The Federal Reserve contemplates how to unwind QE: weekly update 10 April

The Federal Reserve contemplates how to unwind QE: weekly update 10 April

In our macroeconomic and market update for the week ending 7 April 2017, we look at US Non-Farm Payrolls, which disappointed – but unemployment fell, while the Federal Reserve (Fed) contemplated how and when to unwind Quantitative Easing (QE). Inflation figures will be in focus this week.

Non-farm payrolls fell short of expectations

Only 98,000 jobs were added in March (180,000 had been expected) and the readings for the previous two months were revised down by a cumulative 38,000. Despite this, the three-month run rate remains at a healthy 178,000 jobs added per month, and with unemployment unexpectedly falling 0.2% to 4.5%, it’s hard to argue that employment is anything but robust (at least on the surface).

With economic conditions seemingly continuing on this stronger path, the minutes from the recent Federal Open Market Committee (FOMC) meeting suggested that the Fed’s balance sheet could start to be reduced later this year. While inevitable, this is nonetheless likely to be a major event, as it represents the first step of unwinding the Quantitative Easing (QE) monetary policy experiment, and will see the Fed cease reinvestment on maturing assets. While the discussion has started, it still appears the Fed is some way from agreeing how this will work in practice, such as whether there will be a strict mechanical process, or whether it will be more of a ‘qualitative’ approach, effectively becoming a second discretionary tool alongside interest rates. Either way, the Fed will be keen to avoid a re-run of the ‘taper-tantrum’ in 2013 when it first announced it was going to scale back QE, and whatever is decided is likely to be very well telegraphed to markets.

Broader economic data was more subdued

This includes both ‘hard’ output data and ‘soft’ survey data. UK Services PMI picked up from 53.3 to 55.0 (53.5 expected), but Manufacturing PMI slipped from 54.5 to 54.2 (55.1 expected), and industrial production in February slowed 0.5% to 2.8% year on year (an acceleration to 3.7% was expected). The US Non-Manufacturing PMI from the Institute for Supply Management fell from 57.6 to 55.2 (57.0 was forecast), while Manufacturing PMI fell 0.5 to 57.2 (though this was ahead of the 57.0 forecast), and over in China the Caixin Services PMI fell from 52.6 to 52.2 (an increase to 53.2 was expected). There was no PMI or production measures from the Eurozone this week, though retail sales remained strong, up 0.3% to 1.8% year on year (a slow-down to 1.4% was forecast). While we have seen signs of a cyclical upturn in recent global economic data, these data remind us that continued growth and recovery are still far from certain.

Last week’s other events

- Japan’s Tankan measures showed the Manufacturers Index rise two points to 12 in Q1 (14 expected), and All Industry Capex slip from 5.5 to 0.6 (-0.1 expected). Consumer confidence rose from 43.2 to 43.9 (43.5 expected) while the Coincident Index rose from 115.1 to 115.5 and the Leading Economic Index slipped from 104.9 to 104.4 (104.7 expected).

- South Africa has had its sovereign debt downgraded to junk status by both S&P and Fitch amid concerns over the political situation in the country.

- Eurozone unemployment fell 0.1% to 9.5%, in line with expectation.

The markets

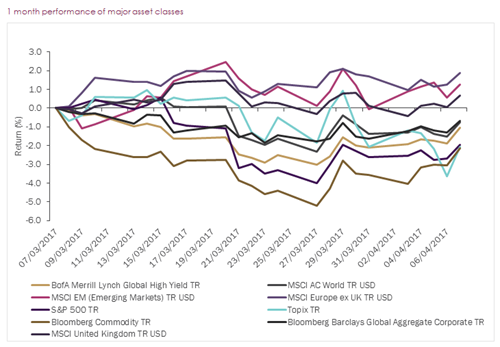

Equities were again rather quiet as sovereign bond yields continued to tighten.

Equities – There was little movement in the main bourses last week. In the UK, the MSCI United Kingdom index returned 0.7% on the week, and across the Channel, the MSCI Europe ex-UK index was flat. In the US, the S&P 500 slipped -0.2% on the week, while in Japan the TOPIX fell -1.5%. The Hang Seng index in Hong Kong rose 0.7% for the week.

Bonds – Core sovereign bond yields were lower again last week. German 10-year bund yields fell 10 basis points (bps) to 0.23%. There were similar moves on the 10-year gilt, with yields seven bps lower to 1.08% and the equivalent US Treasury yields were down three bps to 2.38%.

Commodities – Some strength returned to the oil market last week, with Brent Crude closing at US$55.24/barrel. Gold was fairly unchanged, ending at US$1,254.30/ounce and the same was true of copper, which finished at US$2.65/lb.

Currencies – Sterling was weaker across the board last week, finishing at US$1.24, €1.17 and ¥137.

The week ahead

It is much quieter on the scheduled data front heading in to the Easter weekend. On Tuesday, UK inflation is forecast to remain at 2.3% year on year, while core inflation is expected to slip to 1.9% (from 2.0%). Also on Tuesday, Eurozone Industrial Production figures will be released, with an increase in February from 0.6% year on year to 1.9% forecast (although the month on month reading is expected to have slowed from 0.9% to 0.1%). Chinese inflation is reported on Wednesday (an increase from 0.8% to 1.0% is expected), and on Good Friday, the US will report its latest inflation numbers – expectations are for 2.6% year on year from 2.7% on the headline rate, and 2.3% from 2.2% on the core measure. Elsewhere:

Monday: The Japanese Economy Watchers outlook survey and machine tools orders are out early in the morning. In the afternoon the Fed releases its Labor Market Conditions index.

Tuesday: After UK inflation numbers and Eurozone Industrial Production figures, there is also the ZEW economic survey output for the Eurozone and Germany due for release.

Wednesday: As well as inflation data, the Chinese authorities will also update Foreign Direct Investment and the Producer Price Index first thing in the morning. After that, UK employment numbers are released and in the afternoon, US Import and Export Prices are updated.

Thursday: Chinese trade data come out early in the morning. It is then quiet until the US initial jobless numbers, and PPI measures are released in the afternoon, followed by the Michigan Consumer Sentiment results.

Friday: Being Good Friday, it’s a particularly quiet end to the week. The main data of note are out from the US, where, as well as inflation data, the latest Retail Sales and Business Inventories are released.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.