Weekly macroeconomic and market update 08 March 2016

Weekly macroeconomic and market update

Weekly macroeconomic and market update

US employment data and the latest PMI figures

US non-farm payrolls provided a short-term boost to risk assets on Friday, although the broader picture remains unconvincing in terms of economic growth. The reading of 242,000 jobs added was well ahead of expectations for 190,000, whilst the previous month’s miss was revised up from 151,000 to 172,000 – still short of the forecast 190,000, but a far more reasonable reading. Unemployment was unchanged at 4.9% but earnings were disappointing, showing a month-on-month contraction of -0.1%, down from a 0.5% increase in January and despite expectations for a small moderation to 0.2% growth.

The PMI story also remained mixed, following on from the readings discussed last week. The Institute of Supply Management (ISM) measure of manufacturing PMI continued to improve, posting a much better than expected increase from 48.2 to 49.5 (48.5 was expected) but coming from a low base and still in contractionary territory. The non-manufacturing figure slipped from 53.5 to 53.4, although this was ahead of forecasts for a fall to 53.2. Looking at the revisions to the Markit PMI numbers, manufacturing PMI was revised up from 51.0 to 51.3 but services PMI estimates were trimmed down 0.1 to 49.7 – leaving the final ‘composite’ Markit reading finely balanced between expansion and contraction at the 50.0 mark (from 50.1). Although there have been some improvements in the data, with the current numbers it remains difficult to build a particularly compelling story for continued economic growth.

The People’s Bank of China injects fresh stimulus – but will it help?

China also showed further signs of stress. The People’s Bank of China injected fresh stimulus by cutting the reserve requirement ratio by 50 bps to 17.0% for the main banks, just ahead of PMI announcements that pointed to further slowdown. Measures for services and manufacturing fell more than expected on both the official reading and the Caixin independent reading, both falling 0.4 to 49.0 and 48.0 respectively (only a 0.1 fall had been expected). This also marked a full year of contractionary territory for the more reliable Caixin reading.

Services PMIs remained in expansion but were also lower. The official non-manufacturing reading fell from 53.5 to 52.7 while the Caixin measure fell from 52.4 to 51.2. Concerns remain over excess capacity in China, and these falling measures are likely to be part of the result, whilst the further loosening of monetary policy could put more downward pressure on the currency.

Last week’s other events

The markets

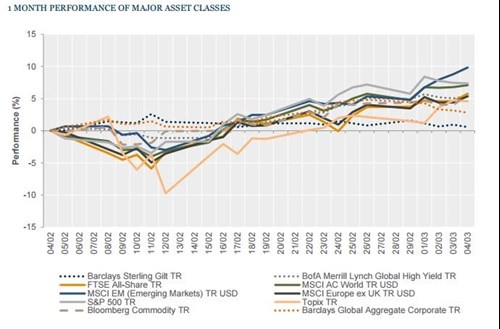

It was another good week for risk assets, which saw equities and commodities rally whilst sovereign bonds were softer. Sterling also had a bounce after recent Brexit-related weakness.

Equities – A solid week for major equity markets. In the US the S&P 500 gained 2.7% on the week, breaking back above 2000 (although on Friday it finished a cruel fraction below at 1999.99). In Japan, the Topix was up 4.9%, Hong Kong was similarly up 4.2% along with mainland China, and Europe (excluding the UK) gained 3.7%. The UK was something of a laggard, but still managed a gain on the FTSE All-Share of +1.7%.

Bonds – Amid the equity rally, sovereign bonds were generally softer. UK 10-year Gilt yields were up 8 bps to 1.49%, US 10-year Treasuries were up 12 bps to 1.88% and 10-year German Bunds were 9 bps higher to 0.24%.

Commodities – Oil improved with Brent rising from US$35 a barrel at the start of the week to finish at US$38.72. Gold continued to show strength and ended just a few cents below US$1,270 an ounce. Copper joined the rally too, ending the week at $2.27 per lb.

Currencies – Sterling bounced back this week, gaining 2.58% against the US dollar, 2.70% against the yen and 1.93% against the euro, with other major exchange rates relatively muted.

The week ahead

This week’s main scheduled event will be the ECB monetary policy decision due on Thursday. Output from recent meetings and commentary from European Central bankers have both clearly signposted further weakening, and the Governing Council will be keen to avoid another miscommunication as happened with “Draghi’s Disappointment” in December.

With unexpected deflation back in the Eurozone, markets are expecting a further cut in interest rates, possibly from-0.3% to -0.4%, as well as an increase in the current quantitative easing (QE) programme, most likely from €60 billion to €70 billion. However, although the direction seems clear, there’s plenty of detail to hide some devils in, including differentiating interest rates and altering the scope as well as the scale and longevity of the QE programme. Elsewhere, it is a relatively quiet week:

There isn’t much to report on Monday morning, but in the afternoon the US updates on labour market conditions, followed by the updated Japanese fourth quarter GDP estimate in the evening. Early morning on Tuesday we have Chinese trade data which are expected to remain contractionary, with export falls accelerating from -11.2% to -12.5% year on year and imports to moderate from -18.8% to -10.0%. Later in the morning we also have revised fourth quarter GDP numbers for the Eurozone.

On Wednesday the UK will release January industrial production figures (forecast to have improved from -0.4% to +0.1% year on year) and manufacturing figures (forecast to have improved from -1.7% to -0.7%).

Ahead of the ECB decision due at 12:45pm, on Thursday morning we have Chinese Foreign Direct Investment and Inflation rates (expected at 1.9% from 1.8%). In the afternoon, US JOLTS (Job Openings and Labour Turnover Survey) job openings and initial jobless claims data are added into the mix of US economic data.

On Friday we get overnight reports on Fixed Asset Investment from China, then the UK updates the Balance of Trade data for January, as well as construction output which is forecast to have fallen by -1.7%. Finally, in the afternoon US import and export prices are forecast to have fallen, by -0.7% and -0.5% month on month respectively.

Data correct as at 07/03/2016. Source: Lipper.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.