Weekly macroeconomic and market review – 13 March 2017

Weekly macroeconomic and market review – 13 March 2017

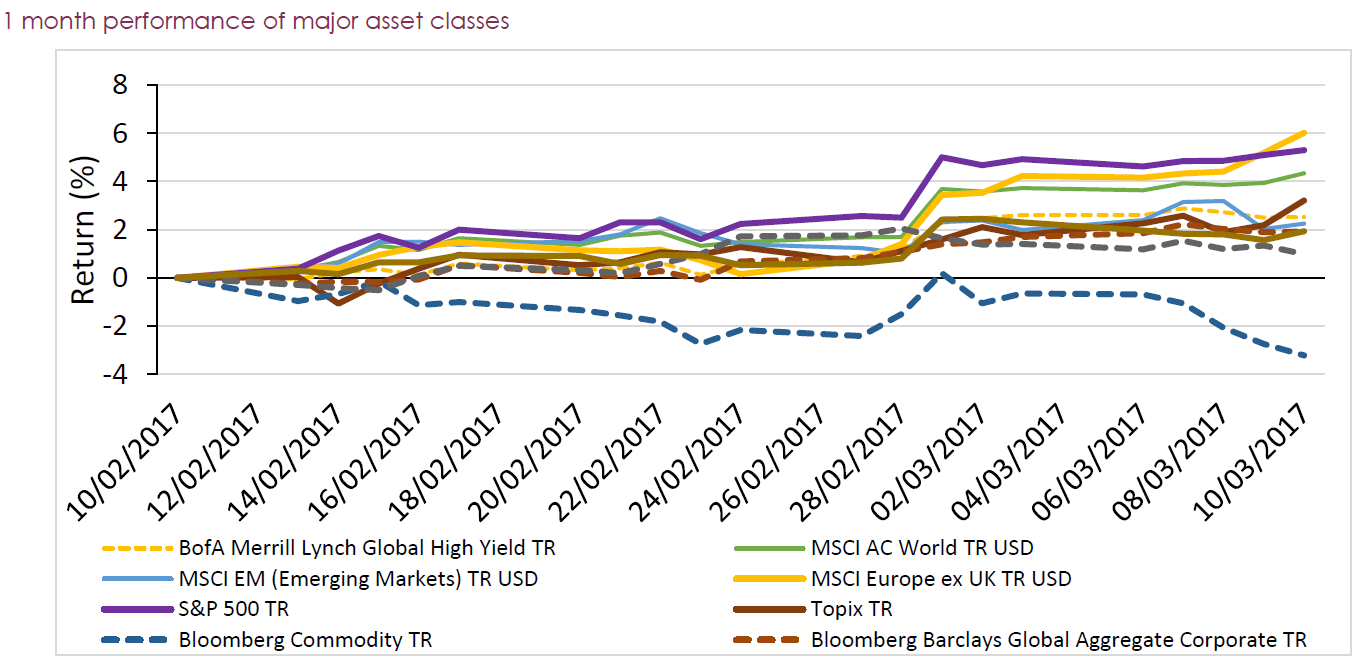

A look back over macroeconomic and market events for the period ending 10/03/17. Tightening monetary policy expectations continued to be a theme, with the European Central Bank signalling a shift in its stance and positive US non-farm payrolls making a US interest-rate hike this week a near certainty. As well as the US meeting, there are also monetary policy meetings at the Bank of Japan and Bank of England this week.

A hike in US interest rates is imminent

Strong US Non-Farm Payroll numbers on Friday effectively sealed the deal for a hike in US interest rates at the upcoming Federal Open Market Committee (FOMC) meeting. The addition of 235,000 jobs in January was actually slightly less than the 238,000 added in December, but was comfortably ahead of the 190,000 forecast. Unemployment fell 0.1% to 4.7% and wage growth remained solid at 2.8% year on year. Markets were already pricing in an even higher probability of an interest-rate hike after Wednesday’s ADP employment change measure, usually a useful primer ahead of non-farm payrolls, which also showed a strong positive surprise and moved the Bloomberg estimates for a March rate increase from 96% to 100% mid-week.

This is a marked change to the start of the year, when investors were wondering whether the Federal Reserve (Fed) would achieve the three hikes projected for this year, after falling well short for the last couple of years. Many market commentators are now wondering whether the Fed will have to move faster and if more than three hikes might be on the cards, something they have not had to contemplate post global financial crisis. To me, this seems to be yet further evidence that we are moving later in the economic cycle, particularly in the US, and aligns with our theme of monetary-to-fiscal stimulus having a major impact on markets in 2017 and 2018.

The end of loose monetary policy

The European Central Bank (ECB) signalled that the era of ultra-loose monetary policy was coming to an end. Although there were no policy changes announced – which really would have been a major shock – there was a stark shift in sentiment in the decision statement and the press conference. The Central bank is no longer poising itself to inject fresh stimulus and is instead clearly positioning for a tightening outlook, albeit with a patient timeframe. The phrase regarding having all weapons at its disposal was removed from the latest statement, signalling a shift in guidance, while at the press conference ECB President Mario Draghi talked about the reduced “sense of urgency” and that he didn’t anticipate the need to lower rates further.

