We anticipated a weaker Yuan and the move this morning by the People’s Bank of China (PBoC) to cut the reference rate for the Yuan by 1.9% has allowed the currency to depreciate. On its own this move is insufficient to make up for the reduction in Chinese competitiveness when compared to moves in European and Japanese currencies. Further devaluation poses a risk to the global economy through deflation.

Depreciating Yuan

The moves by the PBoC may be the beginning of an approach which takes into account market pricing. Other Asian central banks operate a managed floating rate approach and International Monetary Fund (IMF) staff recently set out the view the Chinese currency is no longer undervalued, encouraging greater exchange rate flexibility. They have espoused a move to a floating exchange rate in 2 to 3 years’ time.

The adjustment down to the reference rate follows on the back of the widening of the range within which the currency can trade. This has been set to plus or minus 2%, around the daily reference rate to the dollar, which is set by the authorities. In future to set the daily fixing the PBoC will refer to the previous day’s closing rate and consider exchange rate movements in other currencies. The move is consistent with China’s push for inclusion in the IMF’s Special Drawing Reserve (SDR), although inclusion in the basket has also been seen as potentially deferring any adjustment in the currency.

Market Reaction

Following the announcement the Yuan dropped 1.8% in Shanghai and by more than 2% in trading in Hong Kong, where the moves are not limited. To put this into context, over the last two years the currency is down 3% against the dollar (we noted last week that the yuan has appreciated 30% relative to the dollar over the last ten years). Japanese and Korean equities reacted to the move by falling 0.4% and 0.8% respectively and in currency markets the dollar strengthened (as did US treasuries) with the euro and yen both weaker.

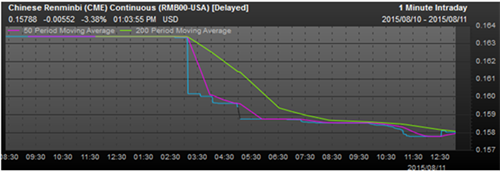

YUAN DEPPRECIATION

Dollar Yuan rate (blue) and 50 day moving average (pink) 200 day (green). Source: Factset 11/08/15

Outlook

We believe this move is the first by the Chinese authorities to restore export competitiveness, which has been dulled by rising domestic wages and the peg to the US dollar that has led to an appreciation in its real exchange rate. As noted by Macro Strategy Partnership “Whilst the devaluation took it to the lowest level against the dollar since 2012, the 1.8% slide is in my opinion wholly inadequate to sustain growth or rebuild its balance sheet. Whilst the market’s knee-jerk reaction will probably be favourable, I would assume the longer term response will be to take this as a signal that China is hurt and vulnerable.”

With inflation already persistently low in the West, this poses a risk of exporting deflation which remains one of our core investment themes. The implication of this includes weak global growth and lower interest rates for longer. This could be played out in equity markets where earnings season has already revealed a mixed outlook for sales growth and fixed income markets where US treasuries benefited from the moves. Commodity prices which are denominated in dollars may also come under pressure if Chinese demand deteriorates.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.