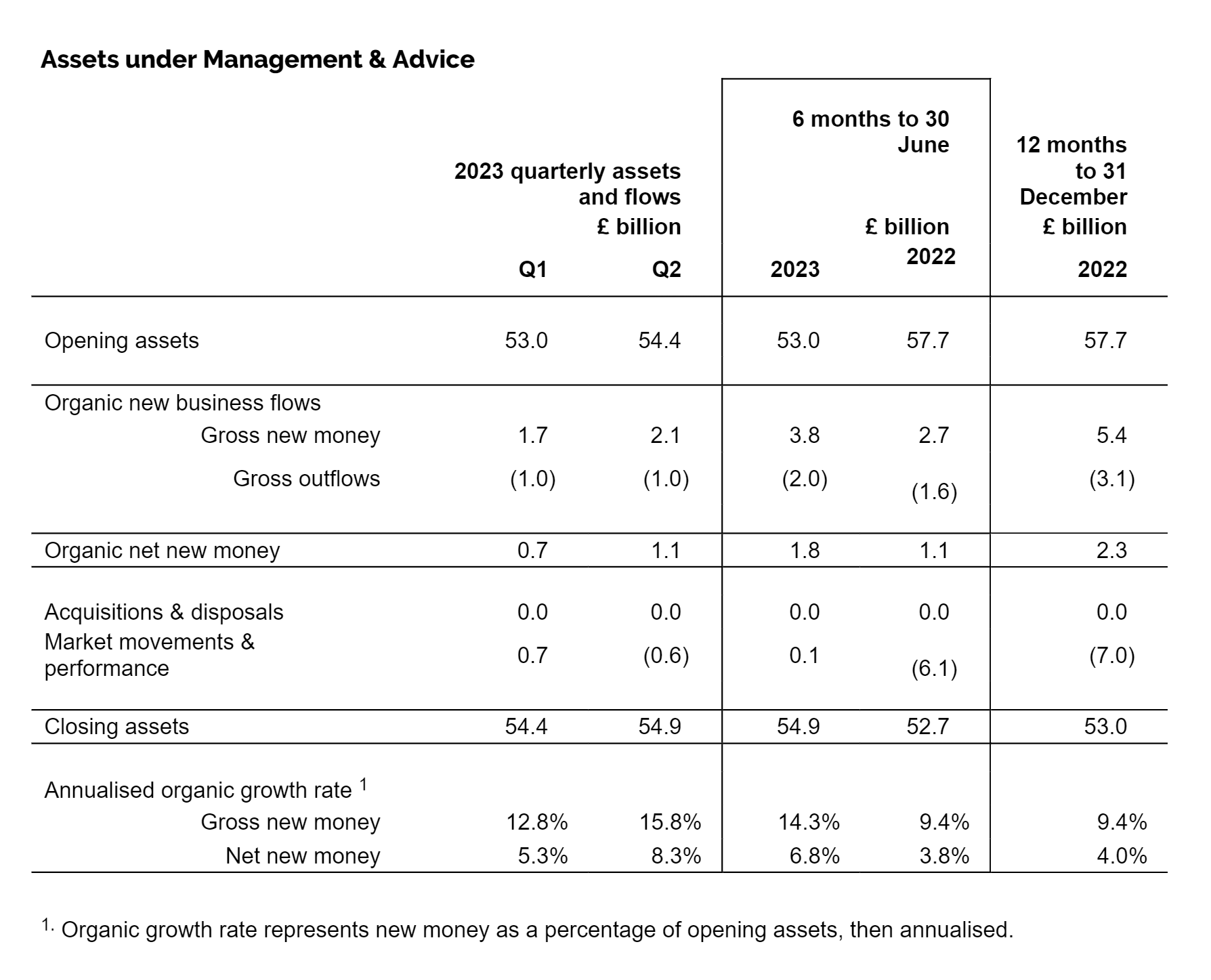

- Strong delivery on organic growth in H1: gross inflows of £3.8 billion were up 40.7% year-on-year (H1 2022: £2.7 billion) and net flows increased by 63.6% to £1.8 billion (H1 2022: £1.1 billion).

- H1 gross inflows were at an annualised growth rate of 14.3% (FY 2022: 9.4%) based on opening assets and net flows grew at an annualised rate of 6.8% (FY 2022: 4.0%).

- After a strong Q1, new business momentum gathered pace in Q2 resulting in a record quarter for new asset gathering with £2.1 billion of gross inflows and £1.1 billion of net inflows. Gross inflows in Q2 grew at an annualised rate of 15.8% and net flows at 8.3%.

- Strong growth in new business and positive market movements lifted assets under management and advice (AuMA) to £54.9 billion at 30 June (H1 2022: £52.7 billion).

