Weekly macroeconomic and market update 06.07.2015

Weekly macroeconomic and market update

The Greek electorate votes “no”

The Greek electorate went to the polls on 5 July, returning a fairly resounding ‘no’ vote with 61% of voters choosing to reject the terms demanded by creditors in exchange for a bailout. This came after the first week of capital controls that limited withdrawals and cross-border transactions. We also saw the expiry of the bailout programme that seemed essential for the country’s continued solvency, as well as the first missed IMF payment which had been bundled to the end of June.

As we have highlighted previously, the direct effects of what remains a political crisis are likely to be limited outside of Greece, and much is already priced in. Greek government bonds are already discounting in a potential default with around a 50% recovery rate. Sentiment can be contagious however, and given the excessive optimism priced into equities these markets could be vulnerable to volatility as a result. In the meantime negotiations will continue and may focus more on debt relief (in line with comments from the IMF last week).

Greek banks are likely to stay closed and capital controls will remain in place until some sort of deal can be made. Many recall that capital controls remained in place for two years after the Cyprus banking crisis of 2012-13. The ECB continues to provide support through the ELA, which although capped has not been withdrawn. However, the ECB’s approach to the solvency of the Greek banking system could heavily influence how events unfold. If Euro-liquidity is not forthcoming the Greek government could be forced to issue IOUs, effectively introducing a new currency and taking the first monetary step towards Grexit.

A speedy sell-off in Chinese equities

Chinese authorities scrambled to stop the sell-off in Chinese equities, which fell another 16% last week despite the People’s Bank of China cutting interest rates and the reserve requirement ratio last weekend. As markets continued to decline the China Securities Regulatory Commission opted to relax the rules on margin lending, effectively making it easier for Chinese investors to trade ‘on credit'. In a further attempt to stimulate activity, transaction fees were also cut on the Shanghai and Shenzhen stock exchanges as well as the state-controlled central clearing house.

As is so often the case, these carrots appear to have been accompanied by sticks – with a number of reports suggesting traders were being warned off shorting the markets. Over the weekend authorities went further, providing liquidity support via official institutions and coordinating market stabilisation measures with a number of major brokerages. Although the Chinese stockmarket is still up over twelve months thanks to a strong run into the summer, the speed at which the market has sold off has caused some alarm. Furthermore, there remains a risk that this negative sentiment could begin spreading to other markets, particularly given the events occurring elsewhere.

Last week’s other events

- US non-farm payrolls showed that 223,000 jobs were added in June, slightly less than the 230,000 expected and a slip from the month before. Average earnings were also flat month on month, although unemployment fell further than expected to 5.3% from 5.5%.

- Still in the US, both pending home sales and the S&P/Case-Shiller house price index came in short of their forecasts (but still showed signs of growth). Elsewhere the Conference Board’s consumer sentiment gauge showed a sharp improvement.

- In the UK the final reading for first quarter GDP was revised up to 2.9% year on year (from 2.4%), while the GfK Consumer Confidence measure surged from 1 to 7 to reach its highest level since 2001. However, optimism was dampened as Manufacturing PMI numbers slipped to 51.4 despite expectations for an increase.

- Eurozone business sentiment indicators were all marginally softer, but perhaps more robust than could have been expected given the current events in Greece. The European Commission’s readings for Industrial Sentiment slipped from -3.0 to -3.4, Economic Sentiment fell from 103.8 to 103.5 and Business Confidence was down from 0.28 to 0.1.

- Industrial indicators were solid in Japan, with a number of indicators from the Bank of Japan’s Tankan surveys showing improvements. Both current conditions and the outlook were up on the previous readings, whilst June’s industrial capex increased 9.3% ahead of an expected 5.2% and a previous fall of 1.2%.

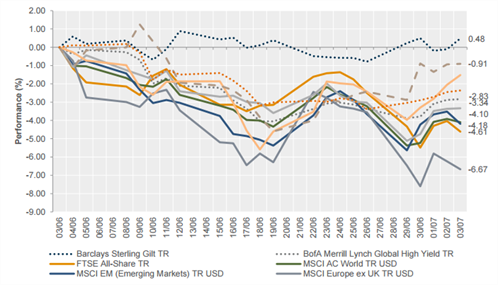

The markets

Last week saw a slip in the major equity markets but a distinct lack of change in bond prices. Currencies showed more movement, including a fall in the euro on the back of the results of the Greek referendum.

Equities – European equities fell 3.5% on the week, while the FTSE All-Share was down 2.15% and the S&P 500 slipped 1.6%.

Bonds – There was very little movement throughout the week. UK ten-year gilts were only 2 bps tighter at 2.01%, US ten-year treasuries were 3 bps wider at 2.39% and German bunds were just 4 bps tighter at 0.79%.

Commodities – The price of oil softened throughout the week with Brent crude finishing at US$60.32 per barrel. Gold was also weaker and closed at US$1,167, and copper – as a proxy for broader industrial metals – was little changed at US$2.62.

Currencies – The yen strengthened throughout the week and finished up 1.4% against the sterling and 0.4% against the US dollar. Conversely, the sterling was slightly weaker across the board and fell 0.86% versus the dollar. The euro was mixed throughout most of the week, but there was a noticeable fall on Sunday with the results of the Greek poll.

The week ahead

The fallout from the Greek vote will no doubt generate a lot of headlines over the next seven days, but things are thinner on the ground in terms of scheduled output. We are only expecting German factory orders and US non-manufacturing PMI today, with German Industrial Production figures and the latest UK Industrial and Manufacturing numbers following tomorrow.

On Wednesday the Federal Reserve will release minutes from the latest meeting, which may give us further insight into the Fed’s current thinking around lowering its interest rate guidance. This is followed by Japanese machinery orders and Chinese inflation figures on Thursday morning, and later in the day we are also expecting the Bank of England to keep rates and quantitative easing on hold. We finish the week with Japanese consumer confidence figures, industrial production numbers from France and Italy, and an update on the Balance of Trade and Construction output from the UK.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.