Weekly macroeconomic and market update 30.06.2015

Weekly macroeconomic and market update

The Greek bailout ends today

The situation in Greece deteriorated over the weekend as negotiations broke down just days before the ending of the current bailout (30 June). In an official press release Eurozone officials stated that despite their continued effort and support at all levels the Greek authorities have unilaterally rejected their recent proposals. Greek Prime Minister Alexis Tsipras has announced a referendum for Greece to accept or reject the very latest proposal, which will take place on 5 July. However, for the time being Greece is on the road to default and will probably miss its IMF payment of €1.5 billion.

Jeroen Dijsselbloem, finance minister and the president of the Eurogroup, has also raised "great concerns on credibility” in terms of Greece implementing the Eurogroup proposals, especially given that the Greek government has recommended to vote against them.

And all of this comes after the European Central Bank has already capped their emergency liquidity assistance programme. Capital controls have also now been imposed in Greece, with banks closing and tight limits being placed on ATM withdrawals.

China cuts interest rates

There was significant news from China last week as the People’s Bank of China chose to cut loan and deposit rates by 25bps. For some banks a 50bps cut in the reserve requirement ratio has also been implemented.

This can be seen as an effort to stimulate growth, and is a response to the recent downturn in the equity market. However it is worth noting that the direct impact of a falling stock market on the wider economy is thought to be limited – although it can be argued there is a significant psychological link.

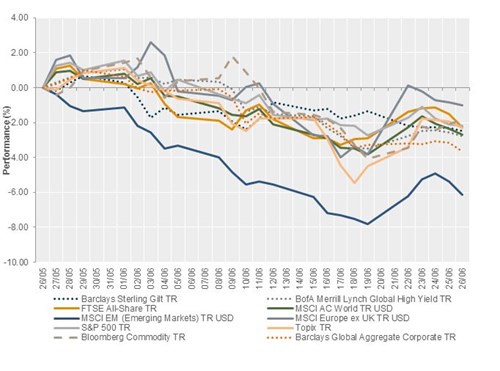

The markets

Last week saw a sell-off in major equity markets as a result of the continued Greece saga, along with mixed results for the major currencies.

Equities – Equity markets sold off towards the end of last week as news spread of the deterioration of negotiations with Greece and the continued decline of Chinese stocks.

Bonds – Over the last week UK 10-year gilt yields moved to 2.07% from 1.99%. Meanwhile, across the pond US 10-year treasury yields tightened to 2.33% from 2.39% a week earlier.

Currencies – The euro weakened against other major currencies, losing 2% against the dollar on the previous week. The sterling strengthened 1.4% against the euro but lost ground against the dollar and yen.

The week ahead

On Tuesday we begin with GfK consumer confidence and Q1 GDP figures in the UK, and PPI and consumer spending figures from France. We’re also expecting the S&P/Case Shiller housing statistics and consumer confidence from the US. Midweek sees the release of the Markit PMIs for US and UK manufacturing. We can also expect IS manufacturing figures from the US.

These are followed on Thursday by Eurozone PPI figures which are expected to show year-on-year contraction. We also get June US non-farm payroll figures alongside jobless claims and hourly earnings. These may be of particular interest to those investors who are keenly watching the Federal Reserve for clues about the timing of a first rate increase. We then finish the week with the release of Markit Eurozone services PMI, which is expected at 54.1, followed by the Markit/CIPS UK services PMI.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.