Weekly macroeconomic and market update 02.08.16

Weekly macroeconomic and market update

Weekly macroeconomic and market update

A look back over macroeconomic events for the week ending 29/07/2016. There was no action from the Bank of Japan (a surprise) or the US Federal Reserve (not a surprise) whilst a syndicate of banks rescued Monte dei Paschi, the beleaguered Eurozone bank. The main event this week will be the Bank of England meeting, expected to inject fresh stimulus.

Central bank inactivity continues to be a theme, as the Bank of Japan opted to hold off meaningful stimulus. This disappointed markets, which had been hoping for fresh action amid weakening inflation expectations and pushed the yen higher. Although the bank did almost double its purchase of ETFs from ¥3.3 trillion to ¥6 trillion, it left the overall asset purchase programme unchanged at ¥80 trillion a year.

The bank also left interest rates untouched, instead biding time to review policy impact. Some sort of stimulus remains likely in the near future, and this could come in part from co-ordinated fiscal and monetary stimulus as authorities begin to worry that monetary policy alone is beginning to lack efficacy.

The US Federal Reserve (Fed) also met, leaving rates unchanged. The lack of a press conference gave little scope for too much excitement but the statement was a little more optimistic than before. The Fed highlighted that “near-term risks to the economic outlook have diminished” – a likely reference to Brexit – and that the job market was strengthening and the economic indicators were moderate.

Expectations for a September hike have been ticking up now the Brexit fallout has started to settle. However a disappointing GDP result for the second quarter, which was just under half the expected figure (1.2% annualised versus 2.5% expected), has put expectations back.

Markets are now implying a 20% chance of a hike in September, with the balance of probabilities now favouring no hike until June 2017. Although for us this frames Central bank activity in terms of “rhetoric heavy, action light”, we would also highlight that any increase in hawkish commentary could be a risk to fragile markets.

European banks provided some interest on Friday, not so much because of the EBA’s stress tests – which were not a pass or fail – but because of the rescue deal for Monte dei Paschi, the world’s oldest bank. A rescue for the bank was announced just before the main stress test results came out, and involves both a capital raise of €5 billion backed by a consortium of banks and the sale of €27.7 billion of non-performing loans.

Although there are still challenges ahead, for now this seems to put to bed the latest concerns over the European banks. It also potentially highlights a shift in the political landscape in Europe towards reconciliation – the rescue bid averts a potential show-down over politically sensitive bail-outs and bail-ins which would otherwise have been triggered.

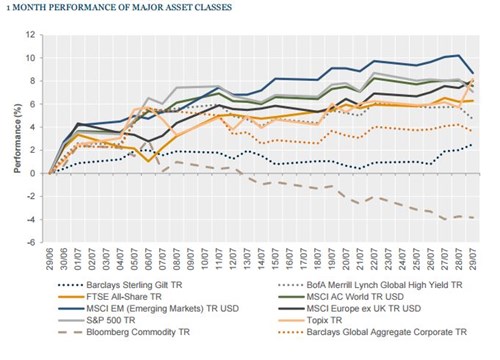

Equity markets were relatively uneventful as safe havens rallied and oil slipped. The US dollar weakened after the poor GDP numbers, while the yen gained thanks to the relative inactivity of the Bank of Japan.

Equities – FTSE All-Share and S&P 500 were both unchanged by the end of the week, while in Europe the EuroStoxx 50 was down -1.1% on the week and in Japan the Topix fell -0.4%. In Hong Kong, the Hang Seng was down -0.3%.

Bonds – UK 10-year gilt yields softened through last week, closing down 15 bps to end at 0.68%, with the equivalent US Treasuries down 13 bps to 1.45%. Ten-year German bunds were negative again, ending the week at -0.12%.

Commodities – oil continued to slide from recent highs, down to US$43.20 a barrell by the end of Friday. Gold was stronger, rallying at the end of the week to finish Friday at US$1,357 an ounce. Copper was relatively unchanged on the week, and ended at US$2.22 per lb.

Currencies – sterling gained ground against the US dollar, which was broadly weaker after the poor GDP figures, finishing the week at US$1.32. However, it slipped against the euro and yen, ending at €1.18 and ¥135 respectively.

Thursday could finally see the ‘Super Thursday’ that Bank of England Governor Mark Carney has been hoping for, as the Monetary Policy Committee releases its latest decision at the same time as the minutes and the inflation report – which may be used to give the decision context. Markets are pricing in a near-certainty of a rate cut, with most expecting a 25 bps cut to 0.25%. There is also the possibility that the Central bank goes even further by restarting quantitative easing or some other scheme. Friday also sees us back around to US non-farm payrolls – which have been swinging around expectations like a seesaw. After the huge recovery last month, forecasts are for a moderation to 175,000 jobs added. After the Q2 GDP print last week, hawks will be looking for a positive result to bolster their positions. Elsewhere:

Early morning on Monday China reports PMIs for manufacturing (official and Caixin) and non-manufacturing (official only). In the afternoon the ISM manufacturing PMI figures are out. On Tuesday these are followed by UK construction PMI, then US expenditure and personal income.

As we reach midweek China’s Caixin services PMI reading comes out, followed by Eurozone retail sales for June, which are expected to have picked up from 1.6% to 1.7% (although this won’t yet include most of the effects of Brexit). In the afternoon, the ISM non-manufacturing PMI for July is released.

Aside from the Bank of England’s releases there is little of note happening on Thursday – although these should provide plenty to keep people going.

First thing on Friday morning, Japan will update the Leading Economic Index and Coincident Index. Then in the afternoon, US non-farm payrolls are expected to normalise after the bumper beat last month (in turn after a significant miss). This will come with the usual associated data, including unemployment, hourly earnings and the participation rate.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.