Tilney Bestinvest launches new At Retirement service as it gears up to help savers navigate the ‘pension revolution’

Tilney Bestinvest launches At Retirement service

- New service will help to de-mystify the world of pensions and retirement

- Powerful tool unveiled to help nation’s savers who want a guaranteed income for life shop around for a better deal

- Competitive new drawdown pricing announced for award-winning, low-cost pension

- Access to expert financial planning and investment management across the UK

Leading investment and financial planning group Tilney Bestinvest is today launching a new At Retirement service. The online and telephone based service provides savers approaching retirement with helpful information and tools to enable them to navigate the wider range of choices they will face as a result of the radical pension reforms heralded in last year’s Budget. These are set to come into place from 6 April.

The decisions individuals take at retirement, whether to purchase a guaranteed income for life, remain invested in a pension or potentially cash in their pension entirely will be one of the most important financial choices they will make in their lives. Tilney Bestinvest believes it is critical that those confronting these decisions get access to clear and helpful information and, if appropriate, expert advice.

The Tilney Bestinvest At Retirement service is packed with educational content and guidance to explain and de-mystify the new pension rules. The At Retirement site provides a balanced overview of the options available, including the pros and cons of income drawdown and the different types of solutions that provide a guaranteed income for life (annuities).

The service will offer savers the option of speaking to a financial planner for personalised advice through the firm’s network of local offices across the UK. For those who want to make their own decisions the At Retirement service will provide access to a highly competitively priced SIPP drawdown product and a tool to help savers wanting to purchase a guaranteed income for life shape and apply for an annuity on a non-advised basis.

Shop around for a better deal

As part of the new At Retirement service Tilney Bestinvest is unveiling a powerful online annuity planner tool in partnership with Just Retirement Solutions to help those on the cusp of retirement get a better deal when selecting a guaranteed income for life. The free-to-use service enables savers to enter in their details and in an easy to use step-by-step process and receive and compare live quotes from a panel of 10 of the UK’s leading annuities providers.

Available for quotes of up to £500,000, the tool will be particularly useful to savers with modest pension pots, where access to financial advice is often difficult. Users of the tool seeking quotes for sizeable annuity purchases will be asked if they would like to speak to an adviser from Tilney Bestinvest’s award-winning financial planning team.

A significant proportion of savers do not shop around when buying an annuity, despite the importance this decision will have on their retirement. The level of income between product providers can vary considerably, (see Case Study 1 below), therefore shopping around may result in a material difference in the retirement income an individual receives.

The search and comparison tool also includes the option of an enhanced annuity for those savers whose medical conditions or lifestyle factors may qualify them for preferential levels of income given their estimated life expectancy. Users of the tool are asked about whether they smoke, have high blood pressure, and have any medical conditions such as cancer, diabetes, heart disease or strokes. It is estimated that a significant number of retirees may be eligible for an enhanced solution that could provide a better deal than a standard product.

Highly competitive low-cost drawdown pricing announced

With the greater flexibility provided by the changes to the pension rules, increased numbers of savers are choosing to keep their pension plan invested and opt to make withdrawals directly from their pension (income drawdown) rather than purchase a secure income through an annuity.

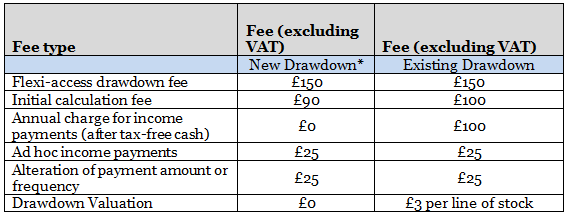

For those savers choosing income drawdown to fund their retirement, Tilney Bestinvest has announced an improved charging structure for its award winning low-cost, execution-only Best SIPP account . From today, Tilney Bestinvest will absorb certain third-party administration costs including the annual charge for income payments (after tax-free cash).

Combined with the Best SIPPs low-cost tiered account fee of 0.3% pa for balances up to £250,000, reducing to 0.2% for balances between £250,000 and £1 million and no charge over £1 million, this makes the Best SIPP one of the most competitive drawdown products in the market. See notes to editors for a comparison table of old versus new drawdown pricing for the Best SIPP.

Unlike some competitors, Tilney Bestinvest’s new drawdown pricing will apply to existing clients with Best SIPP accounts who are in income drawdown as well as to new clients.

