Warning shot for Chancellor as new research reveals public opposition to death duties

Ahead of the upcoming budget on 29th October, speculation is mounting over how the Government will fund the Prime Minister’s pledge to spend an extra £20 billion per year on the NHS by 2023. The Chancellor, Philip Hammond, faces a difficult challenge to meet this commitment through increased taxes given the parliamentary arithmetic and disquiet on the Conservative backbenches. While recent comments by the Chancellor that the cost of tax relief on pensions is “eye wateringly expensive” have raised the spectre of cuts to the annual contribution limits on pensions, another area that could see tinkering are the allowances around gifting and inheritance tax. Earlier this year the Chancellor ordered the Office of Tax Simplification to undertake a comprehensive review of the rules, describing the existing regime as “particularly complex”. On the surface a simplification of the current gifting and inheritance tax regime would be broadly be welcomed in many quarters, as it currently encompasses a patchwork of allowances and reliefs that can be hard to navigate without taking professional advice. However, any changes that might also result in an increase in inheritance tax receipts – which last year hit a record level of £5.2 billion – could prove deeply unpopular with the public according to new research commissioned by financial planning and investment management group Tilney.

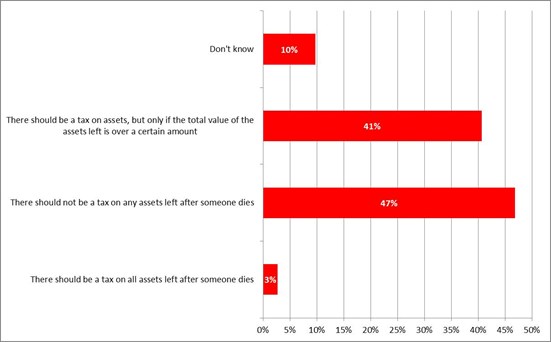

A representative survey of over 6,000 British adults carried out last week on behalf of Tilney[1] has revealed that 47% of adults do not think there should be any tax on any assets after a person dies. This compares to 41% who believe there should be a tax on assets above a certain threshold and only 3% who believe tax should be levied on all assets on a deceased persons’ assets (see appendix).

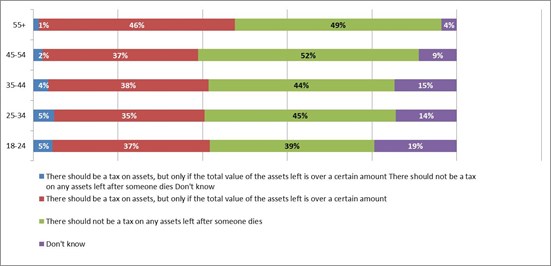

Opposition to taxing any assets on death is felt most keenly by adults aged 45-54 (52%) and by women (50%). Across age groups, 18-24 year olds were the only cohort where the proportion of people in favour of taxing all assets, or assets above a threshold (42%), outweighed those opposed to levying any taxes on the estate (39%).

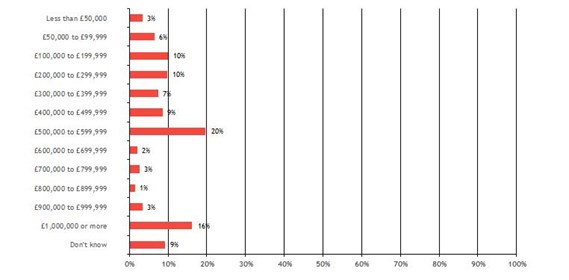

In total 41% of those asked believe there should be tax on assets on death, but only over a certain value. The strongest age cohort in support of this approach (46%) were those aged over 55 years old. Of the respondents who believed there should be a tax on assets over a certain amount, a threshold of £500,000 to £599,999 was the most selected level at which respondents thought taxation should be applied (20%), followed by over £1m (16%) – a significant leap from the current nil rate band for inheritance tax of £325,000 (see appendix).

Commenting on the findings, Ian Dyall, head of estate planning at Tilney, said: “The Chancellor announced at the beginning of the year that he had asked the Office of Tax Simplification to conduct a major review of Inheritance tax (IHT) including looking at gifting allowances. While I always welcome the principle of simplification, too often it leads to a new tax regime, and with Mr Hammond running out of options to generate funds for public service spending commitments, I fear next week’s Budget could turn the screw on taxing estates on death.

“The figures from our survey suggest that any moves to increase IHT receipts under the cover of ‘simplification’ will be an extremely unwelcome decision. Nearly half of the public already think we should not be paying any tax upon death whatsoever, and those who believe such taxes are necessary, feel the nil rate band – which has been frozen at the current level for a decade - kicks in at far too low a level. Rising property prices and strong investment returns over the last decade mean more and more people are getting drawn into the net of inheritance tax.

“We can only wait and see what the Chancellor has up his sleeve. As lifetime gifts and inheritances have a huge role to play in helping address the growing generational wealth gap, we can only hope he does not choose to see this review as a fund-raising exercise for HM Treasury but rather as an opportunity to encourage assets to cascade more easily between the generations.”

[1] All figures, unless stated, are from YouGov Plc. Total sample size was 6,031 adults. Fieldwork was undertaken between 16th and 19th October 2018. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 18+).

- ENDS -

Appendix

For the following question, please think about the total value of the assets someone leaves after they die (i.e. rather than the sum distributed to individual beneficiaries... Which ONE of the following comes closest to your view?

Unweighted base: All GB Adults (6031)

Breakdown by age bands

Unweighted base:

All GB Adults (6031)

18-24 (493)

25-34 (914)

35-44 (969)

45-54 (1039)

55+ (2616)

Q: You previously said that there should be a tax on assets, but only if the total value of the assets left is over a certain amount... What is the maximum total value of assets (before it is distributed to beneficiaries) you think a person should be able to leave after they die, without incurring a tax on those assets? (Please select the option that comes closest)

Unweighted base: All GB Adults who believe that assets left over a certain amount should be taxed (2481)

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.