Tilney Bestinvest’s best-selling funds in February

Tilney Bestinvest’s best-selling funds in February

Japanese funds proved popular during the month

Tilney Bestinvest's Managing Director Jason Hollands comments on the ten most popular funds for clients using the firm's Online Investment Service:

Across the industry, UK Equity Income funds have proved popular with investors for several months in succession now and amongst these one fund has dominated the inflows since its launch last year; the Woodford Equity Income fund. This fund is managed by Neil Woodford, without doubt the UK’s best-known fund manager, who set up his own firm last year.

Investor enthusiasm for Mr. Woodford’s approach was evident amongst clients who use our Online Investment Service by his fund once again ranking as the most popular choice in February.

Japanese equities come back into favour

However, February also showed Japanese equity funds to be in demand, with no less than four of the top ten funds in our table focused on Japan.

After many years of stagnation, the Japanese government of Shinzo Abe and the Bank of Japan are engaged in a programme of measures to shake-up the Japanese economy.

Prime Minister Abe’s hand has been strengthened in recent months by the re-election of his Government in December, and since then there have been concrete signs of further reform, with an agreement to reduce corporate taxes in 2015.

The country is also going to be a beneficiary of falling energy prices, as Japan has been heavily reliant on energy imports since the suspension of its nuclear reactor programme in 2012.

Importantly, investor confidence in Japan has been improving as Japanese companies have been raising dividends and buyback shares, rather than just piling up cash on their balance sheets.

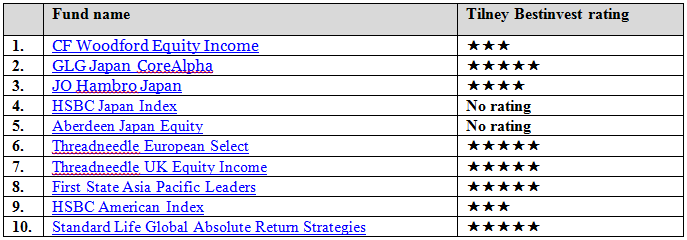

Below are the ten most popular funds our Online Investment Service clients chose:

1. CF Woodford Equity Income

High-profile manager Neil Woodford has seen his new fund CF Woodford Equity Income swell to over £5 billion of assets in just a little over eight months, and at the same time it has significantly outperformed the FTSE All Share Index.

Woodford tends to be a long-term holder, with a style that is risk averse. He is prepared to zero weight major stock market sectors if he feels the outlook is unattractive, so what he doesn’t hold is in some ways as important as what he chooses to invest in. His investment style also leads him towards more businesses that are less sensitive to the economic cycle such as healthcare and tobacco.

2. GLG Japan CoreAlpha

This five star rated fund is managed by veteran fund manager Stephen Harker. He has a distinct large-cap ‘value’ style, meaning he invests in large companies that he believes are trading below their ‘correct’ valuation, rather than smaller or medium sized companies with high rates of growth. Many of Japan’s well known exporters are held in his fund, including the likes of Sony, Nintendo, Toyota and Panasonic.

3. JO Hambro Japan

Managers Scott McGlashan and Ruth Nash invest right across the Japanese stock market, with a strong bias to medium sized and smaller companies. McGlashan has consistently been one of the best performing managers in the sector, taking a pragmatic approach to investing in both growth stocks and companies he believes are undervalued but with the potential to re-rate.

4. HSBC Japan Index

This fund is a tracker that aims to replicate the returns of the FTSE Japan Index. It has a low ongoing costs of 0.15%.

5. Aberdeen Japan Equity

The Aberdeen Japan Equity fund invests in large and mid-sized high quality growth companies, on sensible valuations, and holding them for a protracted period.

6. Threadneedle European Select

This fund is a concentrated portfolio of mostly global companies that are domiciled in Continental Europe. Manager Dave Dudding focuses on high quality growth stocks where companies have a competitive advantage or a natural barrier to entry. Once identified, he typically holds companies for a long period until he believes the investment case for them has materially changed. We believe this is a great core European equity fund.

7. Threadneedle UK Equity Income

Managed jointly by Threadneedle’s Head of Equities Leigh Harrison and fund manager Richard Colwell, the duo take a fairly balanced approach investing predominantly in large and mid-cap UK equities, typically holding between 45 and 60 companies. The fund is managed on a total return basis, with stocks held both for their dividend and growth potential.

8. First State Asia Pacific Leaders

The First State Asia Pacific team, headed by industry stalwart Angus Tulloch, has a fairly conservative investment style focused on high quality companies. This approach has historically served investors well in what can be a very volatile region but with great long-term growth potential.

9. HSBC American Index

When even legendary investor Warren Buffet has admitted that he would put his wife’s cash into a low cost S&P 500 index tracker fund, it is perhaps no wonder that this fund has proven popular choice for our clients. Very few active fund managers have managed to beat the US stock market in recent years. The fund has ongoing charges of just 0.18%.

10. Standard Life Global Absolute Returns Strategy (GARS)

“GARS” has been a blockbuster fund for Standard Life, growing to a towering £23 billion in size. It is an umbrella for around 30 underlying individual investment strategies, covering equities, bonds and currencies with the overall goal of aiming to generate positive returns over the medium term across all market conditions with low volatility.

- ENDS –

Important Information:

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. This press release does not constitute personal advice. If you are in doubt as to the suitability of an investment please contact one of our advisers. Past performance is not a guide to future performance.

Different funds carry varying levels of risk depending on the geographical region and industry sector in which they invest. You should make yourself aware of these specific risks prior to investing.

Press contacts:

Roisin Hynes

0207 189 2403

07966 843 699

roisin.hynes@tilneybestinvest.co.uk

Matthew Gray

0207 189 2492

matthew.gray@tilneybestinvest.co.uk

About Tilney Bestinvest

Tilney Bestinvest is a leading investment and financial planning firm that builds on a heritage of more than 150 years. We look after more than £9 billion of assets on our clients’ behalf and pride ourselves on offering the very highest levels of professional client service with transparent, competitive pricing across our entire range of solutions.

We offer a range of services for clients whether they would like to have their investments managed by us, require the support of a highly qualified adviser, prefer to make their own investment decisions or want to take more than one approach. We also have a nationwide team of expert financial planners to help clients with all aspects of financial planning, including retirement planning.

We have won numerous awards including UK Wealth Manager of the Year, Low-cost SIPP Provider of the Year and Self-select ISA Provider of the Year 2013, as voted by readers of the Financial Times and Investors Chronicle. We are pleased that our greatest source of new business is personal referrals from existing clients.

Headquartered in Mayfair, London, Tilney Bestinvest employs almost 400 staff across our network of offices, giving us full UK coverage, and we combine our award-winning research and expertise to provide a personalised service to clients whatever their investment needs.The Tilney Bestinvest Group of Companies comprises the firms Bestinvest (Brokers) Ltd (Reg. No. 2830297), Tilney Investment Management (Reg. No. 02010520), Bestinvest (Consultants) Ltd (Reg. No. 1550116) and HW Financial Services Ltd (Reg. No. 02030706) all of which are authorised and regulated by the Financial Conduct Authority. Registered office: 6 Chesterfield Gardens, Mayfair, W1J 5BQ.

For further information, please visit: www.tilneybestinvest.co.uk

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.