The ECB has been under pressure to raise rates, particularly from German officials, as Eurozone inflation continues to push up, now standing at 2.0% year on year. As we’ve highlighted before, core inflation remains subdued and remains at 0.9% year on year, so we don’t believe there will be much of a sense of urgency to raise rates. However, with GDP growth improving and economic indicators showing strength, aggressive stimulus should no longer be necessary – indeed it could be seen as counter-productive – if this is to be seen as a sustainable recovery. From here, the most likely course of action is for policy to stay put, allowing QE to run off on schedule in December before thoughts turn to interest rates – but the Bank has long shown a willingness to use rhetoric as a tool and that is likely to continue through this year.

Last week’s other events

- The UK Budget produced relatively few surprises, with growth forecasts upgraded for this year but downgraded in the following years effectively netting off. Overall there was no significant impact to the macroeconomic view – more details can be found in our article here. UK Industrial Product slowed from 4.3% (yoy) growth in December to 3.2% in January, slightly worse than the 3.3% forecast, while Manufacturing Production fell from 4.2% to 2.7% (3.0% was forecast)

- Chinese trade data saw some significant movements, with exports down -1.3% year on year from 7.9% (12.3% expected) but imports surging to 38.1% from 16.7% (20.3% was expected), giving rise to an unexpected trade deficit in February. However, the timing and impact of the Lunar New Year is well-known to cause distortions in these data. The inflation rate fell from 2.5% to 0.8% year on year (1.7% expected) – partly this was caused by deflationary food resulting from a bumper vegetable harvest, but travel price distortion due to new year effects could also have played a part. Producer Prices surged to 7.8% from 6.9% year on year (7.7% was forecast)

- US factory orders slowed from 1.3% to 1.2% month on month in January, but this was ahead of forecasts for 1.0%. Wholesale inventories fell 0.2% month on month (from 1.0% growth previously and forecasts for -0.1%). Export prices were up 0.3% month on month (from 0.2% previously and expectations for the same) while import prices grew 0.2% (down from 0.6% in January, but ahead of 0.1% forecast)

The markets

Reacting to the shifting monetary policy outlook over the last week, the US dollar and euro strengthened through the week, and sovereign bond yields rose. Yet again, equities were barely moved.

Equities – Another quiet session in major equity markets, despite the news flow. In the UK, equities were down marginally with the MSCI United Kingdom index returning -0.3%, the S&P 500 index in the US was similarly down -0.4%. In Europe, the MSCI Europe (ex-UK) index gained 0.3%. Over in the Far East, the TOPIX index of Japanese equities returned 1.0% while the Hang Seng index in Hong Kong advanced just 0.1%

Bonds – The biggest movers were ten-year German bunds, where the ten-year yield rose 12 basis points (bps) to 0.48%. US Treasury yields on the same maturity were 7 bps higher at 2.57% and the equivalent UK gilt yields rose 5 bps to 1.24%

Commodities – The oil price fell after several weeks of range trading, amid rising US inventories and questions over the compliance of OPEC members to the agreed production cut as well as a resurgence of shale production. Gold weakened on the week to US$1,200.70/ounce, back to the levels we last saw mid-January, while copper was also weaker at US$2.59/lb

Currencies – The euro and US dollar were both stronger, at €1.14 and US$1.22 to the pound respectively, while the Japanese yen also gained on sterling, finishing the week at ¥139

The week ahead

Central banks are again in the spotlight this week. After weeks of build-up, and dramatic shifts in expectations, the FOMC meeting on Wednesday will be a focal point, even though a rate hike is now close to a certainty. The main variables that investors will be looking out for are around the reduction of the Fed’s balance sheet (effectively unwinding Quantitative Easing, ‘QE’) which could be discussed in the press conference, and changes to the Fed’s interest rate expectations – the ‘Dot Plot’ that is released as part of the quarterly economic projections report.

Monetary policy decisions are due out on Thursday from both the Bank of Japan (BoJ) and Bank of England (BoE). In both cases, no changes to interest rates or QE are expected. For the BoE, the Monetary Policy Committee meeting minutes are released at the same time as the statement, and will be scoured for any evidence of a shift in the thinking by committee members, particularly given the apparent continued strength of the UK economy. Away from the economic calendar, there is also the possibility that Article 50 is triggered this week, if the Government can get the legislation quickly through both houses of Parliament on its second pass this week. Elsewhere:

Monday: It’s a quiet start to the week, with Foreign Direct Investment data from China the only scheduled release of note.

Tuesday: Overnight there are more data from China with Fixed Asset Investment (8.2% year on year expected from 8.1% previously), Industrial Production (6.2% expected from 6.0%) and Retail Sales (10.5% expected from 10.9%) all updated. Later in the morning, January industrial Production figures for the Eurozone are released, with expectations for a slowdown from 2.0% to 1.1% year-on-year growth. The ZEW business sentiment survey results for Germany are also reported. In the afternoon, US Producer Price Inflation and Fed Labour Market Conditions data are out.

Wednesday: Before the ‘main event’ of the FOMC meeting (starting at 6pm UK time), UK unemployment and average earnings are reported in the morning. A host of US economic data is released in the afternoon, including inflation, the New York Empire State Manufacturing Index and Retail Sales all for the month of February.

Thursday: There is relatively little to focus on on Thursday aside from the BoJ and BoE monetary policy announcements. Final Eurozone inflation readings for February are out in the morning, with the US producing Building Permits, Housing Starts and the Philadelphia Fed Manufacturing index along with Jobless Claims and Job Openings.

Friday: The morning sees Eurozone Balance of Trade and Construction Output reported, while in the afternoon US Industrial Production and the Michigan Consumer Sentiment survey results see the week out.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.