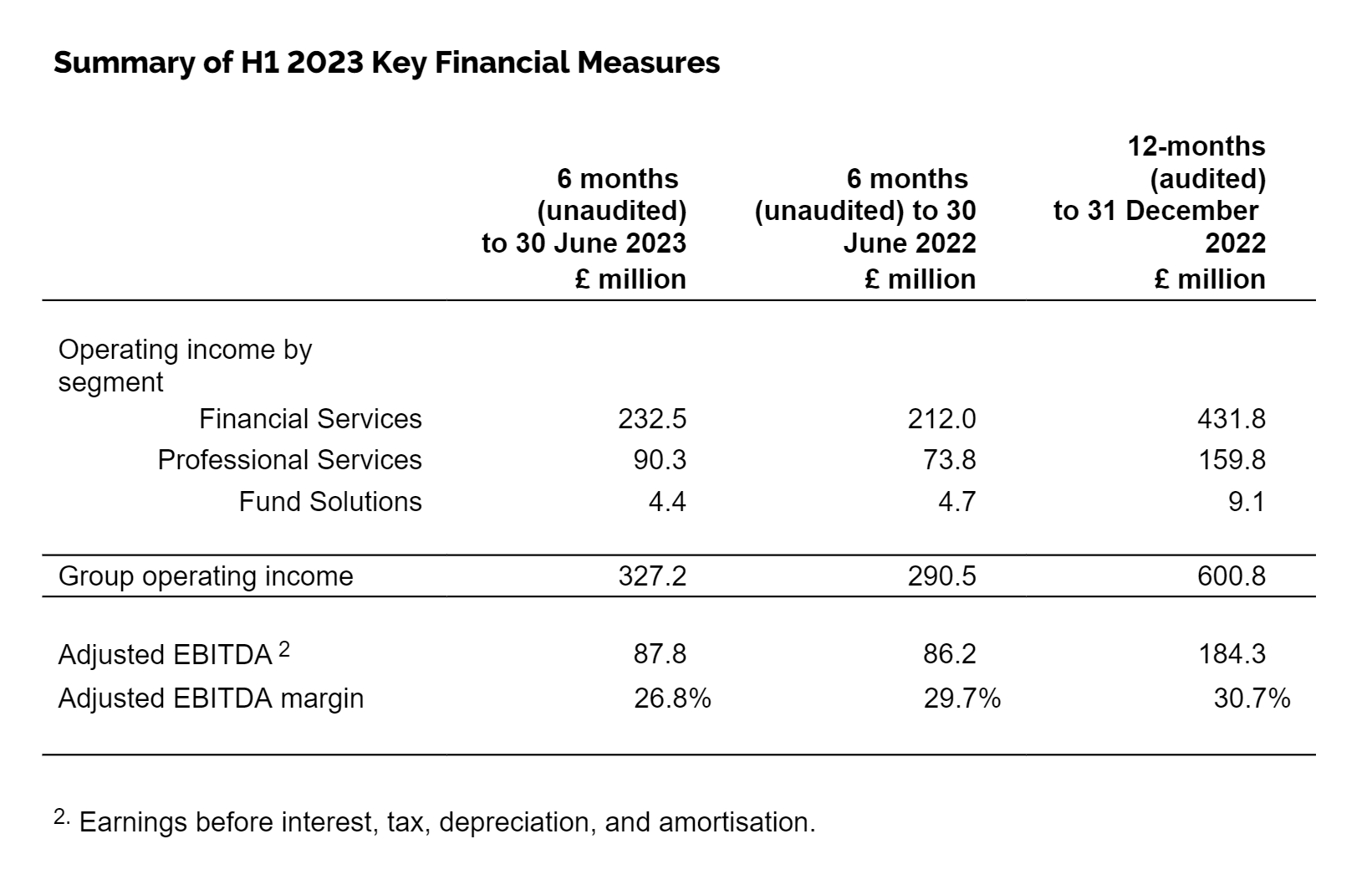

- Group operating income increased 12.6% to £327.2 million (H1 2022: £290.5 million), with 9.7% growth in Financial Services and 22.4% from Professional Services as clients continued to see the value of expert advice.

- Adjusted EBITDA1 increased to £87.8 million (H1 2022: £86.2 million), with adjusted EBITDA margin resilient in the context of higher average assets in H1 2022.

Strategic Highlights

- Strong focus on organic growth, helping clients navigate a higher tax environment through financial planning, private client and business tax services and maximising available allowances including ISAs and pensions.