For investors who like to manage their own investments, the Best SIPP provides access to over 2,500 funds, as well as investment companies, Exchange Traded Funds and UK shares with a plethora of tools and research. Alternatively savers wanting a managed solution can choose from a variety of Multi-Asset Portfolios offered by Tilney Bestinvest and a number of third party providers. Each Tilney Bestinvest Multi-Asset typically invests in 20 underlying funds selected from across the market by the firm’s research team in-line with the firm’s asset allocation models.

For more information and a free downloadable guide to ‘Your Options at Retirement’ visit www.bestinvest.co.uk/retirement

- ENDS -

Notes to editors:

New Drawdown pricing versus existing Drawdown pricing for the Best SIPP:

*Available for SIPPs with a minimum value of £100,000 (after tax-free cash).

Case Study 1 – Shopping around on a standard annuity

Quote basis: Age 65, £25,000 fund, 5 year guarantee period, no escalation, no value protection, based on RH2 postcode, monthly in advance. Rates run on 14/1/15.

- Lowest rate: Standard Life = £1,180.80

- Highest rate: Hodge Lifetime = £1,378.96

- This is a 16.78% difference

Case Study 2 – Uplift on an enhanced annuity

Quote basis: Age 65, overweight saver with Type 2 Diabetes with complications taking 1 medicine, suffered a heart attack requiring surgery in the last six months currently taking 3 medicines. Had a £25,000 pension, 5 year guarantee period, no escalation, no value protection, based on RH2 postcode, monthly in advance. Valid at 14.1.15

- Lowest rate: Standard Life = £1,180.80

- Highest rate: LV= = £1,930

- This is a 63.44% difference

Important Information

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. This press release does not constitute personal advice. If you are in doubt as to the suitability of an investment please contact one of our advisers.

Prevailing tax rates and reliefs are dependent on your individual circumstances and are subject to change. SIPPs are not suitable for everyone. If you don’t want to invest across different asset classes or don’t think you will make use of the investment choices that SIPPs give you then a SIPP might not be right for you. Self-directed investors should regularly review their SIPP portfolio, or seek professional advice, to ensure that the underlying investments remain in line with their pension objectives.

This is a restricted service and not a whole of market solution. You may be able to find a better rate by looking elsewhere or contacting providers directly. Just Retirement Solutions will use your information to provide the annuity comparison service to you for the purpose of obtaining quotes from annuity providers. Once set up, an annuity cannot normally be changed or cancelled. Therefore it is important to consider all of your options, especially in light of the new pension reforms. If you are unsure of your options you should seek professional financial advice or visit Pensionwise.gov.uk.

Press contacts:

Jason Hollands

020 7189 9919

07768 661382

jason.hollands@tilneybestinvest.co.uk

Roisin Hynes

0207 189 2403

07966 843 699

roisin.hynes@tilneybestinvest.co.uk

Matthew Gray

0207 189 2492

matthew.gray@tilneybestinvest.co.uk

About Tilney Bestinvest

Tilney Bestinvest is a leading investment and financial planning firm that builds on a heritage of more than 150 years. We look after more than £9 billion of assets on our clients’ behalf and pride ourselves on offering the very highest levels of professional client service with transparent, competitive pricing across our entire range of solutions.

We offer a range of services for clients whether they would like to have their investments managed by us, require the support of a highly qualified adviser, prefer to make their own investment decisions or want to take more than one approach. We also have a nationwide team of expert financial planners to help clients with all aspects of financial planning, including retirement planning.

We have won numerous awards including UK Wealth Manager of the Year, Low-cost SIPP Provider of the Year and Self-select ISA Provider of the Year 2013, as voted by readers of the Financial Times and Investors Chronicle. We are pleased that our greatest source of new business is personal referrals from existing clients.

Headquartered in Mayfair, London, Tilney Bestinvest employs almost 400 staff across our network of offices, giving us full UK coverage, and we combine our award-winning research and expertise to provide a personalised service to clients whatever their investment needs.

The Tilney Bestinvest Group of Companies comprises the firms Bestinvest (Brokers) Ltd (Reg. No. 2830297), Tilney Investment Management (Reg. No. 02010520), Bestinvest (Consultants) Ltd (Reg. No. 1550116) and HW Financial Services Ltd (Reg. No. 02030706) all of which are authorised and regulated by the Financial Conduct Authority. Registered office: 6 Chesterfield Gardens, Mayfair, W1J 5BQ.

For further information, please visit: www.tilneybestinvest.co.uk

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.