Bank of Japan surprises markets as interest rates are cut into negative territory

Central banks drove activity last week, with the Bank of Japan (BoJ) surprising everyone with an interest rate cut into negative territory. The move to cut interest rates from zero to -0.1% was all the more unexpected since BoJ Governor Kuroda had told parliament the week before that the Central bank wasn’t giving serious consideration to negative rates.

Unlike many other major Central bank leaders, Governor Kuroda seems to take particular pleasure in keeping markets on their toes. However, the measure was only passed by a narrow 5-4 vote. It is believed that some committee members thought the move sent a conflicting message about the efficacy of the quantitative and qualitative easing (QQE) programme, as well as fearing that what is actually a three-tiered interest rate might cause confusion.

As it stands, there are now three interest rates – 0.1% on current deposits, 0% on deposits the BoJ requires banks to keep reserved, and -0.1% on new deposits. There was no change to the QQE programme, which remains in effect at the rate of ¥80 trillion per year, although forecasts showed the BoJ doesn’t think it will hit its 2% inflation target until the middle of 2017.

The Fed leaves interest rates unchanged

The US Federal Reserve left rates unchanged as most expected, with a statement clearly highlighting the ‘watching brief’ as it continues to monitor volatility in financial markets and the slowdown in the global economy. There was no press conference, but the statement was decidedly neutral – suggesting a desire by the Fed to keep all of their options open for further interest rate hikes (though the market clearly expects no more rate increases until the back-end of the year).

Any increases before then would probably be a tough sell, particularly as the US STET 5-year inflation had deteriorated to a reading of 1.55% at the time of the Fed meeting. This measure is the average annual inflation expectation for five years, beginning in five years’ time – a preferred guide for forecasting long-term inflation.

Last week’s other events

- There was more bad news for the US as the initial reading of fourth quarter GDP showed annualised growth of just 0.7%, down from 2.0% in Q3 and slightly below muted expectations for 0.8% growth. The apparent slowdown has been partially blamed on the strong US dollar, whilst weak demand has led to an inventory glut. This gives full-year 2015 GDP of 2.4%, the same rate of growth as 2014.

- US durable goods also provided a shock in December, falling sharply to -5.1% month on month (against expectations of a fall of just -0.6%).

- In the UK, fourth quarter GDP came in as expected at 1.9% year on year. This was a slowdown from 2.1% previously, but did mark an uptick in quarterly growth from 0.4% to 0.5% between the third and fourth quarter.

The markets

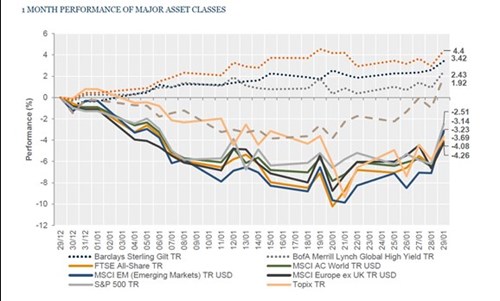

Action from the BoJ cheered most markets at the end of the week, powering the paradox of concurrent rallies in both equites and sovereign bonds. Naturally it was the Japanese yen that suffered.

Equities – All major markets were up on the week. The FTSE All-Share gained 2.6% and the FTSE 100 was back above the 6000 mark at 6083. In the US, the S&P 500 was up 1.6% whilst Europe made 0.8% on the week. At the epicentre of the action, Japan’s Topix index was boosted 4.3%.

Commodities – A rally from a low base in oil saw Brent Crude finish the week at US$36 a barrel. Copper strengthened to US$2.06 a pound whilst gold moved above $1,100 to US$1,116.90 an ounce.

Bonds – Just as equities rallied, Japan’s surprise interest rate cut also pushed down the yield on mainstay government bonds. UK 10-year gilt yields were 15 bps lower to 1.57% and 10-year US Treasury yields slipped below 2% to finish the week at 1.92%. In Japan, 10-year JGB yields fell 14 bps to 0.10%.

Currencies – The yen fell sharply after the BoJ announcement, falling -2.3% against the US dollar, -2.2% against sterling and -2.6% against the euro. The US dollar was the main beneficiary, rising against other major currencies and offsetting weakness earlier in the week.

The week ahead

On Friday we have non-farm payrolls in the US along with the associated employment data, and ahead of that the Bank of England’s “Super Thursday” will see the interest rate decision released at the same time as the meeting minutes and the latest inflation report. Apart from that, there is a lot of mid-level economic data that could add more colour to the state of the global economy.

Monday sees Chinese PMI data (both the official government measure and the Caixin reading) released overnight, with the US Manufacturing PMI being released in the afternoon alongside personal income and spending data plus inflation. Eurozone unemployment and UK Construction PMI data are out on Tuesday morning, followed by minutes from the BoJ monetary policy meeting which could make for interesting reading.

On Wednesday, and still on the theme of BoJ action, Governor Kuroda will give a speech that could give a hint as to his current thinking on monetary policy. Later on we have the UK Services PMI and Eurozone retail sales figures out, before the US reports non-Manufacturing PMI where we expect a slowdown from 55.8 to 55.1.

At midday on Thursday the Bank of England’s “Super Thursday” kicks off with the interest rate decision, quarterly inflation report and meeting minutes all coming out. This comes after Governor Mark Carney’s comment that “now is not the time to consider a rate rise” – so we’re unlikely to see any change in policy. Later in the day we have more US employment data in the form of initial jobless numbers, unit labour costs and non-farm productivity.

Fresh on the heels of Thursday’s employment figures, on Friday the US releases its non-farm payroll numbers which are expected to have slipped from 292,000 to 190,000. US trade data will also be published.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.