- Continued progress made against Evelyn Partners M&A strategy with the completion of three Professional Services transactions and an agreement, subject to regulatory approval, to acquire boutique wealth manager Dart Capital. The addition of these businesses will bolster our regional presence and add complementary capabilities.

- Completed the ninth deal under our scheme for retiring owners of advice businesses, with the team from discretionary manager PPM Wealth joining our Glasgow office

- Launched Evelyn Partners Moneyhealth*, an innovative new service to enable employers to help staff improve their financial wellbeing, demonstrating Evelyn Partners’ ability to create solutions that leverage both our Financial Services expertise and Professional Services experience in developing corporate relationships.

- Announced in June 2023 that, subject to regulatory approval, Paul Geddes will succeed Chris Woodhouse as Group Chief Executive Officer.

Chris Woodhouse, Group Chief Executive, commented:

“Despite the continued challenges in the macro-environment of high inflation and rising borrowing costs, we had an excellent start to the year in delivering strong organic growth. We had a record quarter for new business in Q2, which followed a very strong Q1. Over the first half of the year, we delivered £3.8 billion of gross inflows, and on a net basis we saw inflows of £1.8 billion, demonstrating the value of the advice we provide. Net flows in the first half of the year were 63.6% higher than the same period last year and were at an annualised growth rate of 6.8% based on opening assets. Our strength in asset gathering reflects strong demand for our advice-led services, our growing presence as a partner for IFAs, and the quality and ambition of our people.

“We are building momentum across our business. Alongside growth in new client assets, operating income increased by 12.6%, with strong growth in both Financial Services and Professional Services.

“As part of our growth ambitions, we also continued to make progress augmenting organic growth with M&A. In the Professional Services business, we completed three transactions: the acquisitions of accountancy firms Leathers LLP and the Ashcroft Partnership LLP, as well as a deal which has seen a leading international disputes resolution team join our forensics department. In Financial Services, we announced the acquisition of Dart Capital, a high-quality boutique wealth management firm based in the City of London which, subject to FCA approval, is expected to complete within weeks.

“We also completed our ninth deal under our scheme to provide the owners of advice firms with a new home for their teams and clients ahead of their retirement. The most recent deal has seen the team from Glasgow-based investment managers PPM Wealth join us. We have a strong pipeline of potential deals under the scheme as we enter the second half of the year.

“In June we launched Evelyn Partners Moneyhealth*, an innovative financial wellbeing service to enable employers to provide their staff at all levels: from the new trainee through to senior management, with support to improve their personal finances. The service comprises a digital platform with tools, resources and open banking which is integrated with financial coaching. This is overlayed with executive consulting for the senior managers of subscribing organisations, providing them with access to our financial planners and tax experts. Amid the challenge of a cost-of-living crisis and changing tax landscape, it is an exciting new proposition for the corporate market which is very much consistent with our purpose of ‘placing the power of good advice into more hands’.

“As we announced on 9 June, I will shortly be retiring as CEO of Evelyn Partners and handing the baton over to Paul Geddes, who brings a wealth of experience as a business leader to the role. Paul joined the business as CEO designate at the start of July and we have been working closely on an orderly handover of responsibilities. It has been a huge privilege to have worked with so many talented people and to see the business develop and grow these last several years. Evelyn Partners has an unrivalled range of expertise and considerable growth opportunities ahead, and I wish Paul every success as he leads the Group through the next stage of its journey.”

* Further information on the launch of Evelyn Partners Moneyhealth is available here.

About Evelyn Partners

Evelyn Partners is the UK’s leading integrated wealth management and professional services group, created following the merger of Tilney and Smith & Williamson in 2020. With £59.1 billion of assets under management (as at 31 December 2023), we are one of the largest UK wealth managers ranked by client assets and the seventh largest accountancy firm by ranked by Group fee income (source: Accountancy Age 50+50 rankings, 2023).

We have a network of offices in 30 towns and cities across the UK, the Republic of Ireland and the Channel Islands. Through our operating companies, we offer an extensive range of financial and professional services to individuals, family trusts, professional intermediaries, charities, and businesses.

Our purpose is to ‘place the power of good advice into more hands’, and we are uniquely well-placed to support clients with both their personal financial affairs and their business interests. Our personal wealth management services include financial planning, investment management, personal tax advice and, through Bestinvest, we have a multi award-winning online investment service for self-directed investors. For businesses, our wide range of services includes assurance and accounting, business tax advice, employee benefits, forensics

For further information please visit: www.evelyn.com

Disclaimer

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication.

Issued by the Evelyn Partners group of companies (the “Group”) which comprises Evelyn Partners Limited and any subsidiary of Evelyn Partners Limited from time to time. Further details about the Group are available at: https://www.evelyn.com/legal-compliance-regulatory/registered-details